Neo brokerages offer simplified, low-cost access to stock trading with user-friendly interfaces and zero-commission fees, appealing to new investors. Online trading platforms provide comprehensive tools, advanced charting, and a broader range of assets, catering to experienced traders seeking greater control. Explore the differences to choose the platform best suited for your trading goals.

Why it is important

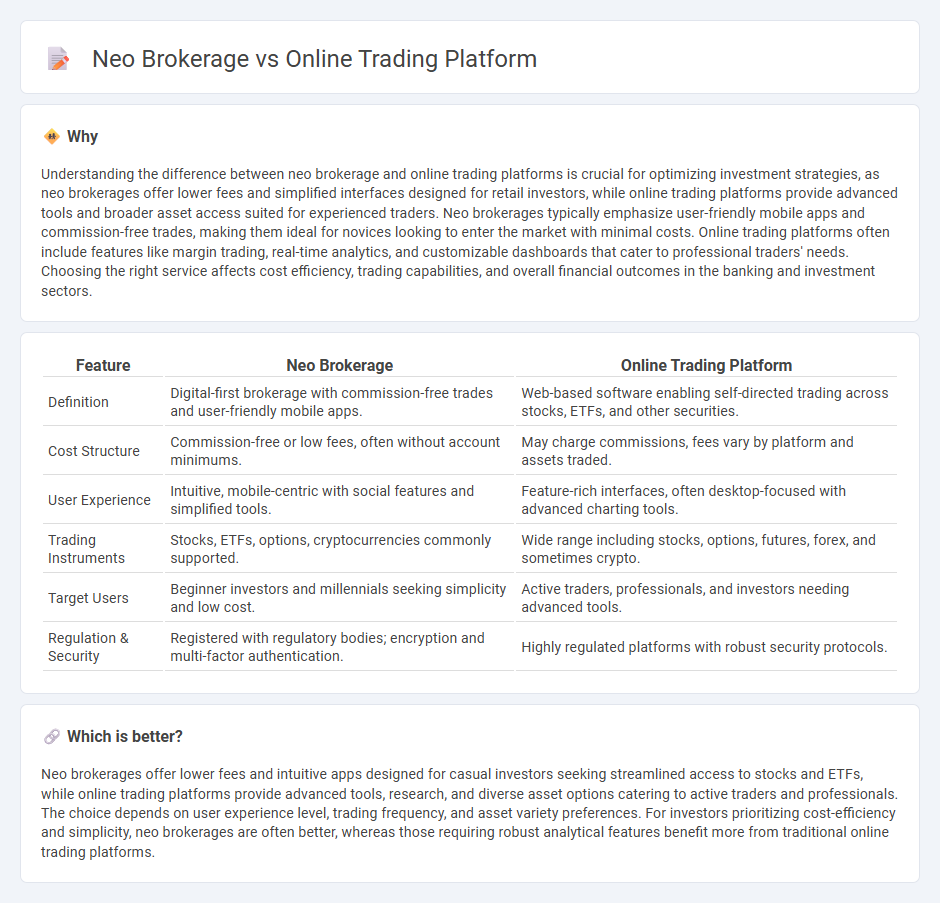

Understanding the difference between neo brokerage and online trading platforms is crucial for optimizing investment strategies, as neo brokerages offer lower fees and simplified interfaces designed for retail investors, while online trading platforms provide advanced tools and broader asset access suited for experienced traders. Neo brokerages typically emphasize user-friendly mobile apps and commission-free trades, making them ideal for novices looking to enter the market with minimal costs. Online trading platforms often include features like margin trading, real-time analytics, and customizable dashboards that cater to professional traders' needs. Choosing the right service affects cost efficiency, trading capabilities, and overall financial outcomes in the banking and investment sectors.

Comparison Table

| Feature | Neo Brokerage | Online Trading Platform |

|---|---|---|

| Definition | Digital-first brokerage with commission-free trades and user-friendly mobile apps. | Web-based software enabling self-directed trading across stocks, ETFs, and other securities. |

| Cost Structure | Commission-free or low fees, often without account minimums. | May charge commissions, fees vary by platform and assets traded. |

| User Experience | Intuitive, mobile-centric with social features and simplified tools. | Feature-rich interfaces, often desktop-focused with advanced charting tools. |

| Trading Instruments | Stocks, ETFs, options, cryptocurrencies commonly supported. | Wide range including stocks, options, futures, forex, and sometimes crypto. |

| Target Users | Beginner investors and millennials seeking simplicity and low cost. | Active traders, professionals, and investors needing advanced tools. |

| Regulation & Security | Registered with regulatory bodies; encryption and multi-factor authentication. | Highly regulated platforms with robust security protocols. |

Which is better?

Neo brokerages offer lower fees and intuitive apps designed for casual investors seeking streamlined access to stocks and ETFs, while online trading platforms provide advanced tools, research, and diverse asset options catering to active traders and professionals. The choice depends on user experience level, trading frequency, and asset variety preferences. For investors prioritizing cost-efficiency and simplicity, neo brokerages are often better, whereas those requiring robust analytical features benefit more from traditional online trading platforms.

Connection

Neo brokerages leverage advanced online trading platforms to provide cost-efficient, user-friendly access to financial markets, enabling investors to execute trades seamlessly and monitor portfolios in real-time. These platforms integrate features like algorithmic trading, real-time data analytics, and mobile accessibility, fostering increased market participation and democratizing investment opportunities. By combining low fees and intuitive interfaces, neo brokerages disrupt traditional banking services and drive the evolution of digital wealth management.

Key Terms

**Online Trading Platform:**

Online trading platforms offer users direct access to a wide range of financial instruments, including stocks, options, ETFs, and forex, with advanced charting tools, real-time market data, and customizable interfaces designed for active traders. These platforms typically provide robust order execution capabilities, extensive research resources, and integrated risk management features to support strategic trading decisions. Explore the benefits and features of top online trading platforms to enhance your investing experience.

Order Execution

Online trading platforms provide direct access to global markets with advanced order types and real-time execution speeds, ideal for active traders seeking control. Neo brokerages emphasize simplified, cost-effective order execution with minimal fees and user-friendly interfaces, appealing to casual investors. Explore detailed comparisons to determine which platform aligns best with your trading goals.

Market Data Access

Online trading platforms typically offer comprehensive market data access, including real-time quotes, advanced charting tools, and extensive research reports, catering to active traders and investors. Neo brokerages provide streamlined market data access with a focus on essential, user-friendly information, often leveraging low-cost or commission-free trading to attract cost-conscious users. Explore deeper comparisons on market data accessibility and trading features to determine which platform aligns best with your investment needs.

Source and External Links

Some of The Best Trading Platforms for 2025 - AvaTrade - AvaTrade offers a wide range of online trading platforms including MetaTrader 4 & 5, AvaOptions, AvaSocial, WebTrader, and mobile apps for seamless trading on both desktop and mobile with features suited for beginners and experts alike.

Best Online Trading Platforms In July 2025 - Bankrate - Highlights top brokerage platforms like Charles Schwab, Fidelity, Merrill Edge (with its MarketPro platform), and Ally Invest, emphasizing features such as customizable dashboards, advanced charting tools, technical studies, and competitive commission structures.

Best Day Trading Platforms: 2025 Top Picks - NerdWallet - Lists leading online trading platforms for day trading including Robinhood, Interactive Brokers IBKR Pro, Webull, and Charles Schwab, focusing on low costs, fast execution, no account minimums, and specialized tools for active traders.

dowidth.com

dowidth.com