Instant payments offer real-time fund transfer, enhancing transaction speed and convenience compared to traditional check payments, which often require several days for clearing and settlement. The adoption of instant payment systems improves cash flow management for businesses and reduces fraud risks associated with physical checks. Explore the benefits and practical applications of instant payments to optimize your banking experience.

Why it is important

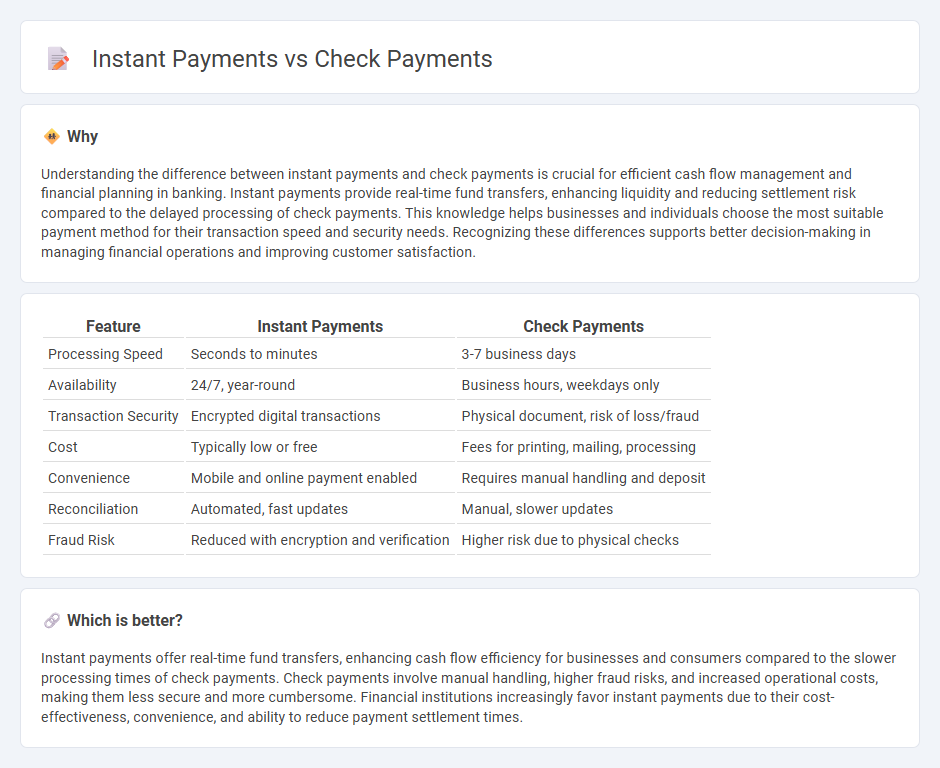

Understanding the difference between instant payments and check payments is crucial for efficient cash flow management and financial planning in banking. Instant payments provide real-time fund transfers, enhancing liquidity and reducing settlement risk compared to the delayed processing of check payments. This knowledge helps businesses and individuals choose the most suitable payment method for their transaction speed and security needs. Recognizing these differences supports better decision-making in managing financial operations and improving customer satisfaction.

Comparison Table

| Feature | Instant Payments | Check Payments |

|---|---|---|

| Processing Speed | Seconds to minutes | 3-7 business days |

| Availability | 24/7, year-round | Business hours, weekdays only |

| Transaction Security | Encrypted digital transactions | Physical document, risk of loss/fraud |

| Cost | Typically low or free | Fees for printing, mailing, processing |

| Convenience | Mobile and online payment enabled | Requires manual handling and deposit |

| Reconciliation | Automated, fast updates | Manual, slower updates |

| Fraud Risk | Reduced with encryption and verification | Higher risk due to physical checks |

Which is better?

Instant payments offer real-time fund transfers, enhancing cash flow efficiency for businesses and consumers compared to the slower processing times of check payments. Check payments involve manual handling, higher fraud risks, and increased operational costs, making them less secure and more cumbersome. Financial institutions increasingly favor instant payments due to their cost-effectiveness, convenience, and ability to reduce payment settlement times.

Connection

Instant payments and check payments are connected through the evolving landscape of banking transaction methods, where instant payments offer a digital alternative to traditional check payments by enabling real-time fund transfers. Both methods require verification and settlement processes that ensure transaction security and accuracy, with instant payments significantly reducing processing time compared to checks. Banks integrate these payment systems to provide customers with versatile options, enhancing efficiency and convenience in financial operations.

Key Terms

Clearing

Check payments rely on physical processing through clearinghouses, which involves manual verification, sorting, and settlement that can take several days to complete. Instant payments utilize real-time clearing systems enabled by digital networks, allowing funds to be transferred and cleared within seconds. Explore the advantages and mechanisms of both clearing processes to understand their impact on transaction speed and efficiency.

Settlement

Check payments undergo a longer settlement process, typically taking several business days to clear due to physical handling and bank verification procedures. Instant payments leverage real-time settlement systems, enabling immediate fund transfer and availability, which enhances cash flow efficiency for businesses and consumers. Explore how instant payment technologies are transforming financial transactions and settlement speed.

Real-Time Processing

Real-time processing in instant payments allows transactions to be completed within seconds, offering immediate fund availability compared to traditional check payments that often require days for clearing. Instant payments rely on advanced digital infrastructure and payment networks like RTP or SEPA Instant Credit Transfer to ensure continuous 24/7 settlement and reduce settlement risk. Explore how real-time processing revolutionizes payment ecosystems for faster, secure financial transactions.

Source and External Links

Check Payment: Definition, Types, Advantages, and Risks - A check payment is a financial instrument instructing a bank to pay a specific amount to a recipient; it is secure, widely used, and allows tracking of expenses but may involve risks like loss or longer clearing times.

Check Payments | Federal Reserve History - The Federal Reserve improves efficiency and safety of the U.S. check payment system by streamlining check collection and promoting a competitive clearing services market.

Check Your Payments | Child Support Services - NY.gov - You can check recent child support payments online via an account on NY.gov or by phone through the Child Support Information Line with proper identification.

dowidth.com

dowidth.com