Instant payments enable near-immediate fund transfers typically settled within seconds, while real-time payments guarantee immediate clearing and availability of funds 24/7 without delays. Both systems enhance liquidity and improve customer convenience by reducing transaction processing times compared to traditional banking methods. Explore the distinctions and benefits of instant versus real-time payments to optimize your financial operations.

Why it is important

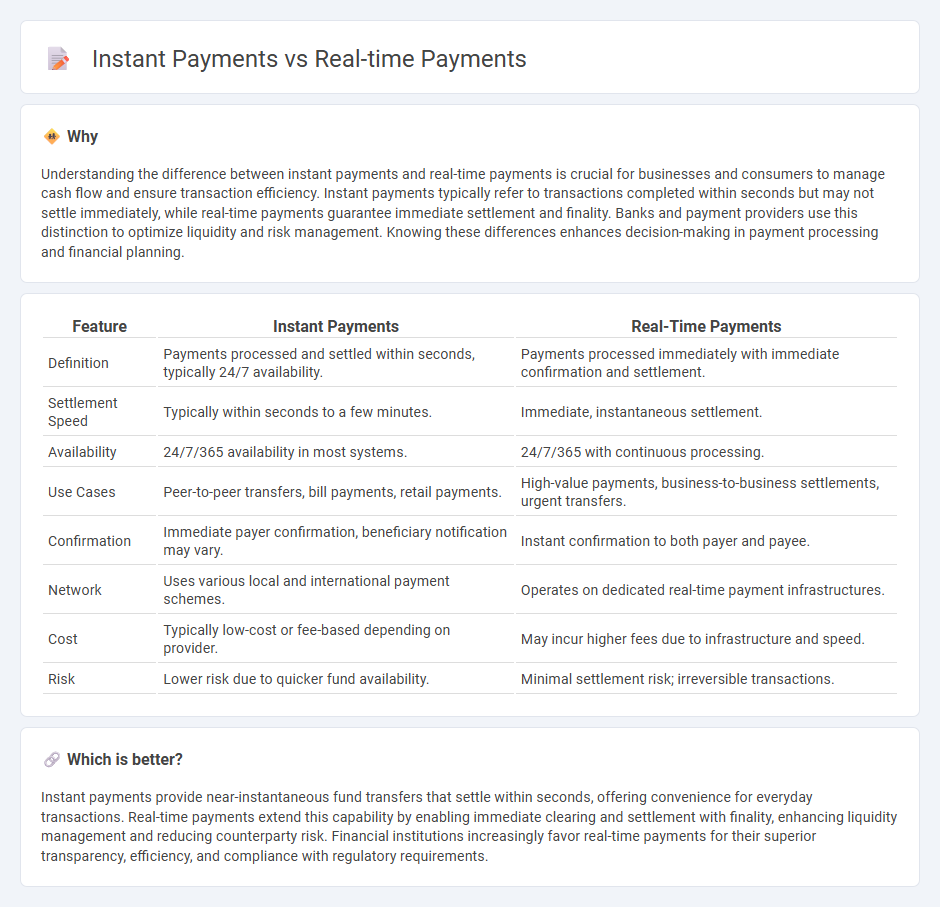

Understanding the difference between instant payments and real-time payments is crucial for businesses and consumers to manage cash flow and ensure transaction efficiency. Instant payments typically refer to transactions completed within seconds but may not settle immediately, while real-time payments guarantee immediate settlement and finality. Banks and payment providers use this distinction to optimize liquidity and risk management. Knowing these differences enhances decision-making in payment processing and financial planning.

Comparison Table

| Feature | Instant Payments | Real-Time Payments |

|---|---|---|

| Definition | Payments processed and settled within seconds, typically 24/7 availability. | Payments processed immediately with immediate confirmation and settlement. |

| Settlement Speed | Typically within seconds to a few minutes. | Immediate, instantaneous settlement. |

| Availability | 24/7/365 availability in most systems. | 24/7/365 with continuous processing. |

| Use Cases | Peer-to-peer transfers, bill payments, retail payments. | High-value payments, business-to-business settlements, urgent transfers. |

| Confirmation | Immediate payer confirmation, beneficiary notification may vary. | Instant confirmation to both payer and payee. |

| Network | Uses various local and international payment schemes. | Operates on dedicated real-time payment infrastructures. |

| Cost | Typically low-cost or fee-based depending on provider. | May incur higher fees due to infrastructure and speed. |

| Risk | Lower risk due to quicker fund availability. | Minimal settlement risk; irreversible transactions. |

Which is better?

Instant payments provide near-instantaneous fund transfers that settle within seconds, offering convenience for everyday transactions. Real-time payments extend this capability by enabling immediate clearing and settlement with finality, enhancing liquidity management and reducing counterparty risk. Financial institutions increasingly favor real-time payments for their superior transparency, efficiency, and compliance with regulatory requirements.

Connection

Instant payments and real-time payments are interconnected as both enable immediate fund transfers between bank accounts, enhancing financial transaction speed and efficiency. Real-time payments refer to the infrastructure and systems that process payments instantly, while instant payments are the actual transactions completed using this technology. This seamless connection supports improved cash flow management and customer satisfaction in modern banking.

Key Terms

Settlement Speed

Real-time payments and instant payments both aim to accelerate transaction settlement, with real-time payments typically processing within seconds across domestic systems, while instant payments guarantee immediate fund availability regardless of banking hours. Settlement speed in real-time payments depends on the underlying network infrastructure, whereas instant payments use advanced clearing mechanisms to ensure near-instant confirmation and irrevocability. Explore detailed comparisons and benefits of real-time versus instant payments to optimize your financial operations.

Clearing Process

Real-time payments clear transactions immediately through centralized systems that settle funds and update accounts simultaneously, ensuring instant availability. Instant payments may involve batch processing or deferred clearing but prioritize near-instant fund access for users, sometimes relying on intermediary entities. Explore how different clearing processes affect transaction speed and security to understand which method suits your business needs best.

Fund Availability

Real-time payments ensure immediate fund transfers with near-instant settlement, enhancing cash flow efficiency for businesses and consumers. Instant payments provide immediate fund availability to recipients, enabling faster access to funds without processing delays. Explore the key differences between real-time and instant payments for optimal fund management strategies.

Source and External Links

Instant payments: Understanding real-time payment networks - Real-time payments enable near-instant money transfers 24/7/365, with immediate and irrevocable settlement, providing businesses improved cash flow and precise payment timing, and include major U.S. systems RTP and FedNow.

Instant Payments: RTP (r) Network and FEDNOW (r) Service - Two primary U.S. instant payment networks, RTP (since 2017) and Federal Reserve's FedNow (since 2023), offer immediate funds availability, automated processing, and rich payment data on a 24/7 basis.

Your real-time guide to real-time payments - Mastercard - Real-time payments process transactions in seconds anytime and worldwide, growing rapidly especially in markets like India and Brazil, with the U.S. expanding adoption via networks like RTP and FedNow launched in 2023.

dowidth.com

dowidth.com