Neobanking offers fully digital banking services through mobile apps without physical branches, focusing on convenience, low fees, and seamless user experiences. Investment banking specializes in financial advisory, capital raising, mergers and acquisitions, and market-making for corporations and institutional clients. Discover how these distinct banking sectors are transforming finance with innovative technologies and tailored solutions.

Why it is important

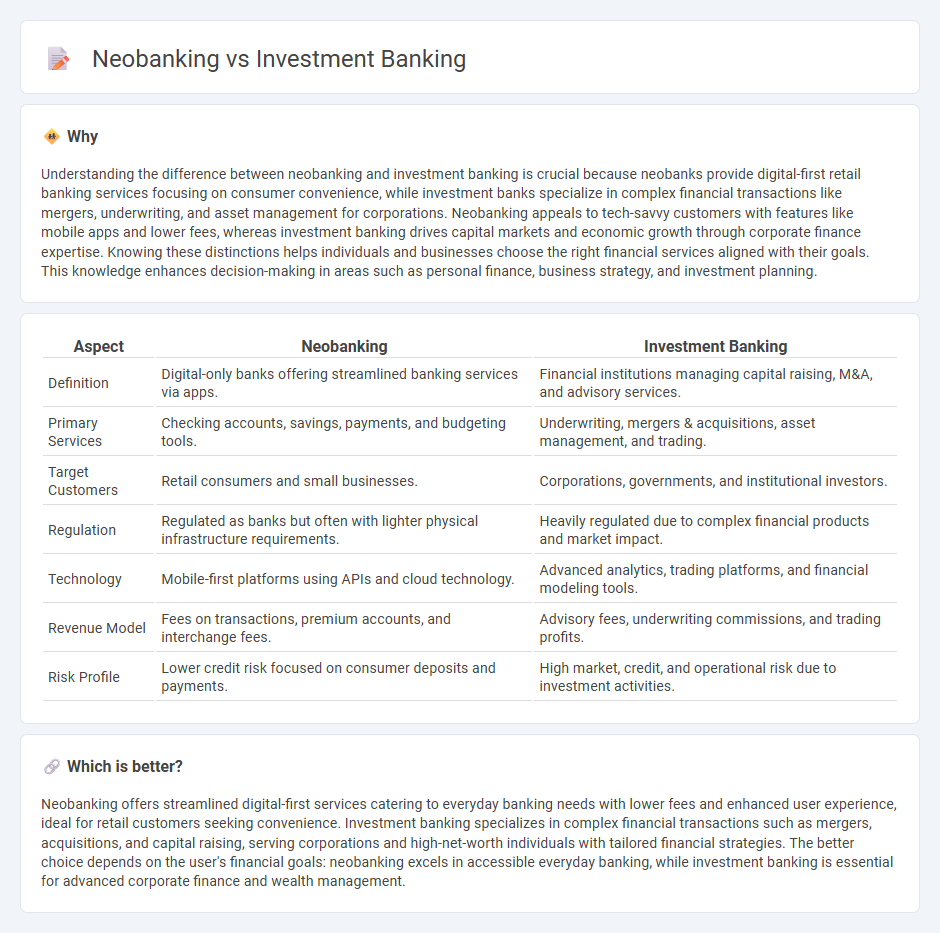

Understanding the difference between neobanking and investment banking is crucial because neobanks provide digital-first retail banking services focusing on consumer convenience, while investment banks specialize in complex financial transactions like mergers, underwriting, and asset management for corporations. Neobanking appeals to tech-savvy customers with features like mobile apps and lower fees, whereas investment banking drives capital markets and economic growth through corporate finance expertise. Knowing these distinctions helps individuals and businesses choose the right financial services aligned with their goals. This knowledge enhances decision-making in areas such as personal finance, business strategy, and investment planning.

Comparison Table

| Aspect | Neobanking | Investment Banking |

|---|---|---|

| Definition | Digital-only banks offering streamlined banking services via apps. | Financial institutions managing capital raising, M&A, and advisory services. |

| Primary Services | Checking accounts, savings, payments, and budgeting tools. | Underwriting, mergers & acquisitions, asset management, and trading. |

| Target Customers | Retail consumers and small businesses. | Corporations, governments, and institutional investors. |

| Regulation | Regulated as banks but often with lighter physical infrastructure requirements. | Heavily regulated due to complex financial products and market impact. |

| Technology | Mobile-first platforms using APIs and cloud technology. | Advanced analytics, trading platforms, and financial modeling tools. |

| Revenue Model | Fees on transactions, premium accounts, and interchange fees. | Advisory fees, underwriting commissions, and trading profits. |

| Risk Profile | Lower credit risk focused on consumer deposits and payments. | High market, credit, and operational risk due to investment activities. |

Which is better?

Neobanking offers streamlined digital-first services catering to everyday banking needs with lower fees and enhanced user experience, ideal for retail customers seeking convenience. Investment banking specializes in complex financial transactions such as mergers, acquisitions, and capital raising, serving corporations and high-net-worth individuals with tailored financial strategies. The better choice depends on the user's financial goals: neobanking excels in accessible everyday banking, while investment banking is essential for advanced corporate finance and wealth management.

Connection

Neobanking leverages digital platforms to offer streamlined financial services, often incorporating investment banking features like wealth management and asset trading. Investment banking provides the capital markets expertise and financial instruments that neobanks can integrate into their technology-driven solutions. This synergy enables consumers to access sophisticated investment products through user-friendly neobanking apps, bridging retail banking with advanced investment opportunities.

Key Terms

Underwriting

Investment banking excels in underwriting by facilitating the issuance of securities and managing risk for clients during IPOs and bond offerings, leveraging extensive market expertise and regulatory compliance. Neobanking, primarily focused on digital retail banking services, lacks underwriting capabilities but offers streamlined, technology-driven financial solutions. Explore the distinct roles of underwriting in investment banking versus the digital innovation of neobanks to understand their impact on financial markets.

Digital-Only Banking

Investment banking primarily involves capital raising, mergers and acquisitions, and advisory services for corporations and institutions, while neobanking focuses on providing digital-only banking services directly to consumers without traditional brick-and-mortar branches. Digital-only banking platforms leverage advanced technology to offer seamless, cost-effective financial services such as real-time payments, budgeting tools, and personalized financial insights, differentiating them from the complex, institution-driven operations of investment banks. Explore further to understand how digital-only neobanks are reshaping consumer banking landscapes with innovation and accessibility.

Mergers & Acquisitions

Investment banking specializes in Mergers & Acquisitions (M&A) by providing advisory services, capital raising, and due diligence to facilitate complex transactions for corporations and private equity firms. Neobanking, while primarily digital-focused financial services, rarely engages in direct M&A advisory but may support startups and fintech entities through streamlined funding and payment solutions. Discover more about how investment banks dominate M&A deal-making compared to the emerging role of neobanks in the financial ecosystem.

Source and External Links

What is an Investment Banker? | CFA Institute - Investment bankers are professionals who provide corporate finance services such as capital raising, mergers and acquisitions advisory, and securities issuance, often working in a fast-paced and demanding environment supporting clients from startups to governments.

Investment Banking Overview - Corporate Finance Institute - Investment banking is a financial division that serves governments, corporations, and institutions by underwriting securities and advising on mergers and acquisitions, acting as intermediaries between investors and companies seeking capital.

Investment banking - Wikipedia - Investment banking is an advisory financial service focused on underwriting, trading securities, and providing buy-side advice, generating revenue primarily through fees rather than deposits, distinct from commercial banking.

dowidth.com

dowidth.com