Cloud core banking systems offer scalable, real-time processing with enhanced security and seamless integration capabilities, outperforming legacy core banking platforms that rely on traditional, on-premise infrastructure and batch processing. Banks adopting cloud solutions benefit from increased agility, cost-efficiency, and continuous software updates, driving innovation and customer-centric services. Explore how cloud core banking transforms financial institutions beyond legacy constraints for future-ready operations.

Why it is important

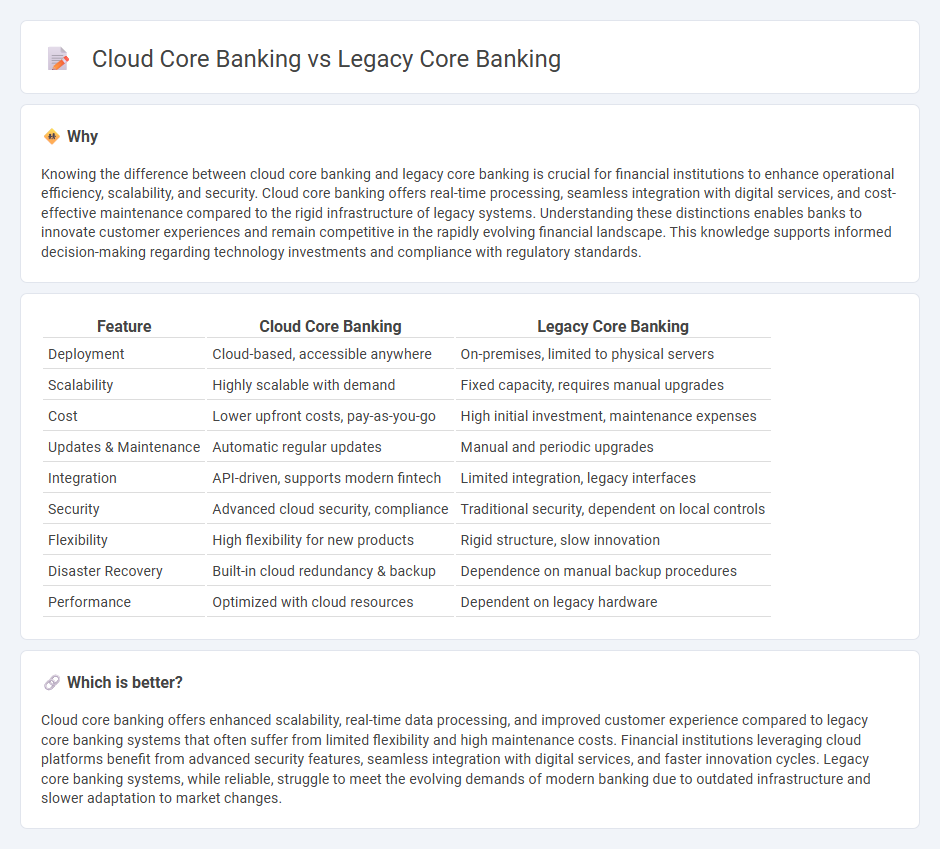

Knowing the difference between cloud core banking and legacy core banking is crucial for financial institutions to enhance operational efficiency, scalability, and security. Cloud core banking offers real-time processing, seamless integration with digital services, and cost-effective maintenance compared to the rigid infrastructure of legacy systems. Understanding these distinctions enables banks to innovate customer experiences and remain competitive in the rapidly evolving financial landscape. This knowledge supports informed decision-making regarding technology investments and compliance with regulatory standards.

Comparison Table

| Feature | Cloud Core Banking | Legacy Core Banking |

|---|---|---|

| Deployment | Cloud-based, accessible anywhere | On-premises, limited to physical servers |

| Scalability | Highly scalable with demand | Fixed capacity, requires manual upgrades |

| Cost | Lower upfront costs, pay-as-you-go | High initial investment, maintenance expenses |

| Updates & Maintenance | Automatic regular updates | Manual and periodic upgrades |

| Integration | API-driven, supports modern fintech | Limited integration, legacy interfaces |

| Security | Advanced cloud security, compliance | Traditional security, dependent on local controls |

| Flexibility | High flexibility for new products | Rigid structure, slow innovation |

| Disaster Recovery | Built-in cloud redundancy & backup | Dependence on manual backup procedures |

| Performance | Optimized with cloud resources | Dependent on legacy hardware |

Which is better?

Cloud core banking offers enhanced scalability, real-time data processing, and improved customer experience compared to legacy core banking systems that often suffer from limited flexibility and high maintenance costs. Financial institutions leveraging cloud platforms benefit from advanced security features, seamless integration with digital services, and faster innovation cycles. Legacy core banking systems, while reliable, struggle to meet the evolving demands of modern banking due to outdated infrastructure and slower adaptation to market changes.

Connection

Cloud core banking integrates with legacy core banking systems through APIs and middleware, enabling seamless data exchange and real-time transaction processing. This hybrid approach allows banks to leverage cloud scalability and flexibility while maintaining the stability and security of existing legacy infrastructure. Enhanced interoperability supports improved customer experiences and operational efficiency without the need for complete system overhaul.

Key Terms

Source and External Links

Legacy Banking Systems: Why and how to Modernize - Legacy core banking systems are older, monolithic, and rigid platforms relying on outdated languages and hardware, managing core financial services but lacking flexibility and scalability, making modernization risky but necessary.

Legacy Core Banking Systems - These are traditional in-house banking software platforms for core operations like deposits and loans that have become costly to maintain, limited in functionality, inflexible, and vulnerable, pushing banks to adopt newer scalable and cloud-based systems.

Breaking Free from Legacy Banking Systems for Innovation and Cost Savings - Legacy systems pose hidden risks including security vulnerabilities, high operational costs, talent shortages, and integration complexity, prompting banks to explore modular, API-driven modernization approaches instead of full replacements.

dowidth.com

dowidth.com