Income streaming in banking involves generating consistent revenue through diversified financial products, while mortgage servicing rights (MSRs) specifically pertain to the contractual rights to service mortgage loans and collect associated fees. MSRs represent a valuable asset class influencing bank profitability and risk management, often linked to interest rate fluctuations and loan prepayment speeds. Explore deeper insights into how income streaming strategies compare to the financial implications of mortgage servicing rights.

Why it is important

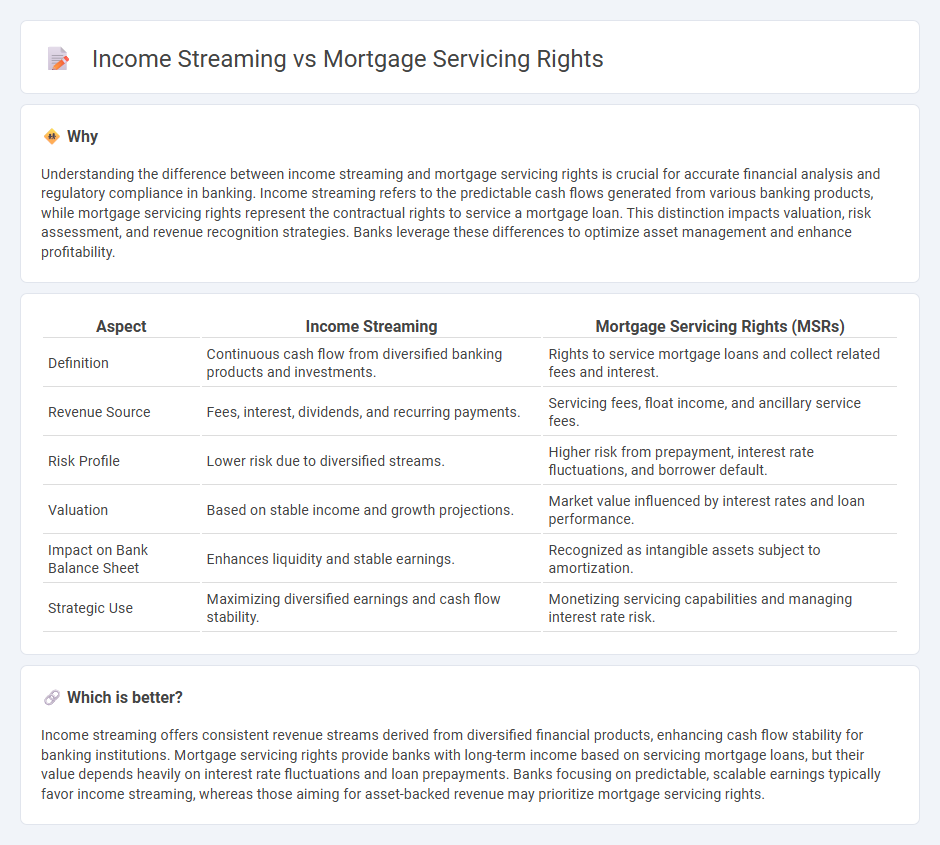

Understanding the difference between income streaming and mortgage servicing rights is crucial for accurate financial analysis and regulatory compliance in banking. Income streaming refers to the predictable cash flows generated from various banking products, while mortgage servicing rights represent the contractual rights to service a mortgage loan. This distinction impacts valuation, risk assessment, and revenue recognition strategies. Banks leverage these differences to optimize asset management and enhance profitability.

Comparison Table

| Aspect | Income Streaming | Mortgage Servicing Rights (MSRs) |

|---|---|---|

| Definition | Continuous cash flow from diversified banking products and investments. | Rights to service mortgage loans and collect related fees and interest. |

| Revenue Source | Fees, interest, dividends, and recurring payments. | Servicing fees, float income, and ancillary service fees. |

| Risk Profile | Lower risk due to diversified streams. | Higher risk from prepayment, interest rate fluctuations, and borrower default. |

| Valuation | Based on stable income and growth projections. | Market value influenced by interest rates and loan performance. |

| Impact on Bank Balance Sheet | Enhances liquidity and stable earnings. | Recognized as intangible assets subject to amortization. |

| Strategic Use | Maximizing diversified earnings and cash flow stability. | Monetizing servicing capabilities and managing interest rate risk. |

Which is better?

Income streaming offers consistent revenue streams derived from diversified financial products, enhancing cash flow stability for banking institutions. Mortgage servicing rights provide banks with long-term income based on servicing mortgage loans, but their value depends heavily on interest rate fluctuations and loan prepayments. Banks focusing on predictable, scalable earnings typically favor income streaming, whereas those aiming for asset-backed revenue may prioritize mortgage servicing rights.

Connection

Income streaming in banking refers to the predictable revenue generated from mortgage servicing rights (MSRs), which allow lenders to earn fees by managing mortgage loan payments. The value of MSRs fluctuates based on interest rates and prepayment speeds, impacting the consistency of income streaming. Financial institutions leverage MSRs to create stable cash flows and enhance balance sheet asset valuation.

Key Terms

Asset Valuation

Mortgage servicing rights (MSRs) represent the contractual rights to service a mortgage loan and generate income through fees over its lifetime, while income streaming refers to the ongoing cash flow generated from such assets. Asset valuation of MSRs involves discounting expected servicing fees based on prepayment rates, interest rate forecasts, and credit risk, making accurate assumptions critical for financial reporting and investment decisions. Explore detailed methodologies and market trends to enhance your understanding of MSR asset valuation.

Cash Flow

Mortgage servicing rights (MSRs) represent the contractual rights to service mortgage loans, generating consistent fee income tied to loan balances and payments, which directly impacts cash flow by providing steady revenue streams over time. Income streaming involves diversifying revenue sources, often through various financial instruments or operational activities, to create multiple, stable cash inflows enhancing overall liquidity management. Explore further to understand how leveraging MSRs alongside income streaming strategies can optimize your cash flow management.

Amortization

Mortgage servicing rights (MSRs) represent the contractual rights to service a loan and collect fees over its amortization period, directly impacting income streams from loan repayments. Income streaming from MSRs depends heavily on the amortization schedule, as the timing of principal and interest payments influences the steady cash flow generated. Explore how amortization intricacies affect the valuation and profitability of MSRs for deeper insights.

Source and External Links

What are mortgage servicing rights? - Mortgage servicing rights (MSRs) are contractual agreements allowing the right to service a mortgage loan--such as collecting payments, managing escrow, and handling customer inquiries--to be sold by the original lender to a third-party servicer, who then takes over these administrative responsibilities for a fee.

Servicing Transcript - MSRs become a distinct financial asset when separated from the underlying mortgage loan, and servicers--whether the originator or a third party--perform essential functions like payment collection, escrow management, and handling delinquencies, with the right to service potentially bought, sold, or retained independently of loan ownership.

Mortgage Servicing Rights (MSRs): A Promising Opportunity Area for Investors? - MSRs are an income-generating asset class valued for their steady cash flows and sensitivity to interest rates, with investors earning fees (typically 25-50 basis points of the loan balance) for servicing mortgages, without owning the underlying loans themselves.

dowidth.com

dowidth.com