Neobanks operate exclusively online without physical branches, offering streamlined digital banking services primarily targeting tech-savvy users. Challenger banks may maintain some physical presence and often compete directly with traditional banks by providing innovative products and personalized customer experiences. Explore more to understand the distinct advantages of each banking model.

Why it is important

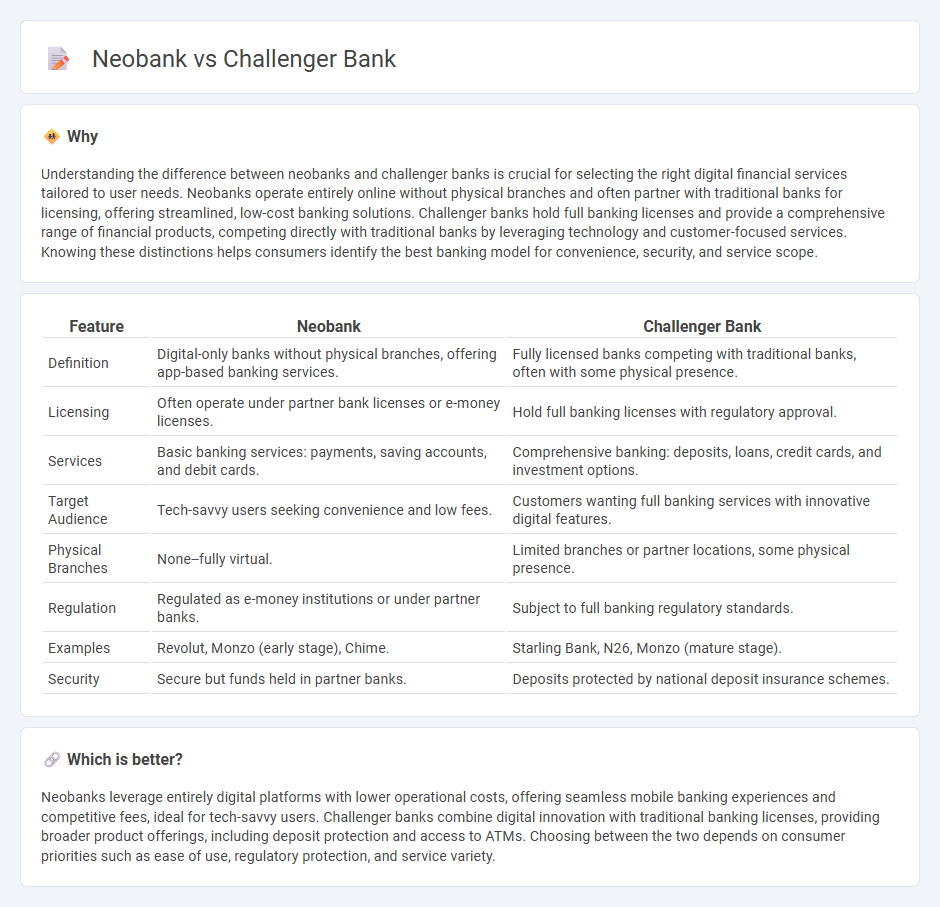

Understanding the difference between neobanks and challenger banks is crucial for selecting the right digital financial services tailored to user needs. Neobanks operate entirely online without physical branches and often partner with traditional banks for licensing, offering streamlined, low-cost banking solutions. Challenger banks hold full banking licenses and provide a comprehensive range of financial products, competing directly with traditional banks by leveraging technology and customer-focused services. Knowing these distinctions helps consumers identify the best banking model for convenience, security, and service scope.

Comparison Table

| Feature | Neobank | Challenger Bank |

|---|---|---|

| Definition | Digital-only banks without physical branches, offering app-based banking services. | Fully licensed banks competing with traditional banks, often with some physical presence. |

| Licensing | Often operate under partner bank licenses or e-money licenses. | Hold full banking licenses with regulatory approval. |

| Services | Basic banking services: payments, saving accounts, and debit cards. | Comprehensive banking: deposits, loans, credit cards, and investment options. |

| Target Audience | Tech-savvy users seeking convenience and low fees. | Customers wanting full banking services with innovative digital features. |

| Physical Branches | None--fully virtual. | Limited branches or partner locations, some physical presence. |

| Regulation | Regulated as e-money institutions or under partner banks. | Subject to full banking regulatory standards. |

| Examples | Revolut, Monzo (early stage), Chime. | Starling Bank, N26, Monzo (mature stage). |

| Security | Secure but funds held in partner banks. | Deposits protected by national deposit insurance schemes. |

Which is better?

Neobanks leverage entirely digital platforms with lower operational costs, offering seamless mobile banking experiences and competitive fees, ideal for tech-savvy users. Challenger banks combine digital innovation with traditional banking licenses, providing broader product offerings, including deposit protection and access to ATMs. Choosing between the two depends on consumer priorities such as ease of use, regulatory protection, and service variety.

Connection

Neobanks and challenger banks both operate as digital-first financial institutions offering streamlined, technology-driven banking services without traditional branch networks. While neobanks rely exclusively on digital platforms to provide customer-centric solutions, challenger banks often have banking licenses and can offer a broader range of regulated financial products. Their connection lies in disrupting traditional banking by leveraging innovative fintech technologies to enhance user experience and accessibility.

Key Terms

Digital-only

Challenger banks are fully licensed digital-only banks that offer a wide range of banking services, while neobanks primarily operate as fintech companies providing limited banking products through mobile apps without holding full banking licenses. Both emphasize streamlined digital experiences and lower fees compared to traditional banks, targeting tech-savvy customers seeking convenience. Explore detailed comparisons and insights to understand which digital banking model suits your financial needs best.

Regulatory License

Challenger banks operate under full banking licenses granted by regulatory authorities, allowing them to offer a broad range of financial services including deposits and loans, similar to traditional banks. Neobanks often function without a full banking license, partnering with licensed banks to provide banking services through digital platforms, which limits their regulatory scope. Explore the differences in licensing structures to understand their impact on service offerings and consumer protections.

Traditional Bank Partnership

Challenger banks often establish strategic partnerships with traditional banks to leverage established financial infrastructures and regulatory frameworks, enhancing their service offerings and customer trust. In contrast, neobanks typically operate independently, relying on digital-only platforms without direct collaboration with legacy financial institutions, focusing on innovative, user-centric experiences. Explore the distinct approaches of challenger banks and neobanks to understand their impact on the evolving banking landscape.

Source and External Links

Challenger Banks Explained: Trends and Opportunities - Ulam Labs - A challenger bank is a digital-first financial institution that operates primarily through mobile apps and online platforms, offering lower fees and faster, user-friendly services to challenge traditional banks, emerging strongly after regulatory changes in the UK post-2008 crisis that opened access to customer data and innovation.

Challenger Banks: What You Need to Know | Jenius Bank - Challenger banks prioritize modern, digital, and customer-centric financial services with benefits like mobile access, better rates, and fee transparency, reshaping banking after the 2008 crisis as convenient alternatives to traditional banks.

Challenger Bank Definition - FinTech Weekly - Challenger banks, also known as neobanks, are modern retail banks focused on leveraging financial technology to compete against established banks by offering more customer-focused services, enabled by regulatory changes allowing new entrants since 2010.

dowidth.com

dowidth.com