Debt recycling leverages existing home equity to pay off non-deductible debt by converting it into tax-deductible investment debt, enhancing wealth accumulation potential. A line of credit offers flexible borrowing against home equity with variable interest rates, suitable for managing cash flow and short-term financing needs. Explore how these strategies can optimize your financial planning and debt management.

Why it is important

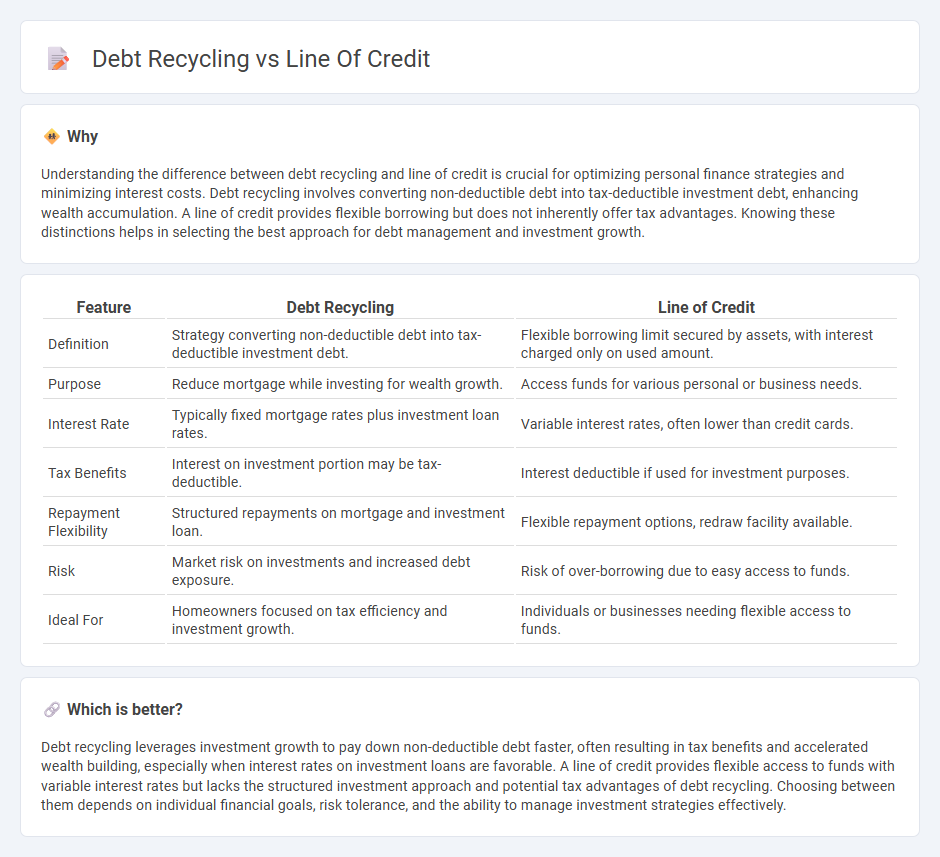

Understanding the difference between debt recycling and line of credit is crucial for optimizing personal finance strategies and minimizing interest costs. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing wealth accumulation. A line of credit provides flexible borrowing but does not inherently offer tax advantages. Knowing these distinctions helps in selecting the best approach for debt management and investment growth.

Comparison Table

| Feature | Debt Recycling | Line of Credit |

|---|---|---|

| Definition | Strategy converting non-deductible debt into tax-deductible investment debt. | Flexible borrowing limit secured by assets, with interest charged only on used amount. |

| Purpose | Reduce mortgage while investing for wealth growth. | Access funds for various personal or business needs. |

| Interest Rate | Typically fixed mortgage rates plus investment loan rates. | Variable interest rates, often lower than credit cards. |

| Tax Benefits | Interest on investment portion may be tax-deductible. | Interest deductible if used for investment purposes. |

| Repayment Flexibility | Structured repayments on mortgage and investment loan. | Flexible repayment options, redraw facility available. |

| Risk | Market risk on investments and increased debt exposure. | Risk of over-borrowing due to easy access to funds. |

| Ideal For | Homeowners focused on tax efficiency and investment growth. | Individuals or businesses needing flexible access to funds. |

Which is better?

Debt recycling leverages investment growth to pay down non-deductible debt faster, often resulting in tax benefits and accelerated wealth building, especially when interest rates on investment loans are favorable. A line of credit provides flexible access to funds with variable interest rates but lacks the structured investment approach and potential tax advantages of debt recycling. Choosing between them depends on individual financial goals, risk tolerance, and the ability to manage investment strategies effectively.

Connection

Debt recycling leverages a home equity line of credit (HELOC) to convert non-deductible mortgage debt into tax-deductible investment debt, enhancing wealth-building strategies. By drawing from the line of credit to invest, borrowers can potentially increase investment returns while managing mortgage repayments more efficiently. This financial tactic optimizes cash flow and tax benefits through the strategic use of a line of credit linked to home equity.

Key Terms

Credit Limit

A line of credit offers a flexible credit limit that borrowers can access up to a predetermined amount, while debt recycling strategically uses this credit limit to convert non-deductible debt into tax-deductible investment debt. Managing the credit limit effectively maximizes borrowing potential, enhances cash flow, and optimizes tax benefits in debt recycling strategies. Explore more to understand how to leverage credit limits in debt recycling for financial growth.

Interest Rate

Interest rates on a line of credit typically fluctuate with the variable market rates, often resulting in lower initial costs but potential variability over time. Debt recycling involves using a line of credit to convert non-deductible home loan debt into tax-deductible investment debt, leveraging interest rate differences for financial benefits. Explore how strategic interest rate management in debt recycling can optimize your borrowing costs and tax efficiency.

Principal Repayment

Principal repayment in a line of credit involves reducing the outstanding balance directly, which lowers interest costs over time and increases borrowing capacity. Debt recycling, on the other hand, strategically converts non-deductible home loan debt into tax-deductible investment debt by using a line of credit to recycle repaid principal into new investments. Explore the benefits and strategies behind principal repayment and debt recycling to optimize your financial planning.

dowidth.com

dowidth.com