Instant payments enable real-time fund transfers, enhancing liquidity and customer satisfaction by providing immediate transaction confirmation. Batch payments process multiple transactions simultaneously at scheduled intervals, optimizing efficiency for bulk payrolls or vendor payments but with inherent delays. Explore the benefits and use cases of instant versus batch payments to determine the best fit for your financial operations.

Why it is important

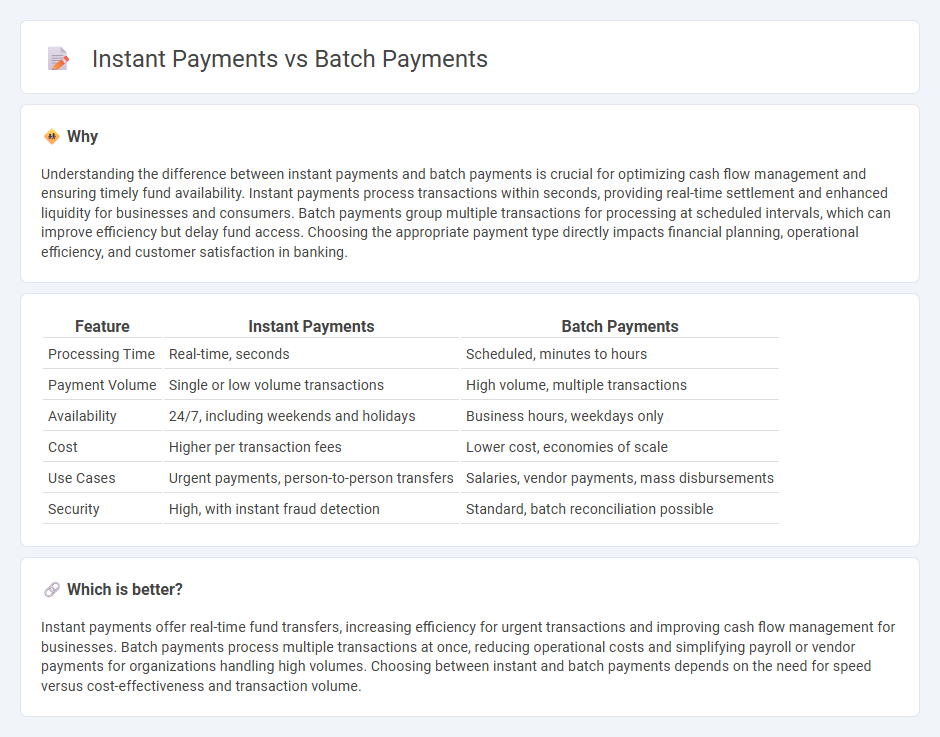

Understanding the difference between instant payments and batch payments is crucial for optimizing cash flow management and ensuring timely fund availability. Instant payments process transactions within seconds, providing real-time settlement and enhanced liquidity for businesses and consumers. Batch payments group multiple transactions for processing at scheduled intervals, which can improve efficiency but delay fund access. Choosing the appropriate payment type directly impacts financial planning, operational efficiency, and customer satisfaction in banking.

Comparison Table

| Feature | Instant Payments | Batch Payments |

|---|---|---|

| Processing Time | Real-time, seconds | Scheduled, minutes to hours |

| Payment Volume | Single or low volume transactions | High volume, multiple transactions |

| Availability | 24/7, including weekends and holidays | Business hours, weekdays only |

| Cost | Higher per transaction fees | Lower cost, economies of scale |

| Use Cases | Urgent payments, person-to-person transfers | Salaries, vendor payments, mass disbursements |

| Security | High, with instant fraud detection | Standard, batch reconciliation possible |

Which is better?

Instant payments offer real-time fund transfers, increasing efficiency for urgent transactions and improving cash flow management for businesses. Batch payments process multiple transactions at once, reducing operational costs and simplifying payroll or vendor payments for organizations handling high volumes. Choosing between instant and batch payments depends on the need for speed versus cost-effectiveness and transaction volume.

Connection

Instant payments and batch payments both facilitate money transfers within the banking system, with instant payments enabling real-time fund transfers for immediate settlement and batch payments processing multiple transactions collectively at scheduled intervals. Banks often integrate these systems to optimize cash flow management and enhance operational efficiency by balancing demand for immediacy and cost-effective bulk processing. Advanced payment platforms support seamless interoperability, allowing businesses to choose between immediate transaction execution and grouped payment processing based on liquidity needs and payment priorities.

Key Terms

Settlement Time

Batch payments process multiple transactions in a single batch, typically settling at scheduled intervals which may delay fund availability by several hours or even days. Instant payments enable immediate fund transfers and settlement, often within seconds, enhancing liquidity and cash flow management. Explore the differences in settlement times to determine the best payment solution for your business needs.

Processing Method

Batch payments process multiple transactions together at scheduled intervals, optimizing efficiency for businesses handling high volumes. Instant payments, in contrast, enable real-time fund transfers, providing immediate confirmation and faster cash flow. Explore the detailed differences in processing methods to determine which suits your financial operations best.

Transaction Fees

Batch payments typically incur lower transaction fees as multiple transactions are processed together, reducing costs per individual payment. Instant payments often have higher fees due to real-time processing demands and infrastructure requirements, which can impact businesses with frequent small-value transactions. Explore detailed comparisons and cost-saving strategies to optimize your payment processing.

Source and External Links

What Is a Batch Payment and How Does It Work? - 3S Money - Batch payments allow businesses to send multiple individual payments to different recipients as a single transaction, streamlining processes like payroll, vendor payments, and international transfers while reducing errors and administrative overhead.

How batch payment processing works - Stripe - Batch payment processing groups multiple transactions for processing at specific intervals, typically reducing fees and simplifying reconciliation for businesses with high, regular payment volumes, such as payroll and supplier payments.

Guide to Batch Payment Processing - GoCardless - Batch payment processing consolidates numerous transactions into a single operation, enabling businesses to handle recurring payments, invoices, and payroll efficiently while improving cash flow management and minimizing duplicate payments.

dowidth.com

dowidth.com