Loyalty fintech platforms integrate banking rewards and incentives directly into user accounts, enhancing customer retention through personalized offers and seamless point redemption. Digital wallets focus on streamlining payments and fund transfers, offering convenience and speed for everyday transactions without traditional card usage. Explore how these innovations reshape financial experiences and drive customer engagement in modern banking.

Why it is important

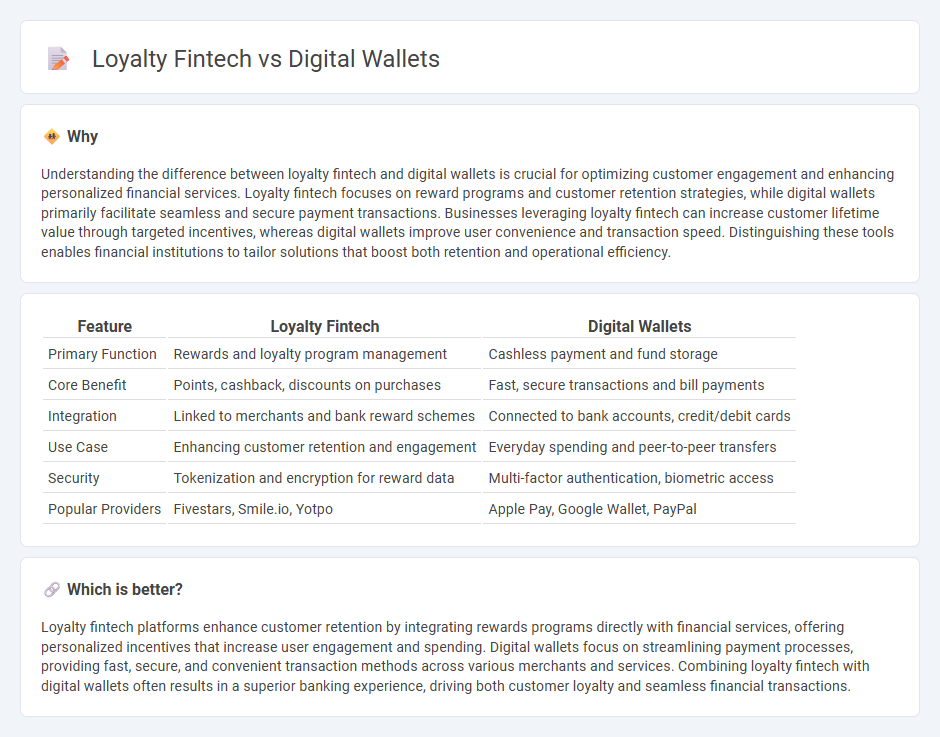

Understanding the difference between loyalty fintech and digital wallets is crucial for optimizing customer engagement and enhancing personalized financial services. Loyalty fintech focuses on reward programs and customer retention strategies, while digital wallets primarily facilitate seamless and secure payment transactions. Businesses leveraging loyalty fintech can increase customer lifetime value through targeted incentives, whereas digital wallets improve user convenience and transaction speed. Distinguishing these tools enables financial institutions to tailor solutions that boost both retention and operational efficiency.

Comparison Table

| Feature | Loyalty Fintech | Digital Wallets |

|---|---|---|

| Primary Function | Rewards and loyalty program management | Cashless payment and fund storage |

| Core Benefit | Points, cashback, discounts on purchases | Fast, secure transactions and bill payments |

| Integration | Linked to merchants and bank reward schemes | Connected to bank accounts, credit/debit cards |

| Use Case | Enhancing customer retention and engagement | Everyday spending and peer-to-peer transfers |

| Security | Tokenization and encryption for reward data | Multi-factor authentication, biometric access |

| Popular Providers | Fivestars, Smile.io, Yotpo | Apple Pay, Google Wallet, PayPal |

Which is better?

Loyalty fintech platforms enhance customer retention by integrating rewards programs directly with financial services, offering personalized incentives that increase user engagement and spending. Digital wallets focus on streamlining payment processes, providing fast, secure, and convenient transaction methods across various merchants and services. Combining loyalty fintech with digital wallets often results in a superior banking experience, driving both customer loyalty and seamless financial transactions.

Connection

Loyalty fintech platforms revolutionize customer retention by integrating seamlessly with digital wallets, enabling users to earn and redeem rewards instantly during transactions. This connection enhances user engagement through personalized cashback, discounts, and points stored directly in digital wallets, increasing transaction frequency. Banks leverage this synergy to collect valuable consumer data, optimize marketing strategies, and drive increased financial product adoption.

Key Terms

**Digital Wallets:**

Digital wallets enable seamless, secure mobile payments by storing credit and debit card information, offering instant transaction processing and enhanced user convenience. With features like biometric authentication and integration with multiple financial services, digital wallets drive faster, contactless purchases and facilitate budgeting and expense tracking. Explore the advancements and benefits of digital wallets to understand their critical role in modern fintech ecosystems.

Mobile Payments

Mobile payments have transformed the way consumers engage with digital wallets by enabling seamless, contactless transactions through smartphones, supported by technologies such as NFC and QR codes. Loyalty fintech integrates reward programs directly into mobile payment solutions, enhancing user retention by delivering personalized offers and real-time incentives. Explore the latest trends and innovations in digital wallets and loyalty fintech to understand how they are reshaping mobile payment experiences.

Tokenization

Tokenization plays a critical role in both digital wallets and loyalty fintech by enhancing security and enabling seamless transactions through encrypted customer data. Digital wallets leverage tokenization to store payment credentials safely, reducing the risk of fraud during online and contactless payments. Explore how tokenization is transforming payment security and customer engagement in loyalty fintech platforms.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - DashDevs - Digital wallets are software systems that securely store payment info and enable online or contactless purchases; they come mainly in two types: centralized wallets managed by institutions (like PayPal, Apple Pay) and decentralized wallets operating on blockchain for crypto assets (like MetaMask, Trust Wallet).

What is a Digital Wallet and How to Use It? - Bill.com - A digital wallet is a secure app on your device storing payment methods, loyalty cards, and documents, enabling electronic payments without physical cards and using security features like biometrics to protect user identity.

Digital Wallets: Everything You Need to Know - N26 - Digital wallets facilitate easy payments by saving payment info securely with encryption and device protection, often requiring biometrics or two-factor authentication; crypto wallets are a specialized form that manage cryptocurrency access keys rather than holding currency themselves.

dowidth.com

dowidth.com