Alternative data lending leverages non-traditional data sources such as utility payments, social media activity, and mobile phone usage to assess creditworthiness, expanding access for underserved borrowers. Cash flow-based lending focuses on analyzing a business's income and expense statements, providing loans based on real-time revenue streams and financial health. Explore how these innovative lending models transform credit evaluation and support financial inclusion.

Why it is important

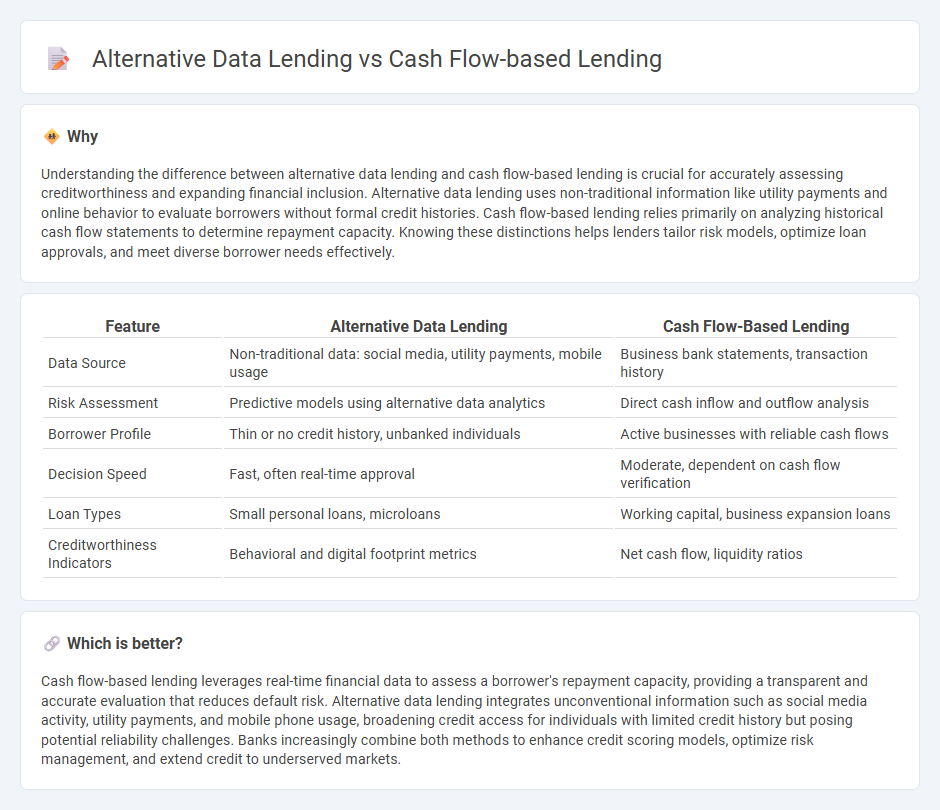

Understanding the difference between alternative data lending and cash flow-based lending is crucial for accurately assessing creditworthiness and expanding financial inclusion. Alternative data lending uses non-traditional information like utility payments and online behavior to evaluate borrowers without formal credit histories. Cash flow-based lending relies primarily on analyzing historical cash flow statements to determine repayment capacity. Knowing these distinctions helps lenders tailor risk models, optimize loan approvals, and meet diverse borrower needs effectively.

Comparison Table

| Feature | Alternative Data Lending | Cash Flow-Based Lending |

|---|---|---|

| Data Source | Non-traditional data: social media, utility payments, mobile usage | Business bank statements, transaction history |

| Risk Assessment | Predictive models using alternative data analytics | Direct cash inflow and outflow analysis |

| Borrower Profile | Thin or no credit history, unbanked individuals | Active businesses with reliable cash flows |

| Decision Speed | Fast, often real-time approval | Moderate, dependent on cash flow verification |

| Loan Types | Small personal loans, microloans | Working capital, business expansion loans |

| Creditworthiness Indicators | Behavioral and digital footprint metrics | Net cash flow, liquidity ratios |

Which is better?

Cash flow-based lending leverages real-time financial data to assess a borrower's repayment capacity, providing a transparent and accurate evaluation that reduces default risk. Alternative data lending integrates unconventional information such as social media activity, utility payments, and mobile phone usage, broadening credit access for individuals with limited credit history but posing potential reliability challenges. Banks increasingly combine both methods to enhance credit scoring models, optimize risk management, and extend credit to underserved markets.

Connection

Alternative data lending leverages non-traditional financial information such as utility payments, social media activity, and transaction patterns to assess creditworthiness, providing a broader customer profile beyond conventional credit scores. Cash flow-based lending evaluates a borrower's real-time income and expenses to determine loan eligibility, offering a dynamic and accurate risk assessment. Both approaches utilize alternative data sources and real-time financial insights to enhance predictive accuracy and expand access to credit for underserved or non-prime borrowers.

Key Terms

Borrower Cash Flow Analysis

Cash flow-based lending prioritizes analyzing a borrower's historical and projected cash flows to evaluate repayment capacity, relying heavily on financial statements and bank account data. Alternative data lending incorporates non-traditional data sources such as utility payments, social media activity, and transactional patterns to assess creditworthiness, especially for borrowers with limited financial histories. Explore the detailed methodologies and advantages of both lending approaches to better understand their impact on borrower cash flow analysis.

Alternative Data Sources

Alternative data lending leverages diverse non-traditional sources such as social media activity, utility bill payments, and mobile phone usage patterns to assess borrower creditworthiness, offering a broader and more inclusive evaluation framework compared to cash flow-based lending that relies mainly on financial statements and transaction histories. This innovative approach enhances risk assessment accuracy by incorporating real-time behavioral data and digital footprints, which are especially valuable for underserved or thin-file borrowers lacking comprehensive financial records. Explore how alternative data sources transform lending practices and improve access to credit in today's evolving financial ecosystem.

Credit Risk Assessment

Cash flow-based lending evaluates credit risk by analyzing a borrower's income statements and cash flow trends, offering a reliable indicator of repayment capacity through historical financial performance. Alternative data lending incorporates non-traditional information such as utility payments, social media activity, and mobile phone usage, providing credit insights for borrowers with limited credit history. Explore detailed comparisons of these credit risk assessment methods to understand their impact on lending decisions.

Source and External Links

Unleashing the Potential of Cash Flow Lending - Cash flow lending focuses on a business's ability to generate consistent cash inflows and uses operational performance and future cash flow projections--rather than collateral--to determine creditworthiness.

Business Owner's Guide to Cash Flow Lending - Cash flow lending provides loans based on anticipated future revenue, offering faster funding and flexible repayment for businesses, even those with less-than-perfect credit or limited collateral.

What is cash flow finance? - Cash flow lending is typically unsecured, short-term financing with higher interest rates, where approval relies more on business performance and future cash flow than on business credit score or assets.

dowidth.com

dowidth.com