Wealthtech platforms leverage advanced technology to provide personalized investment and wealth management solutions, transforming traditional financial advisory services for high-net-worth individuals. Neobanks operate entirely online, offering streamlined, low-cost banking services without physical branches, targeting digitally-savvy customers seeking convenience and flexibility. Explore the key differences and unique benefits of wealthtech and neobanks to determine which modern banking innovation suits your financial needs best.

Why it is important

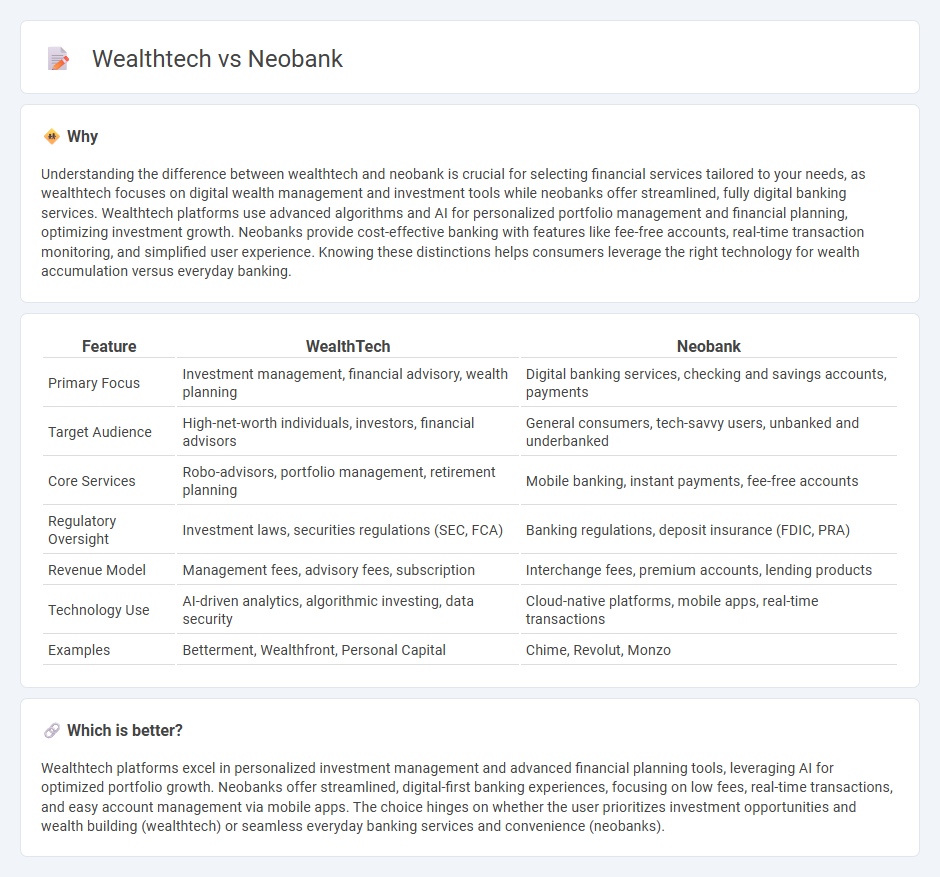

Understanding the difference between wealthtech and neobank is crucial for selecting financial services tailored to your needs, as wealthtech focuses on digital wealth management and investment tools while neobanks offer streamlined, fully digital banking services. Wealthtech platforms use advanced algorithms and AI for personalized portfolio management and financial planning, optimizing investment growth. Neobanks provide cost-effective banking with features like fee-free accounts, real-time transaction monitoring, and simplified user experience. Knowing these distinctions helps consumers leverage the right technology for wealth accumulation versus everyday banking.

Comparison Table

| Feature | WealthTech | Neobank |

|---|---|---|

| Primary Focus | Investment management, financial advisory, wealth planning | Digital banking services, checking and savings accounts, payments |

| Target Audience | High-net-worth individuals, investors, financial advisors | General consumers, tech-savvy users, unbanked and underbanked |

| Core Services | Robo-advisors, portfolio management, retirement planning | Mobile banking, instant payments, fee-free accounts |

| Regulatory Oversight | Investment laws, securities regulations (SEC, FCA) | Banking regulations, deposit insurance (FDIC, PRA) |

| Revenue Model | Management fees, advisory fees, subscription | Interchange fees, premium accounts, lending products |

| Technology Use | AI-driven analytics, algorithmic investing, data security | Cloud-native platforms, mobile apps, real-time transactions |

| Examples | Betterment, Wealthfront, Personal Capital | Chime, Revolut, Monzo |

Which is better?

Wealthtech platforms excel in personalized investment management and advanced financial planning tools, leveraging AI for optimized portfolio growth. Neobanks offer streamlined, digital-first banking experiences, focusing on low fees, real-time transactions, and easy account management via mobile apps. The choice hinges on whether the user prioritizes investment opportunities and wealth building (wealthtech) or seamless everyday banking services and convenience (neobanks).

Connection

Wealthtech platforms leverage digital technology to offer personalized investment solutions, while neobanks provide seamless, app-based banking services; their integration enables real-time wealth management within everyday banking apps. This synergy enhances customer experience by combining banking transactions with automated financial advice and portfolio management. Collaboration between wealthtech and neobank ecosystems fosters data-driven insights, facilitating smarter financial decisions for users.

Key Terms

**Neobank:**

Neobanks revolutionize banking by offering fully digital, mobile-first services that eliminate traditional branch networks, providing seamless access to checking and savings accounts, payments, and loans. These platforms leverage advanced technology to deliver user-friendly interfaces, real-time transactions, and lower fees, appealing to tech-savvy customers and underserved markets. Explore how neobanks reshape financial ecosystems and challenge conventional banking models.

Digital-Only Banking

Digital-only banking through neobanks offers seamless, branchless financial services focused on convenience, low fees, and user-friendly mobile interfaces. Wealthtech platforms specialize in digital wealth management, providing automated investment solutions and personalized financial planning tools. Explore the evolving landscape of digital finance to understand how neobanks and wealthtech reshape banking and investing.

Fintech Integration

Neobank platforms primarily focus on offering digital-first banking services such as checking, savings, and payments, optimizing user experience through seamless mobile integration. Wealthtech solutions integrate advanced financial technologies like robo-advisors, algorithmic trading, and personalized investment management to enhance wealth growth and portfolio optimization. Explore the evolving landscape of fintech integration to discover how these sectors transform financial services.

Source and External Links

What is a neobank? Definition from ... - A neobank is a digital-first fintech company offering core banking services like checking and savings accounts, debit cards, and loans entirely online without physical branches, often through partnerships with traditional banks to provide FDIC insurance and backend banking functions.

What Is a Neobank? - Neobanks are nonbank fintech firms that provide online banking services via partner banks, typically featuring lower fees, competitive rates, mobile-first interfaces, and focused financial products but lack in-person support.

What is a Neobank? How fintech is transforming banking - Neobanks are digital-only financial institutions that increase accessibility to banking, especially benefiting underserved or rural customers, and offer features like reduced fees and faster transactions by operating entirely online.

dowidth.com

dowidth.com