Stablecoin rails leverage blockchain technology to enable fast, low-cost cross-border transactions with enhanced transparency and security compared to traditional mobile money platforms. Mobile money platforms offer widespread accessibility and convenience through mobile devices but often face regulatory challenges and higher transaction fees. Explore the evolving landscape of digital payments to understand which solution best fits modern banking needs.

Why it is important

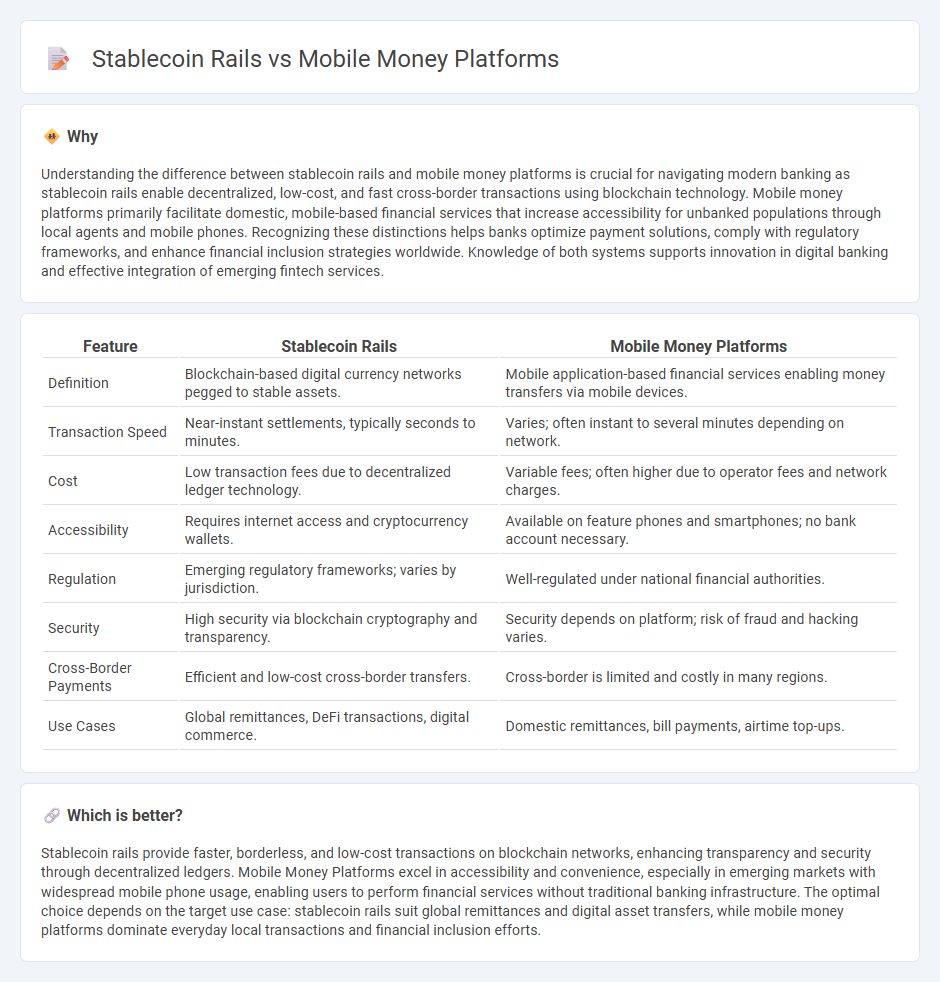

Understanding the difference between stablecoin rails and mobile money platforms is crucial for navigating modern banking as stablecoin rails enable decentralized, low-cost, and fast cross-border transactions using blockchain technology. Mobile money platforms primarily facilitate domestic, mobile-based financial services that increase accessibility for unbanked populations through local agents and mobile phones. Recognizing these distinctions helps banks optimize payment solutions, comply with regulatory frameworks, and enhance financial inclusion strategies worldwide. Knowledge of both systems supports innovation in digital banking and effective integration of emerging fintech services.

Comparison Table

| Feature | Stablecoin Rails | Mobile Money Platforms |

|---|---|---|

| Definition | Blockchain-based digital currency networks pegged to stable assets. | Mobile application-based financial services enabling money transfers via mobile devices. |

| Transaction Speed | Near-instant settlements, typically seconds to minutes. | Varies; often instant to several minutes depending on network. |

| Cost | Low transaction fees due to decentralized ledger technology. | Variable fees; often higher due to operator fees and network charges. |

| Accessibility | Requires internet access and cryptocurrency wallets. | Available on feature phones and smartphones; no bank account necessary. |

| Regulation | Emerging regulatory frameworks; varies by jurisdiction. | Well-regulated under national financial authorities. |

| Security | High security via blockchain cryptography and transparency. | Security depends on platform; risk of fraud and hacking varies. |

| Cross-Border Payments | Efficient and low-cost cross-border transfers. | Cross-border is limited and costly in many regions. |

| Use Cases | Global remittances, DeFi transactions, digital commerce. | Domestic remittances, bill payments, airtime top-ups. |

Which is better?

Stablecoin rails provide faster, borderless, and low-cost transactions on blockchain networks, enhancing transparency and security through decentralized ledgers. Mobile Money Platforms excel in accessibility and convenience, especially in emerging markets with widespread mobile phone usage, enabling users to perform financial services without traditional banking infrastructure. The optimal choice depends on the target use case: stablecoin rails suit global remittances and digital asset transfers, while mobile money platforms dominate everyday local transactions and financial inclusion efforts.

Connection

Stablecoin rails enhance mobile money platforms by enabling instant, low-cost cross-border transactions using blockchain technology, reducing reliance on traditional banking infrastructure. Mobile money platforms integrate stablecoins to expand financial inclusion in underserved regions, leveraging digital currency stability to facilitate seamless payments and remittances. This synergy drives increased liquidity, transparency, and real-time settlement in digital financial ecosystems.

Key Terms

Digital Wallets

Mobile money platforms provide accessible digital wallet services, enabling users to store, send, and receive funds via mobile devices, particularly in regions with limited banking infrastructure. Stablecoin rails offer enhanced stability and interoperability across borders by leveraging blockchain technology, facilitating faster and cheaper cross-border payments within digital wallets. Explore how these innovations are transforming digital financial ecosystems and expanding wallet functionalities worldwide.

Blockchain Settlement

Mobile money platforms enable quick, accessible transactions through centralized systems, while stablecoin rails utilize blockchain settlement to offer decentralized, transparent, and instantaneous cross-border payments. Blockchain technology ensures immutability and reduces settlement times compared to traditional mobile money networks, enhancing security and lowering transaction costs. Explore deeper insights into how blockchain settlement transforms digital payments and stablecoin integration.

Fiat On/Off Ramp

Mobile money platforms leverage traditional banking infrastructure to facilitate fiat on/off ramps, enabling seamless transfers between digital wallets and bank accounts. Stablecoin rails utilize blockchain technology to bridge fiat currencies with cryptocurrencies, offering faster, borderless transactions with reduced settlement times. Explore how these payment systems reshape financial inclusion and cross-border remittance.

Source and External Links

Top 10 Mobile Money Platforms - Mobile money platforms like M-Pesa, Orange Money, and MTN Mobile Money have revolutionized financial services in developing regions by enabling accessible digital financial tools without traditional bank infrastructure.

MobiFin Mobile Money solution - MobiFin offers a comprehensive mobile wallet platform for MNOs, MVNOs, banks, and financial institutions to launch mobile money services with easy user registration, KYC, and support for digital cashless payments through apps, web, or USSD.

Mobile Money as a Stepping Stone to Financial Inclusion - Mobile money platforms provide financial services to unbanked customers, often in emerging economies, through mobile phone interfaces without needing linked bank accounts or internet access, using technologies like USSD and agent networks to widely expand access.

dowidth.com

dowidth.com