Instant settlement enables funds to be transferred and made available within seconds, enhancing liquidity and enabling real-time transactions. Same-day settlement processes payments by the end of the banking day, offering speed but with slight delay compared to instant options. Explore the differences and benefits of each to optimize your financial operations.

Why it is important

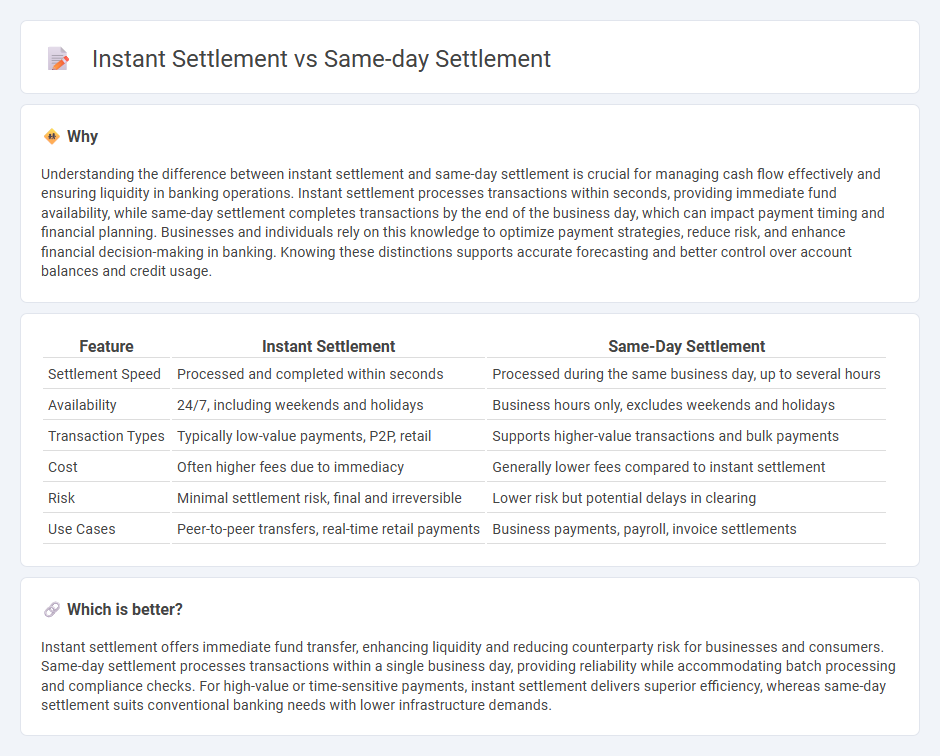

Understanding the difference between instant settlement and same-day settlement is crucial for managing cash flow effectively and ensuring liquidity in banking operations. Instant settlement processes transactions within seconds, providing immediate fund availability, while same-day settlement completes transactions by the end of the business day, which can impact payment timing and financial planning. Businesses and individuals rely on this knowledge to optimize payment strategies, reduce risk, and enhance financial decision-making in banking. Knowing these distinctions supports accurate forecasting and better control over account balances and credit usage.

Comparison Table

| Feature | Instant Settlement | Same-Day Settlement |

|---|---|---|

| Settlement Speed | Processed and completed within seconds | Processed during the same business day, up to several hours |

| Availability | 24/7, including weekends and holidays | Business hours only, excludes weekends and holidays |

| Transaction Types | Typically low-value payments, P2P, retail | Supports higher-value transactions and bulk payments |

| Cost | Often higher fees due to immediacy | Generally lower fees compared to instant settlement |

| Risk | Minimal settlement risk, final and irreversible | Lower risk but potential delays in clearing |

| Use Cases | Peer-to-peer transfers, real-time retail payments | Business payments, payroll, invoice settlements |

Which is better?

Instant settlement offers immediate fund transfer, enhancing liquidity and reducing counterparty risk for businesses and consumers. Same-day settlement processes transactions within a single business day, providing reliability while accommodating batch processing and compliance checks. For high-value or time-sensitive payments, instant settlement delivers superior efficiency, whereas same-day settlement suits conventional banking needs with lower infrastructure demands.

Connection

Instant settlement and same-day settlement both enhance transaction efficiency by drastically reducing the time required to process payments. Instant settlement enables funds to be transferred and available immediately, while same-day settlement ensures transactions are completed within the same business day. These mechanisms improve liquidity management, reduce credit risk, and streamline cash flow for banks and customers alike.

Key Terms

Clearing

Same-day settlement ensures that securities transactions are cleared and settled within the same business day, reducing counterparty risk and improving liquidity. Instant settlement advances this concept by finalizing clearing and settlement processes in real-time or near real-time, enhancing efficiency and minimizing delays in fund availability. Explore how clearing innovations drive faster settlement solutions and their impact on financial markets.

Settlement Window

Same-day settlement processes transactions within the same business day, typically during bank operating hours, resulting in a settlement window that spans several hours. Instant settlement minimizes this window to mere seconds, enabling real-time fund transfers and improving cash flow efficiency for businesses. Explore our detailed comparison to understand how settlement windows impact transaction speed and liquidity.

Funds Availability

Same-day settlement ensures that funds are processed and available by the end of the business day, typically within a few hours, depending on the financial institution's cut-off times. Instant settlement, on the other hand, offers real-time funds availability, allowing users immediate access to transferred money without any delay. Explore the differences between these payment methods to optimize cash flow management and enhance transaction efficiency.

Source and External Links

Same day settlement - IBM - Same day settlement occurs when financial institutions process and settle transactions on the same business day, using business rules to determine eligibility and set settlement dates, instead of the usual next-day settlement process.

Not just a pipe dream: Achieving same day settlement in FX - e-Forex - Same day settlement means trades are executed and settled immediately on the same day, with recent blockchain trials showing faster processing compared to traditional two-day settlement systems.

GSD Same-Day Settling Service - DTCC - The DTCC's Same-Day Settling Service enables eligible government securities trades to settle on the same day, bypassing the typical netting process and offering voluntary participation for some members but mandatory for others.

dowidth.com

dowidth.com