Regulatory sandboxes permit banks and fintech firms to test innovative financial products in a controlled environment under the supervision of regulators, fostering compliance and risk mitigation. Incubators focus on nurturing early-stage startups by providing resources like mentorship, funding, and workspace to accelerate growth and market entry. Explore how these frameworks shape the future of banking innovation and regulatory technology.

Why it is important

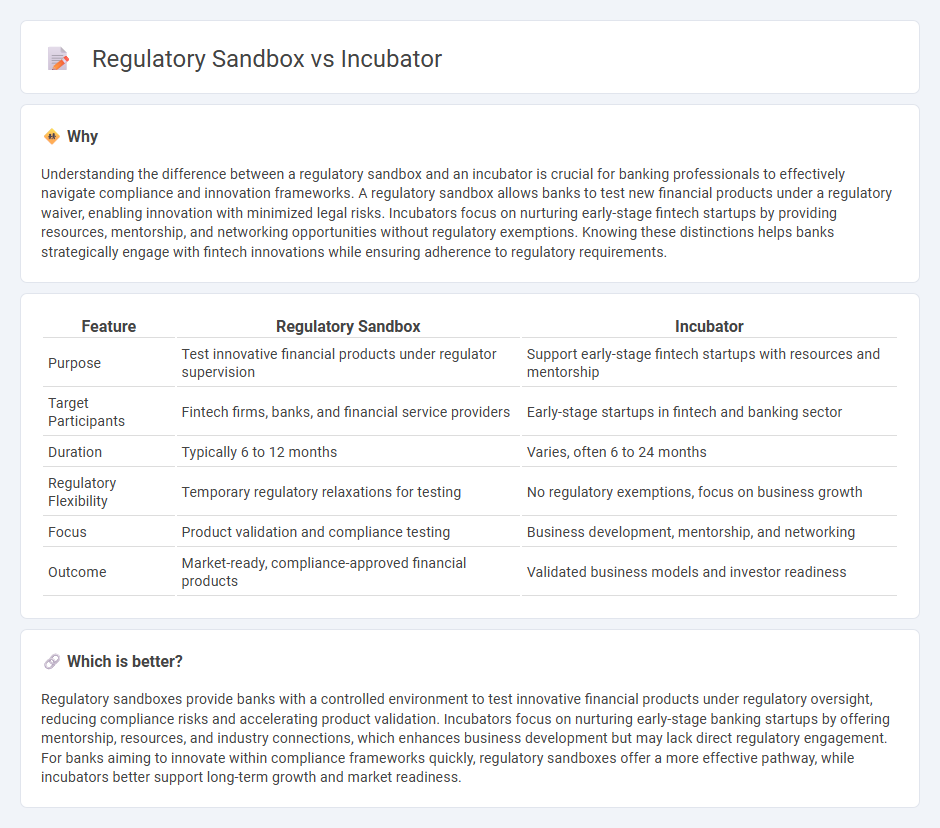

Understanding the difference between a regulatory sandbox and an incubator is crucial for banking professionals to effectively navigate compliance and innovation frameworks. A regulatory sandbox allows banks to test new financial products under a regulatory waiver, enabling innovation with minimized legal risks. Incubators focus on nurturing early-stage fintech startups by providing resources, mentorship, and networking opportunities without regulatory exemptions. Knowing these distinctions helps banks strategically engage with fintech innovations while ensuring adherence to regulatory requirements.

Comparison Table

| Feature | Regulatory Sandbox | Incubator |

|---|---|---|

| Purpose | Test innovative financial products under regulator supervision | Support early-stage fintech startups with resources and mentorship |

| Target Participants | Fintech firms, banks, and financial service providers | Early-stage startups in fintech and banking sector |

| Duration | Typically 6 to 12 months | Varies, often 6 to 24 months |

| Regulatory Flexibility | Temporary regulatory relaxations for testing | No regulatory exemptions, focus on business growth |

| Focus | Product validation and compliance testing | Business development, mentorship, and networking |

| Outcome | Market-ready, compliance-approved financial products | Validated business models and investor readiness |

Which is better?

Regulatory sandboxes provide banks with a controlled environment to test innovative financial products under regulatory oversight, reducing compliance risks and accelerating product validation. Incubators focus on nurturing early-stage banking startups by offering mentorship, resources, and industry connections, which enhances business development but may lack direct regulatory engagement. For banks aiming to innovate within compliance frameworks quickly, regulatory sandboxes offer a more effective pathway, while incubators better support long-term growth and market readiness.

Connection

Regulatory sandboxes and incubators are interconnected through their shared goal of fostering innovation within the banking sector by providing controlled environments for testing new financial technologies. Banks and fintech startups benefit from incubators by gaining access to mentorship and resources, while regulatory sandboxes offer a framework to experiment with innovative products under regulatory supervision. This collaboration accelerates the development of compliant, customer-centric banking solutions and helps regulators adapt to emerging financial trends.

Key Terms

Innovation Support

Incubators provide startups with resources such as mentorship, office space, and funding opportunities to accelerate business growth, emphasizing early-stage innovation support. Regulatory sandboxes allow startups and tech companies to test new products and services in a controlled environment with relaxed regulatory requirements, fostering innovation in compliance-heavy sectors like fintech and healthtech. Explore how combining incubators and regulatory sandboxes can optimize innovation strategies for emerging businesses.

Compliance Testing

Compliance testing in incubators primarily supports startups by providing a controlled environment to assess regulatory adherence during product development stages. Regulatory sandboxes offer a more structured framework, allowing businesses to test innovative solutions under real market conditions with regulatory oversight to ensure compliance. Explore further to understand how these approaches can accelerate product approvals and reduce compliance risks.

Risk Management

Incubators primarily support startups by providing mentorship, resources, and networking opportunities to mitigate operational risks, while regulatory sandboxes offer a controlled environment for testing innovative products under regulatory supervision to manage compliance and market risks. In the context of risk management, incubators focus on business development risks, whereas regulatory sandboxes concentrate on regulatory and legal risks associated with new financial technologies or services. Explore how these frameworks balance innovation and risk mitigation to accelerate safe market entry.

Source and External Links

Business incubator - Wikipedia - A business incubator is an organization that supports startup companies and entrepreneurs by providing resources like office space, administrative services, and mentoring to help develop their businesses.

Incubators at Tractor Supply Co. - Incubators for hatching eggs provide controlled environments with optimal temperature and humidity, available in automatic and manual types, to help hatch chicks without the need for mother hens.

Chicken Incubator & Brooder Supplies - Mann Lake - Poultry incubators regulate humidity and temperature to improve hatch rates, and brooders provide warmth and protection for newly hatched chicks, with different sizes available for various flock needs.

dowidth.com

dowidth.com