Wealthtech platforms leverage advanced algorithms and AI-driven tools to offer personalized investment portfolios, targeting affluent clients seeking to optimize wealth growth. Personal finance management platforms focus on budgeting, expense tracking, and financial goal-setting, catering to a broader user base aiming to improve everyday money management. Discover how each platform transforms banking through technology and find the best fit for your financial ambitions.

Why it is important

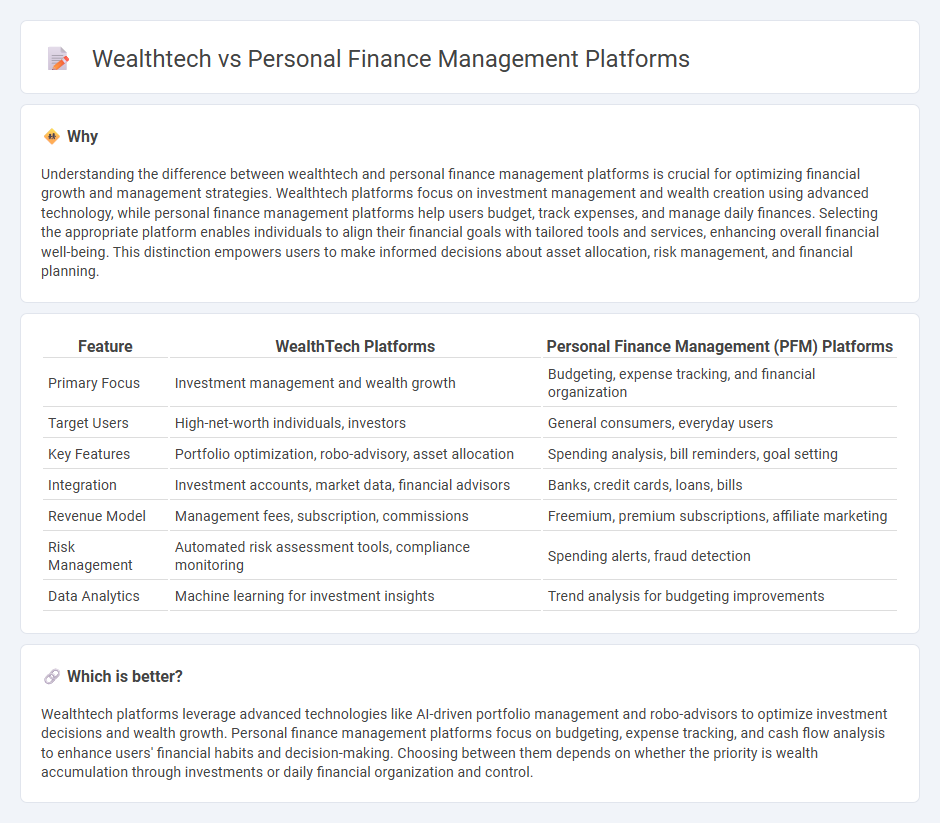

Understanding the difference between wealthtech and personal finance management platforms is crucial for optimizing financial growth and management strategies. Wealthtech platforms focus on investment management and wealth creation using advanced technology, while personal finance management platforms help users budget, track expenses, and manage daily finances. Selecting the appropriate platform enables individuals to align their financial goals with tailored tools and services, enhancing overall financial well-being. This distinction empowers users to make informed decisions about asset allocation, risk management, and financial planning.

Comparison Table

| Feature | WealthTech Platforms | Personal Finance Management (PFM) Platforms |

|---|---|---|

| Primary Focus | Investment management and wealth growth | Budgeting, expense tracking, and financial organization |

| Target Users | High-net-worth individuals, investors | General consumers, everyday users |

| Key Features | Portfolio optimization, robo-advisory, asset allocation | Spending analysis, bill reminders, goal setting |

| Integration | Investment accounts, market data, financial advisors | Banks, credit cards, loans, bills |

| Revenue Model | Management fees, subscription, commissions | Freemium, premium subscriptions, affiliate marketing |

| Risk Management | Automated risk assessment tools, compliance monitoring | Spending alerts, fraud detection |

| Data Analytics | Machine learning for investment insights | Trend analysis for budgeting improvements |

Which is better?

Wealthtech platforms leverage advanced technologies like AI-driven portfolio management and robo-advisors to optimize investment decisions and wealth growth. Personal finance management platforms focus on budgeting, expense tracking, and cash flow analysis to enhance users' financial habits and decision-making. Choosing between them depends on whether the priority is wealth accumulation through investments or daily financial organization and control.

Connection

Wealthtech and personal finance management platforms are interconnected through their shared goal of enhancing financial decision-making using advanced technology such as AI, machine learning, and data analytics. Wealthtech solutions provide tailored investment strategies and portfolio management, while personal finance management platforms offer users comprehensive budgeting, expense tracking, and financial goal setting. Together, these platforms deliver a seamless ecosystem that empowers users to optimize wealth growth and manage personal finances with greater accuracy and convenience.

Key Terms

**Personal Finance Management Platforms:**

Personal Finance Management Platforms emphasize budgeting, expense tracking, and goal setting, providing users with tools to manage day-to-day finances and improve financial discipline. These platforms integrate bank accounts, credit cards, and bills to offer real-time insights and personalized advice. Discover how Personal Finance Management Platforms can empower you to achieve financial clarity and control.

Budgeting

Personal finance management platforms specialize in budgeting by providing tools for expense tracking, bill reminders, and cash flow analysis to help users control daily finances. Wealthtech platforms integrate budgeting with investment management, offering a comprehensive approach to wealth growth and long-term financial planning, often powered by AI-driven insights. Explore our detailed comparison to discover which solution best fits your budgeting and wealth-building goals.

Expense Tracking

Expense tracking in personal finance management platforms offers detailed insights into daily spending patterns, budget adherence, and cash flow monitoring. Wealthtech solutions integrate advanced analytics and AI-driven tools to provide predictive expense forecasting and personalized financial advice. Explore the evolving capabilities of these platforms to optimize your financial health and decision-making.

Source and External Links

Where to Find Personal Finance Software Free - Lists top free personal finance software like Goodbudget, HomeBank, and Money Manager Ex, offering budgeting, expense tracking, and investment management without subscriptions or ads.

PocketSmith - The Best Budgeting & Personal Finance Software - PocketSmith is a highly rated personal finance platform used by hundreds of thousands that offers forecasting of daily balances up to 30 years ahead and customizable dashboards for tracking accounts, budgets, and transactions.

Mint: Budget Tracker & Planner | Free Online Money ... - Mint, now integrated with Credit Karma, provides free online money management by linking accounts from over 17,000 financial institutions to monitor transactions, spending by category, and overall net worth in one place.

dowidth.com

dowidth.com