Finfluencers leverage social media platforms to provide real-time personal finance tips, investment insights, and budget strategies, appealing to a tech-savvy generation seeking accessible financial advice. Bank advisors offer personalized, regulated guidance tailored to each client's financial situation, ensuring compliance and addressing complex banking needs such as loans, mortgages, and retirement planning. Discover how these two approaches impact your financial decisions and which one aligns best with your goals.

Why it is important

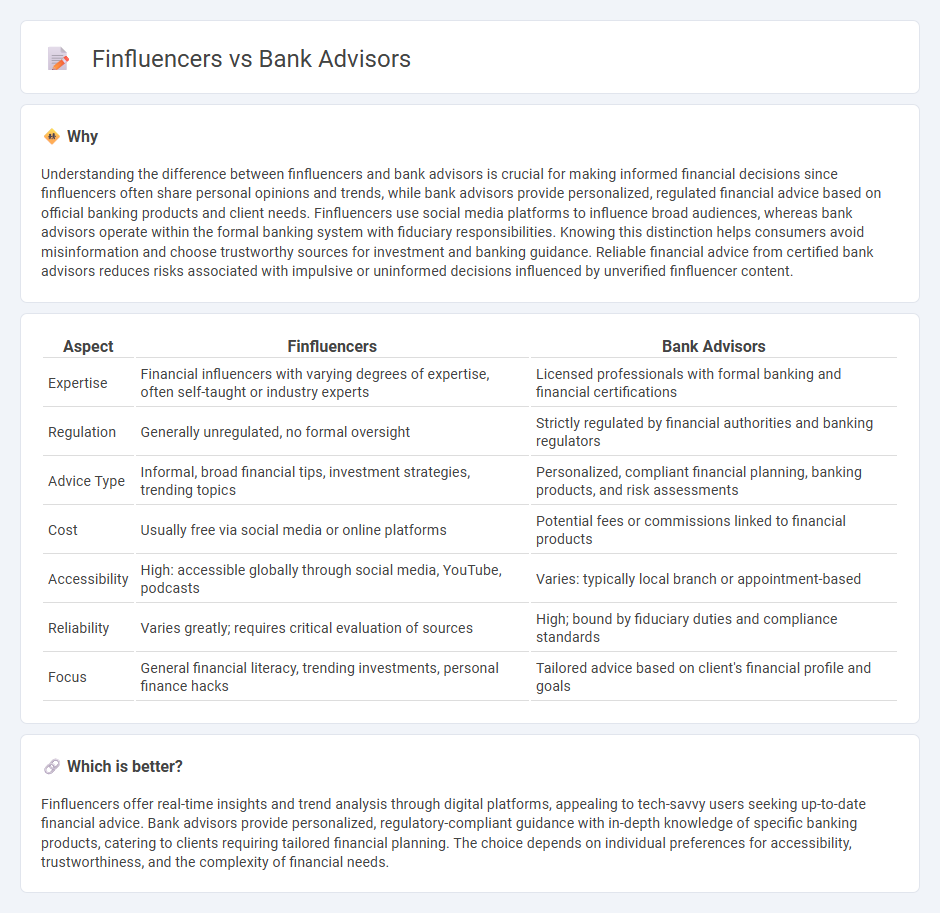

Understanding the difference between finfluencers and bank advisors is crucial for making informed financial decisions since finfluencers often share personal opinions and trends, while bank advisors provide personalized, regulated financial advice based on official banking products and client needs. Finfluencers use social media platforms to influence broad audiences, whereas bank advisors operate within the formal banking system with fiduciary responsibilities. Knowing this distinction helps consumers avoid misinformation and choose trustworthy sources for investment and banking guidance. Reliable financial advice from certified bank advisors reduces risks associated with impulsive or uninformed decisions influenced by unverified finfluencer content.

Comparison Table

| Aspect | Finfluencers | Bank Advisors |

|---|---|---|

| Expertise | Financial influencers with varying degrees of expertise, often self-taught or industry experts | Licensed professionals with formal banking and financial certifications |

| Regulation | Generally unregulated, no formal oversight | Strictly regulated by financial authorities and banking regulators |

| Advice Type | Informal, broad financial tips, investment strategies, trending topics | Personalized, compliant financial planning, banking products, and risk assessments |

| Cost | Usually free via social media or online platforms | Potential fees or commissions linked to financial products |

| Accessibility | High: accessible globally through social media, YouTube, podcasts | Varies: typically local branch or appointment-based |

| Reliability | Varies greatly; requires critical evaluation of sources | High; bound by fiduciary duties and compliance standards |

| Focus | General financial literacy, trending investments, personal finance hacks | Tailored advice based on client's financial profile and goals |

Which is better?

Finfluencers offer real-time insights and trend analysis through digital platforms, appealing to tech-savvy users seeking up-to-date financial advice. Bank advisors provide personalized, regulatory-compliant guidance with in-depth knowledge of specific banking products, catering to clients requiring tailored financial planning. The choice depends on individual preferences for accessibility, trustworthiness, and the complexity of financial needs.

Connection

Finfluencers and bank advisors both provide financial guidance, but finfluencers use social media platforms to reach a broad audience with accessible tips on saving, investing, and budgeting, while bank advisors offer personalized, regulatory-compliant advice tailored to individual clients' financial goals. Collaboration between finfluencers and bank advisors enhances financial literacy by combining engaging digital content with professional expertise, facilitating better-informed financial decisions among consumers. This synergy supports banks' efforts to attract younger demographics by leveraging influencer credibility alongside traditional advisory services.

Key Terms

Fiduciary Duty

Bank advisors are legally bound by fiduciary duty to act in the best interests of their clients, providing personalized financial advice with a high standard of care and confidentiality. Finfluencers, while influential on social media platforms, often lack formal regulatory oversight and fiduciary obligations, which may lead to advice driven by sponsorships or personal gain rather than client benefit. Explore how fiduciary duty impacts financial advice quality and trustworthiness by learning more about these contrasting advisory roles.

Regulatory Compliance

Bank advisors operate under strict regulatory compliance frameworks such as MiFID II in Europe and FINRA regulations in the United States, ensuring transparency, fiduciary duty, and client protection. Finfluencers, often utilizing social media platforms like Instagram, TikTok, and YouTube, typically face fewer regulations, raising concerns about the accuracy and reliability of their financial advice. Discover how regulatory compliance impacts the trustworthiness and safety of financial guidance in today's digital era.

Suitability Assessment

Bank advisors conduct thorough Suitability Assessments by evaluating clients' financial situations, risk tolerance, and investment goals to recommend personalized financial products aligned with regulatory standards. In contrast, finfluencers often provide general advice lacking formal assessment procedures, which may not account for individual suitability or compliance requirements. Explore detailed comparisons on suitability practices between bank advisors and finfluencers to make informed financial decisions.

Source and External Links

Bank Advisors Ltd. - Bank Advisors specializes in outsourced loan underwriting, risk review, and M&A advisory services for community banks and credit unions, leveraging decades of industry expertise to provide regulatory compliance, ongoing risk management, and actionable insights.

Bank & Credit Union Advisors - Raymond James - Raymond James Financial Institutions Division empowers bank and credit union advisors with a robust wealth platform, technology, and dedicated support to expand investment and advisory capabilities for clients.

Find a Financial Advisor or Banker | U.S. Bancorp Investments - U.S. Bank offers access to experienced wealth management and private banking advisors who develop personalized financial plans, leveraging technology and a full suite of banking, investment, and trust services.

dowidth.com

dowidth.com