Green financing focuses on funding projects with environmental benefits, such as renewable energy, sustainable agriculture, and clean technology initiatives. Project financing involves funding specific large-scale infrastructure or industrial projects, often relying on the project's cash flow and assets as collateral. Discover how these financing methods transform investment strategies and drive economic growth.

Why it is important

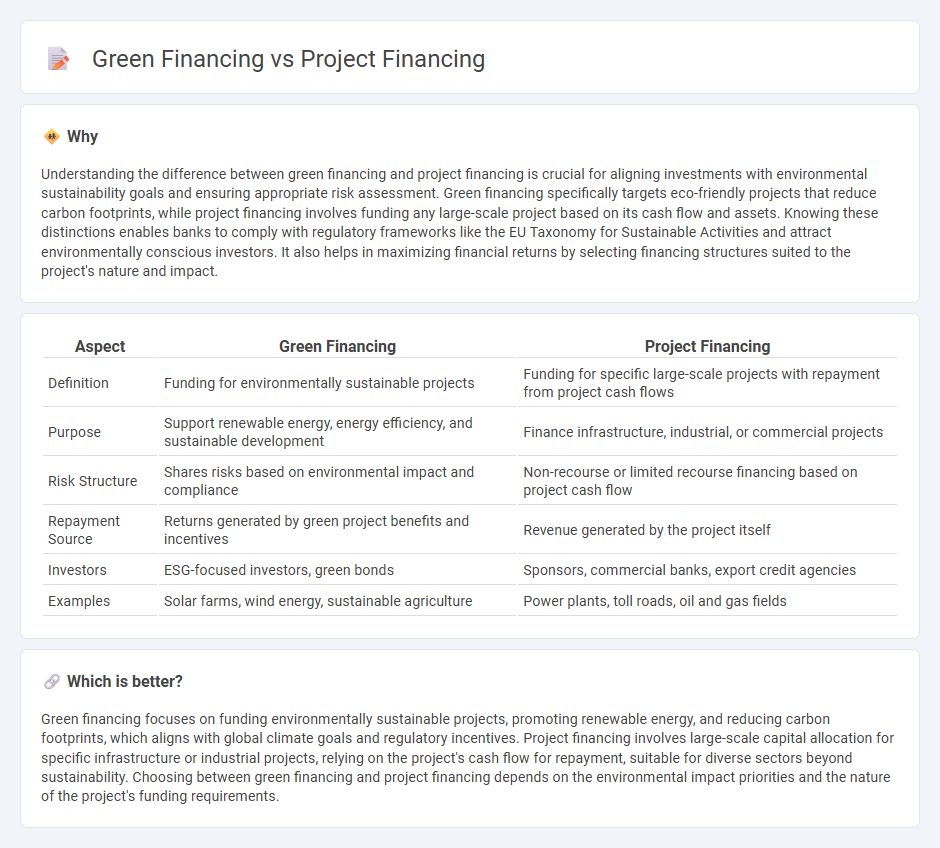

Understanding the difference between green financing and project financing is crucial for aligning investments with environmental sustainability goals and ensuring appropriate risk assessment. Green financing specifically targets eco-friendly projects that reduce carbon footprints, while project financing involves funding any large-scale project based on its cash flow and assets. Knowing these distinctions enables banks to comply with regulatory frameworks like the EU Taxonomy for Sustainable Activities and attract environmentally conscious investors. It also helps in maximizing financial returns by selecting financing structures suited to the project's nature and impact.

Comparison Table

| Aspect | Green Financing | Project Financing |

|---|---|---|

| Definition | Funding for environmentally sustainable projects | Funding for specific large-scale projects with repayment from project cash flows |

| Purpose | Support renewable energy, energy efficiency, and sustainable development | Finance infrastructure, industrial, or commercial projects |

| Risk Structure | Shares risks based on environmental impact and compliance | Non-recourse or limited recourse financing based on project cash flow |

| Repayment Source | Returns generated by green project benefits and incentives | Revenue generated by the project itself |

| Investors | ESG-focused investors, green bonds | Sponsors, commercial banks, export credit agencies |

| Examples | Solar farms, wind energy, sustainable agriculture | Power plants, toll roads, oil and gas fields |

Which is better?

Green financing focuses on funding environmentally sustainable projects, promoting renewable energy, and reducing carbon footprints, which aligns with global climate goals and regulatory incentives. Project financing involves large-scale capital allocation for specific infrastructure or industrial projects, relying on the project's cash flow for repayment, suitable for diverse sectors beyond sustainability. Choosing between green financing and project financing depends on the environmental impact priorities and the nature of the project's funding requirements.

Connection

Green financing and project financing intersect through their shared focus on funding sustainable initiatives that promote environmental benefits. Project financing often channels capital into renewable energy, clean technology, and infrastructure projects, which are key components of green financing strategies aimed at reducing carbon footprints. This synergy enables financial institutions to support long-term eco-friendly developments while managing investment risks specific to large-scale environmental projects.

Key Terms

**Project Financing:**

Project financing involves securing long-term funding for infrastructure or industrial projects based on the projected cash flows of the project rather than the balance sheets of sponsors. It typically includes non-recourse or limited recourse loans, where lenders rely on the project's assets and revenue streams as collateral, optimizing risk management. Discover the critical distinctions and strategic advantages of project financing in complex capital ventures.

Special Purpose Vehicle (SPV)

Project financing involves setting up a Special Purpose Vehicle (SPV) to isolate financial risk and manage large-scale infrastructure or industrial projects through non-recourse debt, ensuring that lenders' claims are limited to the SPV's assets and cash flows. Green financing, often facilitated through an SPV, directs capital specifically to environmentally sustainable projects, such as renewable energy installations or energy-efficient buildings, aligning with ESG criteria and international green bond standards. Explore the strategic differences and applications of SPVs in project and green financing to optimize risk management and sustainability goals.

Non-Recourse Loan

Project financing structures large-scale infrastructure or industrial projects using non-recourse loans, where lenders rely solely on the project's cash flow and assets as collateral, minimizing sponsor liability. Green financing specifically supports environmentally sustainable projects, often incorporating non-recourse loans to mitigate risk while promoting renewable energy, energy efficiency, and climate resilience initiatives. Explore the nuances of non-recourse loans within these financing models to better understand risk management and environmental impact strategies.

Source and External Links

Project Financing Basics: How to Fund a Project - Project financing is a structured process to secure and manage financial resources for a project, involving steps like defining goals, conducting feasibility studies, choosing funding methods, and securing agreements with investors or lenders.

Project finance - Wikipedia - Project finance is long-term funding for infrastructure or industrial projects based on the project's cash flows, not the sponsors' balance sheets, typically structured through a special purpose entity with non-recourse loans secured by project assets.

Project Finance - A Primer - Project finance involves analyzing a project's entire life cycle to ensure economic benefits outweigh costs, using a mix of debt and equity through a special purpose vehicle, with repayment relying on the project's cash flow.

dowidth.com

dowidth.com