Robo advisors leverage advanced algorithms and artificial intelligence to provide automated, cost-efficient investment management, offering personalized portfolios with low fees and 24/7 accessibility. In contrast, private bankers deliver customized wealth management services through direct human interaction, focusing on holistic financial planning, estate management, and exclusive client relationships. Explore the key differences between robo advisors and private bankers to determine the best fit for your financial goals.

Why it is important

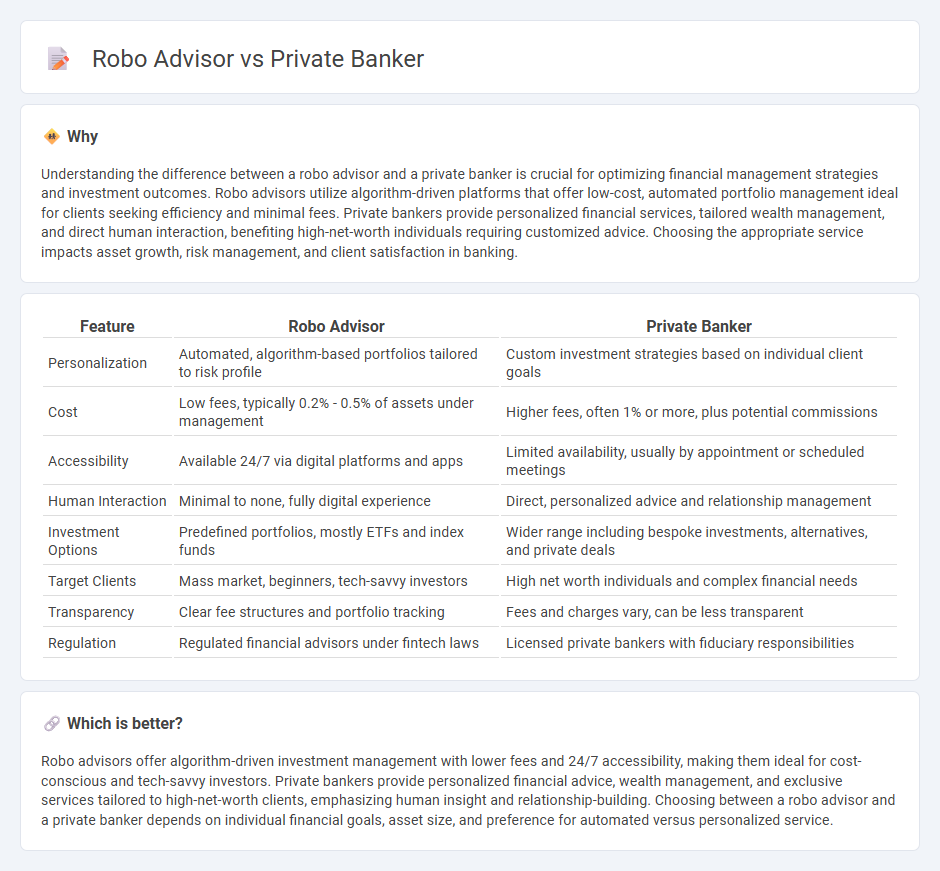

Understanding the difference between a robo advisor and a private banker is crucial for optimizing financial management strategies and investment outcomes. Robo advisors utilize algorithm-driven platforms that offer low-cost, automated portfolio management ideal for clients seeking efficiency and minimal fees. Private bankers provide personalized financial services, tailored wealth management, and direct human interaction, benefiting high-net-worth individuals requiring customized advice. Choosing the appropriate service impacts asset growth, risk management, and client satisfaction in banking.

Comparison Table

| Feature | Robo Advisor | Private Banker |

|---|---|---|

| Personalization | Automated, algorithm-based portfolios tailored to risk profile | Custom investment strategies based on individual client goals |

| Cost | Low fees, typically 0.2% - 0.5% of assets under management | Higher fees, often 1% or more, plus potential commissions |

| Accessibility | Available 24/7 via digital platforms and apps | Limited availability, usually by appointment or scheduled meetings |

| Human Interaction | Minimal to none, fully digital experience | Direct, personalized advice and relationship management |

| Investment Options | Predefined portfolios, mostly ETFs and index funds | Wider range including bespoke investments, alternatives, and private deals |

| Target Clients | Mass market, beginners, tech-savvy investors | High net worth individuals and complex financial needs |

| Transparency | Clear fee structures and portfolio tracking | Fees and charges vary, can be less transparent |

| Regulation | Regulated financial advisors under fintech laws | Licensed private bankers with fiduciary responsibilities |

Which is better?

Robo advisors offer algorithm-driven investment management with lower fees and 24/7 accessibility, making them ideal for cost-conscious and tech-savvy investors. Private bankers provide personalized financial advice, wealth management, and exclusive services tailored to high-net-worth clients, emphasizing human insight and relationship-building. Choosing between a robo advisor and a private banker depends on individual financial goals, asset size, and preference for automated versus personalized service.

Connection

Robo advisors and private bankers are connected through their roles in wealth management, offering personalized financial advice using advanced technology and human expertise. Robo advisors leverage algorithms and data analytics to provide automated investment portfolios, while private bankers deliver tailored services and relationship management for high-net-worth clients. The integration of robo advisory tools enhances private bankers' ability to optimize client portfolios and improve decision-making efficiency.

Key Terms

Personalized Wealth Management

Private bankers provide tailored financial advice and personalized wealth management strategies based on deep client relationships and understanding of complex financial goals. Robo advisors utilize advanced algorithms and AI to offer automated, cost-effective portfolio management with minimal human interaction, ideal for investors seeking convenience and lower fees. Explore the comparative benefits and suitability of private bankers versus robo advisors for your wealth management needs.

Automated Portfolio Allocation

Private bankers offer personalized investment strategies tailored to clients' specific financial goals and risk tolerance, with human expertise guiding portfolio adjustments. Robo advisors utilize sophisticated algorithms and automation to allocate assets efficiently based on predefined parameters, providing cost-effective and scalable investment management. Explore in-depth comparisons to understand which portfolio allocation approach best suits your financial needs and preferences.

Client Relationship

Private bankers offer personalized financial services tailored to high-net-worth clients, fostering deep, trust-based relationships through individualized advice and ongoing support. Robo advisors provide automated, algorithm-driven investment management with minimal human interaction, prioritizing efficiency and low fees over personal connection. Explore how these contrasting approaches impact your wealth management experience and client relationship dynamics.

Source and External Links

What Is a Private Banker? Should You Have One? - A private banker is a banking professional who offers concierge-like, specialized banking and financial services to affluent, high-net-worth individuals.

Citi Private Bank - Citi Private Bank delivers customized, global private banking services to wealthy individuals and families, helping them preserve and grow their wealth across borders.

Private Banking and Wealth Management | First National Bank - Private bankers at FNB partner with successful individuals and families to offer personalized financial solutions, wealth management, checking, savings, mortgage, and loan products.

dowidth.com

dowidth.com