Pay by bank enables direct transfers from checking accounts, reducing processing fees and enhancing transaction security compared to credit cards. Credit cards offer convenience and reward programs but often incur higher interest rates and potential fraud risks. Explore detailed comparisons to find the ideal payment method for your financial needs.

Why it is important

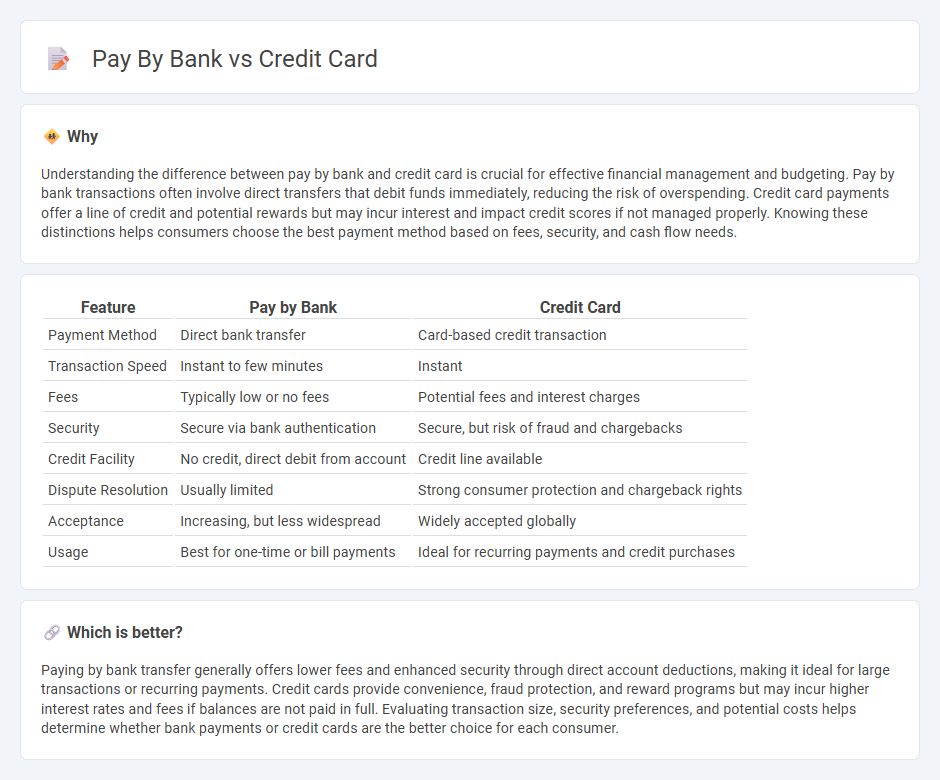

Understanding the difference between pay by bank and credit card is crucial for effective financial management and budgeting. Pay by bank transactions often involve direct transfers that debit funds immediately, reducing the risk of overspending. Credit card payments offer a line of credit and potential rewards but may incur interest and impact credit scores if not managed properly. Knowing these distinctions helps consumers choose the best payment method based on fees, security, and cash flow needs.

Comparison Table

| Feature | Pay by Bank | Credit Card |

|---|---|---|

| Payment Method | Direct bank transfer | Card-based credit transaction |

| Transaction Speed | Instant to few minutes | Instant |

| Fees | Typically low or no fees | Potential fees and interest charges |

| Security | Secure via bank authentication | Secure, but risk of fraud and chargebacks |

| Credit Facility | No credit, direct debit from account | Credit line available |

| Dispute Resolution | Usually limited | Strong consumer protection and chargeback rights |

| Acceptance | Increasing, but less widespread | Widely accepted globally |

| Usage | Best for one-time or bill payments | Ideal for recurring payments and credit purchases |

Which is better?

Paying by bank transfer generally offers lower fees and enhanced security through direct account deductions, making it ideal for large transactions or recurring payments. Credit cards provide convenience, fraud protection, and reward programs but may incur higher interest rates and fees if balances are not paid in full. Evaluating transaction size, security preferences, and potential costs helps determine whether bank payments or credit cards are the better choice for each consumer.

Connection

Paying by bank and credit card are interconnected through electronic payment networks that facilitate secure authorization and fund transfers between the cardholder's bank (issuer) and the merchant's bank (acquirer). Credit cards leverage the cardholder's credit line managed by the issuing bank, while payments are processed via the Automated Clearing House (ACH) or card networks like Visa and Mastercard to debit funds from the bank account. This integration enables seamless transactions, fraud detection, and real-time settlement within the banking infrastructure.

Key Terms

Interest Rate

Credit card interest rates typically range from 15% to 25% APR, which can significantly increase the cost of borrowed funds if balances are not paid in full each month. Pay by bank options, often linked directly to checking accounts, usually do not involve interest charges as payments deduct funds immediately, avoiding debt accumulation. Explore more details on how these payment methods influence your financial health and borrowing costs.

Transaction Fees

Credit card transactions typically involve higher fees, including interchange fees averaging 1.5% to 3% per transaction, plus potential annual fees for cardholders. Pay by bank options often incur lower processing costs, with fees ranging from 0.1% to 0.5%, reducing merchant expenses and improving cash flow. Explore detailed comparisons to understand how transaction fees impact your payment strategy.

Payment Authorization

Payment authorization for credit cards involves real-time verification of card details, available credit, and fraud detection through networks like Visa or Mastercard. Pay by bank leverages direct bank account authentication via open banking APIs, reducing intermediaries and enhancing security by confirming funds prior to transaction approval. Discover more about how these methods impact transaction speed and security.

Source and External Links

Best Credit Cards | July 2025 - Credit Karma - This webpage offers a comprehensive list of the best credit cards for various needs, including rewards, cash back, and no annual fees.

Credit card - Wikipedia - Provides an overview of what credit cards are, how they function, and their differences from other payment cards like debit cards and charge cards.

Apple Card - Offers a unique credit card experience with no fees, up to 3% Daily Cash back, and integration with Apple devices for seamless management.

dowidth.com

dowidth.com