Stablecoin rails leverage blockchain technology to provide fast, low-cost, and transparent transactions, enhancing cross-border payments and reducing reliance on traditional intermediaries. Payment gateways facilitate secure online payment processing by connecting merchants with financial institutions, supporting various payment methods including credit cards and digital wallets. Explore in-depth comparisons of stablecoin rails and payment gateways to optimize your banking solutions.

Why it is important

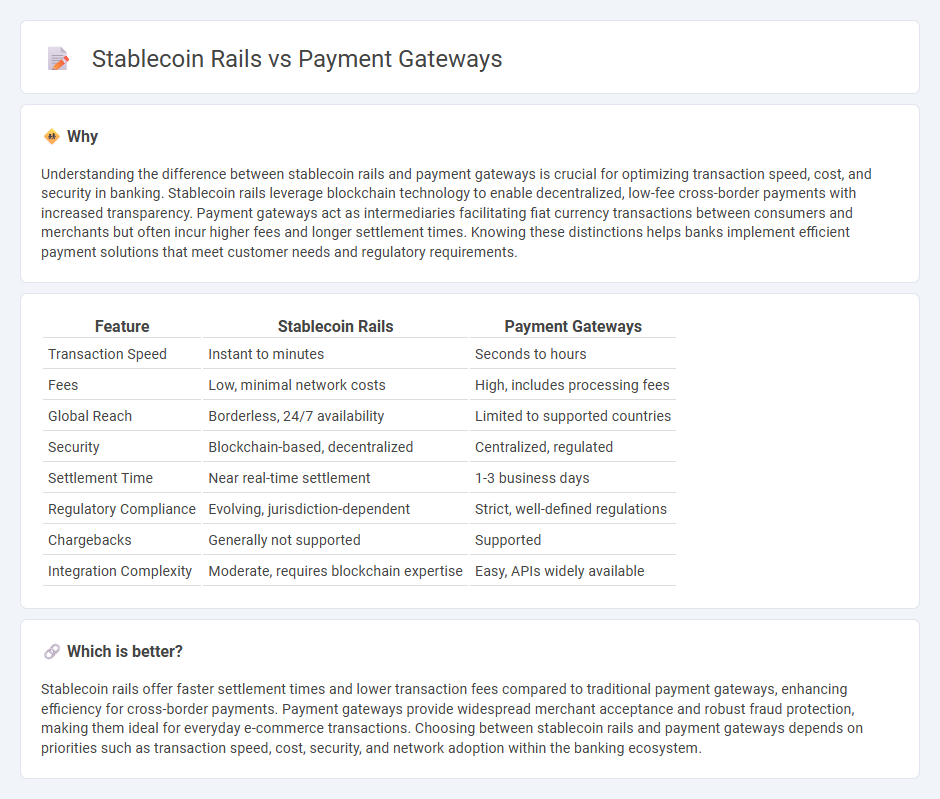

Understanding the difference between stablecoin rails and payment gateways is crucial for optimizing transaction speed, cost, and security in banking. Stablecoin rails leverage blockchain technology to enable decentralized, low-fee cross-border payments with increased transparency. Payment gateways act as intermediaries facilitating fiat currency transactions between consumers and merchants but often incur higher fees and longer settlement times. Knowing these distinctions helps banks implement efficient payment solutions that meet customer needs and regulatory requirements.

Comparison Table

| Feature | Stablecoin Rails | Payment Gateways |

|---|---|---|

| Transaction Speed | Instant to minutes | Seconds to hours |

| Fees | Low, minimal network costs | High, includes processing fees |

| Global Reach | Borderless, 24/7 availability | Limited to supported countries |

| Security | Blockchain-based, decentralized | Centralized, regulated |

| Settlement Time | Near real-time settlement | 1-3 business days |

| Regulatory Compliance | Evolving, jurisdiction-dependent | Strict, well-defined regulations |

| Chargebacks | Generally not supported | Supported |

| Integration Complexity | Moderate, requires blockchain expertise | Easy, APIs widely available |

Which is better?

Stablecoin rails offer faster settlement times and lower transaction fees compared to traditional payment gateways, enhancing efficiency for cross-border payments. Payment gateways provide widespread merchant acceptance and robust fraud protection, making them ideal for everyday e-commerce transactions. Choosing between stablecoin rails and payment gateways depends on priorities such as transaction speed, cost, security, and network adoption within the banking ecosystem.

Connection

Stablecoin rails provide a decentralized and efficient infrastructure for payment gateways, enabling faster and cost-effective cross-border transactions. Payment gateways integrate with stablecoin rails to facilitate secure digital currency settlements, reducing reliance on traditional banking intermediaries. This connection enhances transaction transparency, lowers fees, and supports real-time payment processing in the banking ecosystem.

Key Terms

Transaction Settlement

Payment gateways process transactions by facilitating authorization, capturing funds, and settling payments through traditional banking networks, often resulting in delays of 1-3 business days. Stablecoin rails enable near-instant settlement on blockchain networks by leveraging decentralized ledgers and programmable smart contracts, reducing counterparty risk and settlement times to minutes or seconds. Explore the technical nuances and advantages of each settlement method to optimize your transaction strategy.

Fiat-Crypto Conversion

Payment gateways facilitate fiat-to-crypto conversion through traditional banking networks, enabling seamless transactions via credit cards or bank transfers. Stablecoin rails offer decentralized, blockchain-based solutions that minimize fees and enhance transaction speed by bypassing intermediaries. Explore the advantages of each method to optimize your fiat-crypto conversion experience.

Cross-Border Payments

Payment gateways facilitate cross-border transactions by connecting merchants with multiple payment methods, ensuring quick currency conversion and regulatory compliance. Stablecoin rails leverage blockchain technology to provide near-instantaneous, low-cost transfers with enhanced transparency and minimized currency volatility. Explore how both solutions optimize global payment experiences and reduce friction in international commerce.

Source and External Links

Payment Gateways in 2025: Main Types + How They Work - Payment gateways are merchant services that process credit card payments for ecommerce and physical stores, with popular providers including PayPal, Square, Stripe, and Apple Pay offering features like fraud protection and mobile payment options.

Payment gateway - Wikipedia - A payment gateway is a service that authorizes credit card or direct payments for e-businesses and physical stores by securely transferring payment information between merchants and acquiring banks.

8 Best Payment Gateways of July 2025 - Payment gateways securely transfer customer payment data to processors for authorization, with features like encryption, fraud prevention, and settlement that involves transferring funds to a business account after approval.

dowidth.com

dowidth.com