Sustainable investing focuses on generating long-term financial returns by considering environmental, social, and governance factors that promote positive outcomes for society and the planet. ESG investing specifically evaluates corporate behavior and risk management through measurable criteria in these three areas to identify responsible investments. Explore the distinctions and benefits of sustainable and ESG investing to make informed banking decisions aligned with your values.

Why it is important

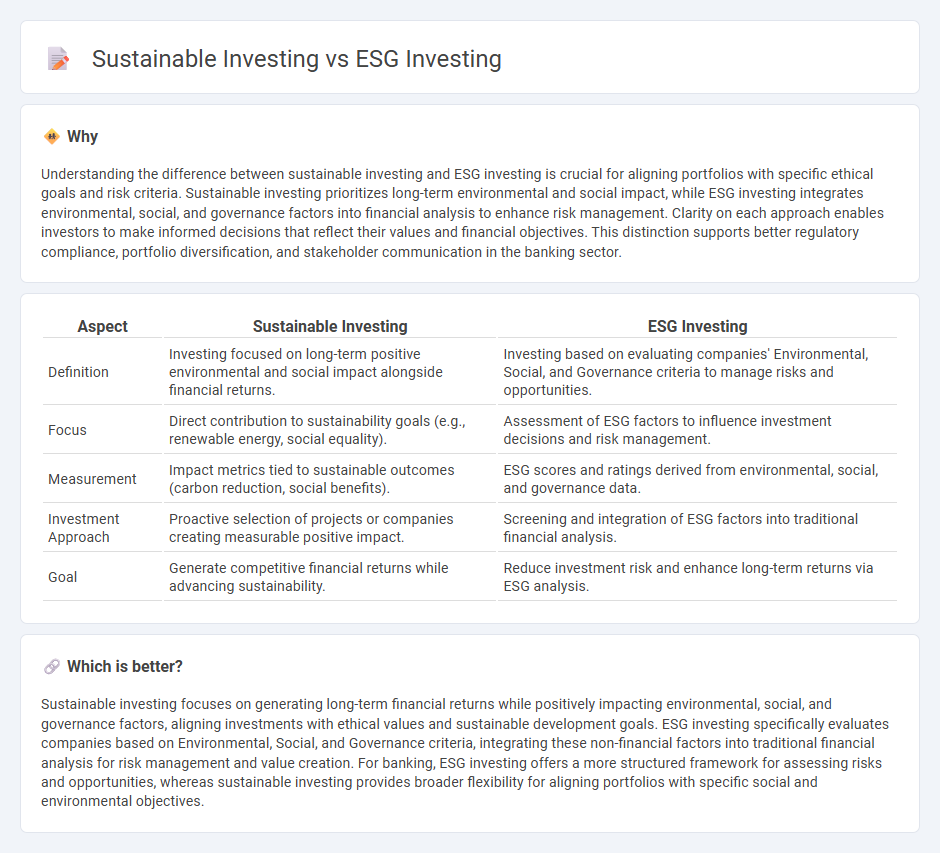

Understanding the difference between sustainable investing and ESG investing is crucial for aligning portfolios with specific ethical goals and risk criteria. Sustainable investing prioritizes long-term environmental and social impact, while ESG investing integrates environmental, social, and governance factors into financial analysis to enhance risk management. Clarity on each approach enables investors to make informed decisions that reflect their values and financial objectives. This distinction supports better regulatory compliance, portfolio diversification, and stakeholder communication in the banking sector.

Comparison Table

| Aspect | Sustainable Investing | ESG Investing |

|---|---|---|

| Definition | Investing focused on long-term positive environmental and social impact alongside financial returns. | Investing based on evaluating companies' Environmental, Social, and Governance criteria to manage risks and opportunities. |

| Focus | Direct contribution to sustainability goals (e.g., renewable energy, social equality). | Assessment of ESG factors to influence investment decisions and risk management. |

| Measurement | Impact metrics tied to sustainable outcomes (carbon reduction, social benefits). | ESG scores and ratings derived from environmental, social, and governance data. |

| Investment Approach | Proactive selection of projects or companies creating measurable positive impact. | Screening and integration of ESG factors into traditional financial analysis. |

| Goal | Generate competitive financial returns while advancing sustainability. | Reduce investment risk and enhance long-term returns via ESG analysis. |

Which is better?

Sustainable investing focuses on generating long-term financial returns while positively impacting environmental, social, and governance factors, aligning investments with ethical values and sustainable development goals. ESG investing specifically evaluates companies based on Environmental, Social, and Governance criteria, integrating these non-financial factors into traditional financial analysis for risk management and value creation. For banking, ESG investing offers a more structured framework for assessing risks and opportunities, whereas sustainable investing provides broader flexibility for aligning portfolios with specific social and environmental objectives.

Connection

Sustainable investing and ESG (Environmental, Social, and Governance) investing are intrinsically linked as both prioritize long-term value creation by integrating environmental stewardship, social responsibility, and strong governance practices into financial analysis and decision-making. ESG criteria serve as a framework for sustainable investing strategies, enabling investors to identify companies with positive impact on climate change, social equity, and ethical management. This connection drives capital toward businesses that align with global sustainability goals and enhances risk management in banking portfolios.

Key Terms

Environmental Criteria

ESG investing integrates environmental criteria such as carbon emissions, resource usage, and waste management to evaluate company performance and risks. Sustainable investing emphasizes long-term environmental impact by supporting businesses committed to renewable energy, pollution reduction, and biodiversity preservation. Discover how these approaches influence responsible investment strategies and drive environmental innovation.

Social Responsibility

ESG investing evaluates companies based on Environmental, Social, and Governance criteria to measure their overall ethical impact, with a strong emphasis on social responsibility elements like labor practices, community engagement, and diversity. Sustainable investing prioritizes long-term environmental and social benefits, targeting investments that support social equity, fair treatment of employees, and positive community outcomes. Explore our comprehensive guide to understand the distinctions and synergy between ESG and sustainable investing in advancing social responsibility goals.

Governance Standards

Governance standards in ESG investing emphasize corporate transparency, board diversity, and ethical decision-making to mitigate risks and enhance long-term value. Sustainable investing incorporates these governance factors while also prioritizing environmental and social criteria to support holistic, responsible business practices. Explore the differences in governance standards to better understand their impact on investment strategies.

Source and External Links

Embracing Sustainable Investment Practices with ESG Investing - This article discusses ESG investing as a strategy that considers environmental, social, and governance factors, highlighting its benefits and growth in the market.

What is ESG Investing? - This FAQ provides an overview of ESG investing, explaining how it prioritizes environmental, social, and governance factors for sustainable investing.

What is ESG investing? - Deutsche Bank Wealth Management - This webpage describes ESG investing as a holistic approach that considers environmental, social, and governance criteria alongside traditional financial factors.

dowidth.com

dowidth.com