Social trading allows investors to follow and replicate the trades of experienced traders directly within a community, fostering collaborative financial growth. Mirror trading automates the process by copying specific trading strategies or signals, ensuring consistency and precision without active decision-making. Explore the differences between social trading and mirror trading to enhance your investment approach.

Why it is important

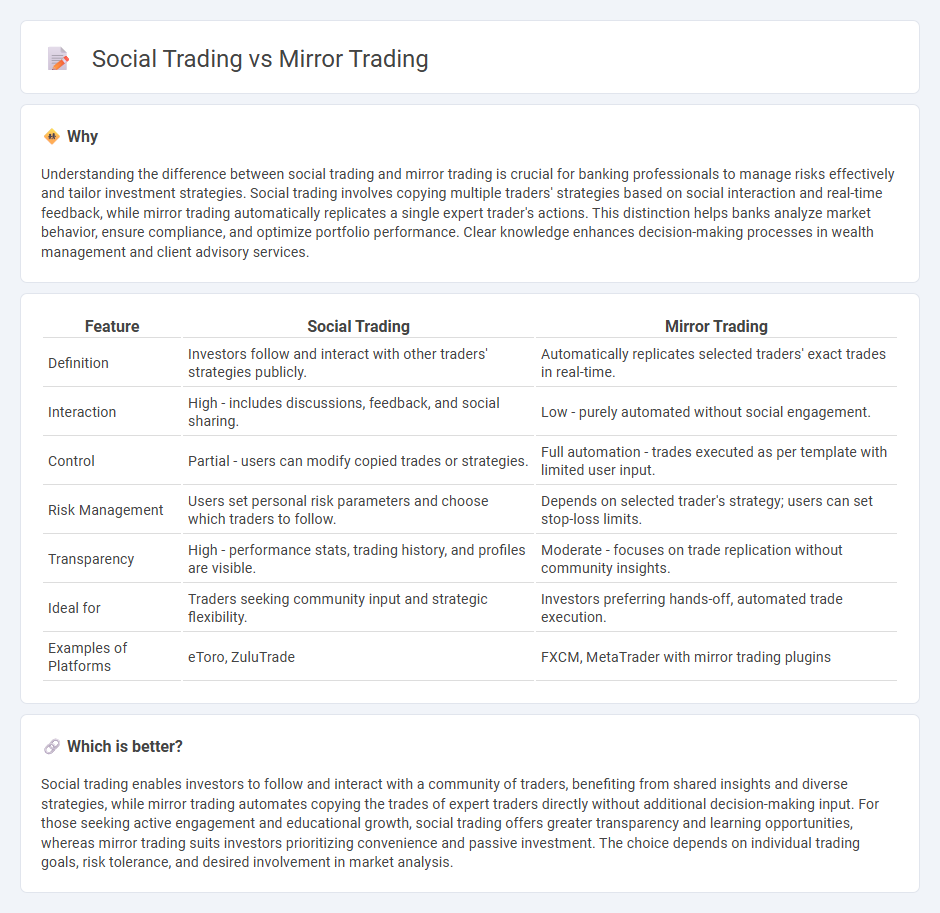

Understanding the difference between social trading and mirror trading is crucial for banking professionals to manage risks effectively and tailor investment strategies. Social trading involves copying multiple traders' strategies based on social interaction and real-time feedback, while mirror trading automatically replicates a single expert trader's actions. This distinction helps banks analyze market behavior, ensure compliance, and optimize portfolio performance. Clear knowledge enhances decision-making processes in wealth management and client advisory services.

Comparison Table

| Feature | Social Trading | Mirror Trading |

|---|---|---|

| Definition | Investors follow and interact with other traders' strategies publicly. | Automatically replicates selected traders' exact trades in real-time. |

| Interaction | High - includes discussions, feedback, and social sharing. | Low - purely automated without social engagement. |

| Control | Partial - users can modify copied trades or strategies. | Full automation - trades executed as per template with limited user input. |

| Risk Management | Users set personal risk parameters and choose which traders to follow. | Depends on selected trader's strategy; users can set stop-loss limits. |

| Transparency | High - performance stats, trading history, and profiles are visible. | Moderate - focuses on trade replication without community insights. |

| Ideal for | Traders seeking community input and strategic flexibility. | Investors preferring hands-off, automated trade execution. |

| Examples of Platforms | eToro, ZuluTrade | FXCM, MetaTrader with mirror trading plugins |

Which is better?

Social trading enables investors to follow and interact with a community of traders, benefiting from shared insights and diverse strategies, while mirror trading automates copying the trades of expert traders directly without additional decision-making input. For those seeking active engagement and educational growth, social trading offers greater transparency and learning opportunities, whereas mirror trading suits investors prioritizing convenience and passive investment. The choice depends on individual trading goals, risk tolerance, and desired involvement in market analysis.

Connection

Social trading and mirror trading are connected through their emphasis on replicating successful traders' strategies within financial markets. Social trading platforms enable investors to follow and interact with expert traders, while mirror trading automatically copies these experts' trades in real time. Both methods leverage collective intelligence and technology to reduce individual research efforts and enhance investment decision-making in banking and finance.

Key Terms

Automated Strategies (Mirror Trading)

Mirror trading leverages automated strategies that execute trades by copying pre-defined algorithms from experienced traders, ensuring consistent and emotion-free execution. Social trading, by contrast, relies on manually following and replicating trades from other investors, which may introduce delays and emotional biases. Discover how automated mirror trading strategies can enhance your portfolio by exploring our in-depth guide.

Copy Trading (Social Trading)

Copy trading, a key subset of social trading, enables investors to automatically replicate the trades of experienced traders in real-time, enhancing portfolio diversification and reducing the need for market expertise. Unlike traditional mirror trading, which strictly duplicates a trader's entire strategy, copy trading offers flexibility by allowing selective copying of trades based on risk appetite and asset preferences. Explore comprehensive insights on how copy trading can optimize your investment strategy and risk management.

Signal Providers

Mirror trading involves replicating trades from professional Signal Providers by automatically copying their strategies, ensuring consistency and precision. Social trading emphasizes interaction, allowing users to follow, discuss, and select Signal Providers based on performance metrics and community feedback. Explore how the roles of Signal Providers differ in mirror and social trading to enhance your investment approach.

Source and External Links

Mirror trading - Wikipedia - Mirror trading is a method that allows traders to automatically copy the trades of selected strategies or experts directly into their own brokerage accounts, primarily used in forex markets and requiring no intervention from the user.

What is Mirror Trading? | NICE Actimize - Mirror trading enables investors to replicate the trades of experienced professionals in real time using automated platforms, providing access to advanced strategies without the need for personal market expertise.

Guide To Mirror Trading Platforms & Software - DayTrading.com - Mirror trading allows traders to copy the positions of others in real time, often through automated systems or bots, making it especially appealing for beginners seeking to learn from seasoned traders.

dowidth.com

dowidth.com