Super apps integrate multiple financial services, including payments, insurance, and investments, providing users with a seamless banking experience within a single platform. Lending platforms focus exclusively on credit solutions, offering personalized loan options and streamlined approval processes through advanced data analytics. Explore the evolving dynamics between super apps and lending platforms to understand their impact on consumer finance.

Why it is important

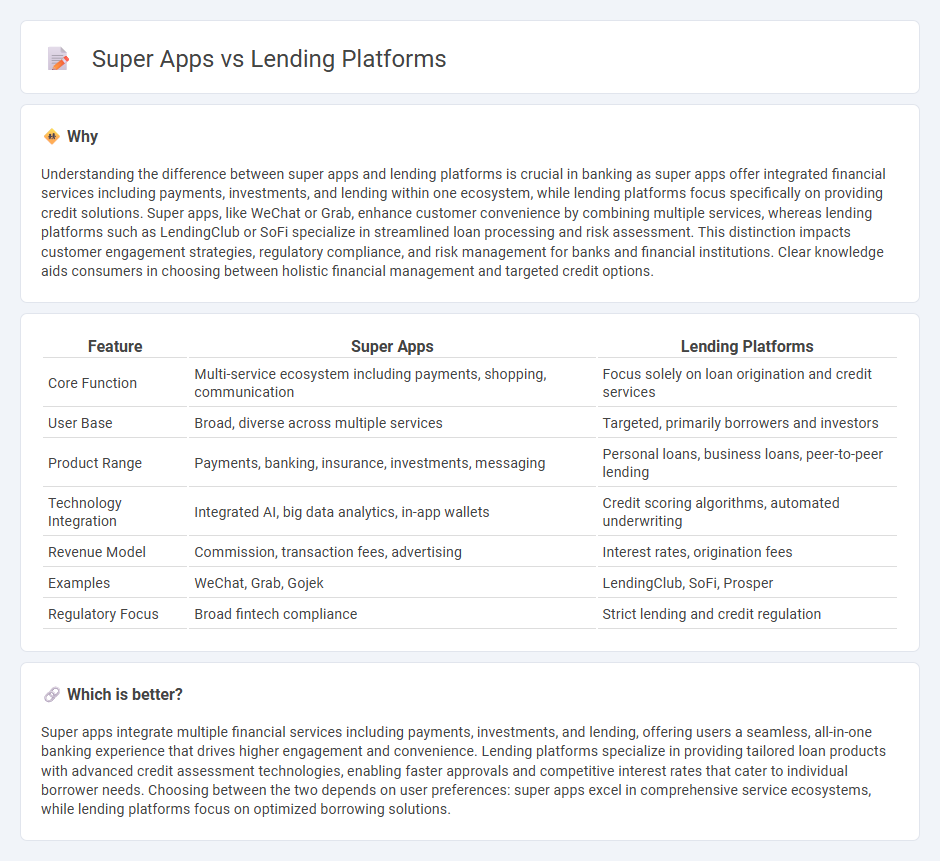

Understanding the difference between super apps and lending platforms is crucial in banking as super apps offer integrated financial services including payments, investments, and lending within one ecosystem, while lending platforms focus specifically on providing credit solutions. Super apps, like WeChat or Grab, enhance customer convenience by combining multiple services, whereas lending platforms such as LendingClub or SoFi specialize in streamlined loan processing and risk assessment. This distinction impacts customer engagement strategies, regulatory compliance, and risk management for banks and financial institutions. Clear knowledge aids consumers in choosing between holistic financial management and targeted credit options.

Comparison Table

| Feature | Super Apps | Lending Platforms |

|---|---|---|

| Core Function | Multi-service ecosystem including payments, shopping, communication | Focus solely on loan origination and credit services |

| User Base | Broad, diverse across multiple services | Targeted, primarily borrowers and investors |

| Product Range | Payments, banking, insurance, investments, messaging | Personal loans, business loans, peer-to-peer lending |

| Technology Integration | Integrated AI, big data analytics, in-app wallets | Credit scoring algorithms, automated underwriting |

| Revenue Model | Commission, transaction fees, advertising | Interest rates, origination fees |

| Examples | WeChat, Grab, Gojek | LendingClub, SoFi, Prosper |

| Regulatory Focus | Broad fintech compliance | Strict lending and credit regulation |

Which is better?

Super apps integrate multiple financial services including payments, investments, and lending, offering users a seamless, all-in-one banking experience that drives higher engagement and convenience. Lending platforms specialize in providing tailored loan products with advanced credit assessment technologies, enabling faster approvals and competitive interest rates that cater to individual borrower needs. Choosing between the two depends on user preferences: super apps excel in comprehensive service ecosystems, while lending platforms focus on optimized borrowing solutions.

Connection

Super apps integrate multiple financial services, including lending platforms, to offer users seamless access to credit products within one interface. Lending platforms embedded in super apps utilize advanced data analytics and AI to assess creditworthiness quickly, enhancing loan approval efficiency. This connectivity enables personalized lending experiences and boosts financial inclusion by reaching underserved customer segments.

Key Terms

**Lending Platforms:**

Lending platforms specialize in offering tailored financial services such as personal loans, mortgages, and business financing through streamlined digital processes that enhance user experience and approval speed. These platforms leverage advanced algorithms and credit scoring models to assess risk efficiently, enabling competitive interest rates and flexible repayment options. Explore the evolving landscape of lending platforms to understand how they are transforming access to credit in the digital economy.

Credit Scoring

Lending platforms utilize advanced credit scoring models that incorporate alternative data sources such as transaction history, social behavior, and digital footprints to provide accurate and fast credit decisions. Super apps integrate credit scoring within their multifaceted ecosystems, leveraging comprehensive user data across various services for a holistic financial profile and personalized lending offers. Explore the evolving impact of credit scoring technologies on borrowing experiences within these platforms.

Loan Origination

Lending platforms specialize in streamlining loan origination by leveraging advanced algorithms and credit scoring models to expedite approvals and enhance user experience. Super apps integrate loan origination within a broader ecosystem, offering seamless access to multiple financial services and personalized loan options based on user data across their platform. Explore how these distinct approaches impact borrower convenience and financial inclusion by learning more about their unique loan origination strategies.

Source and External Links

Top 10 Peer-to-Peer Lending Platforms | FinTech Magazine - This article highlights leading peer-to-peer lending platforms like Peerform and Mintos that connect borrowers and lenders directly, offering lower interest rates and better returns than traditional banks in the UK and global markets.

Platform Lending | Digital Finance Inclusion - Explains platform lending as credit provision facilitated by online platforms matching borrowers with lenders, expanding access to funding for consumers and new investment opportunities by leveraging fintech innovations.

Online Personal Loans + Full-Service Banking | LendingClub - LendingClub is a leading U.S. digital marketplace bank offering personal and auto loans up to $60,000 with fixed rates, alongside innovative checking and savings accounts designed to enhance customer financial success.

dowidth.com

dowidth.com