Synthetic identity fraud involves criminals creating fake identities using fabricated or stolen information to open fraudulent bank accounts and access credit, significantly increasing losses for financial institutions. Card-not-present fraud occurs when unauthorized transactions are made online or over the phone without physical card presence, exploiting vulnerabilities in e-commerce and remote payment systems. Discover how these evolving threats impact banking security and the latest prevention strategies.

Why it is important

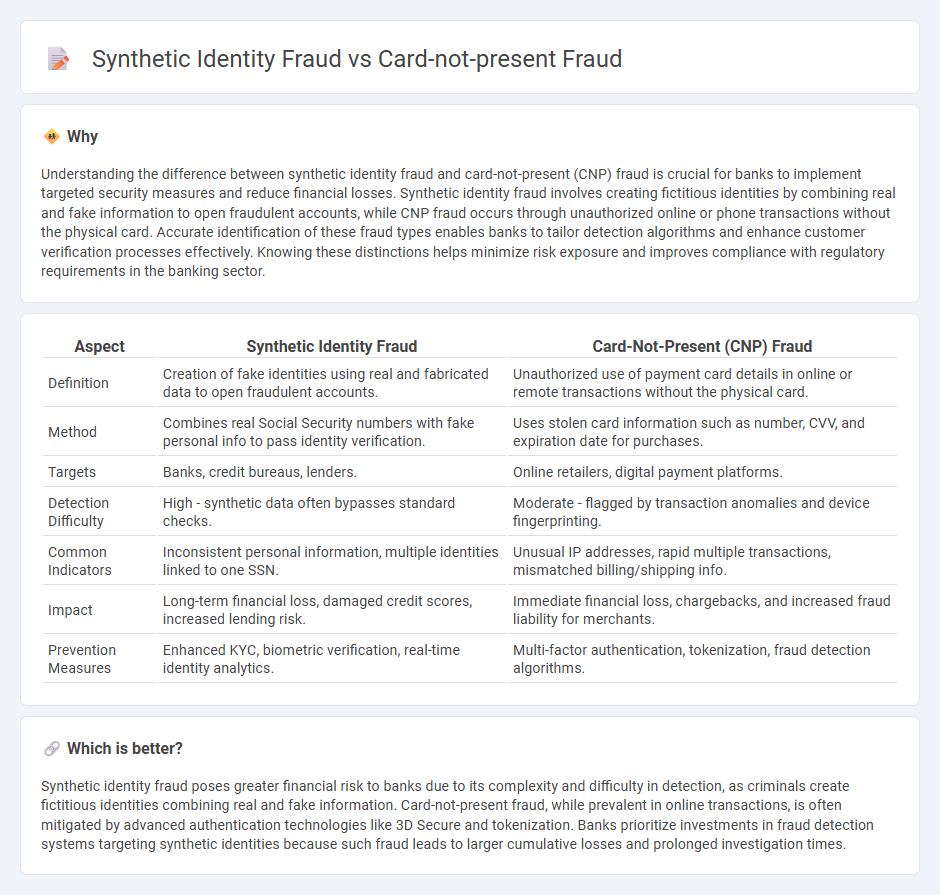

Understanding the difference between synthetic identity fraud and card-not-present (CNP) fraud is crucial for banks to implement targeted security measures and reduce financial losses. Synthetic identity fraud involves creating fictitious identities by combining real and fake information to open fraudulent accounts, while CNP fraud occurs through unauthorized online or phone transactions without the physical card. Accurate identification of these fraud types enables banks to tailor detection algorithms and enhance customer verification processes effectively. Knowing these distinctions helps minimize risk exposure and improves compliance with regulatory requirements in the banking sector.

Comparison Table

| Aspect | Synthetic Identity Fraud | Card-Not-Present (CNP) Fraud |

|---|---|---|

| Definition | Creation of fake identities using real and fabricated data to open fraudulent accounts. | Unauthorized use of payment card details in online or remote transactions without the physical card. |

| Method | Combines real Social Security numbers with fake personal info to pass identity verification. | Uses stolen card information such as number, CVV, and expiration date for purchases. |

| Targets | Banks, credit bureaus, lenders. | Online retailers, digital payment platforms. |

| Detection Difficulty | High - synthetic data often bypasses standard checks. | Moderate - flagged by transaction anomalies and device fingerprinting. |

| Common Indicators | Inconsistent personal information, multiple identities linked to one SSN. | Unusual IP addresses, rapid multiple transactions, mismatched billing/shipping info. |

| Impact | Long-term financial loss, damaged credit scores, increased lending risk. | Immediate financial loss, chargebacks, and increased fraud liability for merchants. |

| Prevention Measures | Enhanced KYC, biometric verification, real-time identity analytics. | Multi-factor authentication, tokenization, fraud detection algorithms. |

Which is better?

Synthetic identity fraud poses greater financial risk to banks due to its complexity and difficulty in detection, as criminals create fictitious identities combining real and fake information. Card-not-present fraud, while prevalent in online transactions, is often mitigated by advanced authentication technologies like 3D Secure and tokenization. Banks prioritize investments in fraud detection systems targeting synthetic identities because such fraud leads to larger cumulative losses and prolonged investigation times.

Connection

Synthetic identity fraud and card-not-present (CNP) fraud are interconnected as synthetic identities often serve as the foundation for executing CNP transactions, exploiting gaps in digital authentication. Fraudsters create synthetic profiles by combining real and fabricated data, enabling unauthorized CNP activities that bypass traditional security measures. This combination amplifies financial losses for banks due to increased chargebacks and fraud detection challenges.

Key Terms

**Card-Not-Present Fraud:**

Card-not-present fraud occurs when criminals use stolen payment information to make online or phone transactions without the physical card, exploiting vulnerabilities in digital payment systems. This type of fraud results in billions of dollars in annual losses for merchants and financial institutions due to its high occurrence in e-commerce and remote payments. Discover effective strategies to detect and prevent card-not-present fraud to protect your business and customers.

Chargeback

Card-not-present fraud frequently leads to chargebacks when unauthorized transactions are disputed by cardholders, causing significant financial losses for merchants and issuing banks. Synthetic identity fraud, involving fabricated identities blending real and fake information, often results in chargebacks through fraudulent credit applications or unauthorized transactions, complicating detection and recovery efforts. Explore more on how these fraud types impact chargeback processes and prevention strategies for businesses.

Payment Gateway

Card-not-present fraud exploits online payment gateways by using stolen card details without the physical card, resulting in unauthorized transactions. Synthetic identity fraud involves creating fake identities by combining real and fabricated information to open fraudulent accounts, often bypassing gateway security measures. Explore advanced payment gateway solutions to effectively detect and prevent both fraud types.

Source and External Links

What Is a Card Not Present (CNP) Transaction and How to Prevent It - This webpage discusses card-not-present fraud, its methods, and strategies like CVN and AVS to prevent it.

Card-not-present transaction - This article explains card-not-present transactions and their association with credit card fraud, highlighting the challenges in verifying cardholder identity.

Card Not Present (CNP): What It Is & How to Prevent - This webpage provides an overview of card-not-present fraud, including its types and methods to protect against it.

dowidth.com

dowidth.com