Hyperpersonalization in banking leverages advanced data analytics and artificial intelligence to tailor financial products and services to individual customer preferences and behaviors, enhancing customer satisfaction and loyalty. Dynamic pricing, on the other hand, adjusts interest rates, fees, and loan offers in real time based on market demand, credit risk, and customer profiles to optimize profitability and competitiveness. Explore how these innovative strategies transform customer experience and financial performance in modern banking.

Why it is important

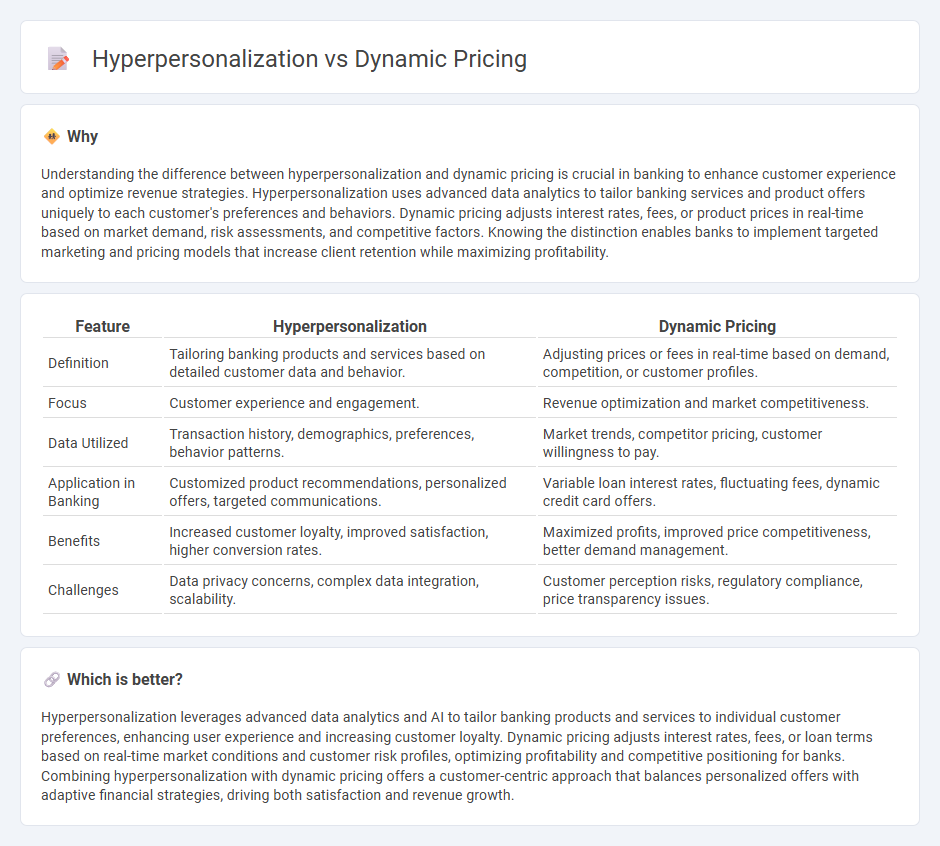

Understanding the difference between hyperpersonalization and dynamic pricing is crucial in banking to enhance customer experience and optimize revenue strategies. Hyperpersonalization uses advanced data analytics to tailor banking services and product offers uniquely to each customer's preferences and behaviors. Dynamic pricing adjusts interest rates, fees, or product prices in real-time based on market demand, risk assessments, and competitive factors. Knowing the distinction enables banks to implement targeted marketing and pricing models that increase client retention while maximizing profitability.

Comparison Table

| Feature | Hyperpersonalization | Dynamic Pricing |

|---|---|---|

| Definition | Tailoring banking products and services based on detailed customer data and behavior. | Adjusting prices or fees in real-time based on demand, competition, or customer profiles. |

| Focus | Customer experience and engagement. | Revenue optimization and market competitiveness. |

| Data Utilized | Transaction history, demographics, preferences, behavior patterns. | Market trends, competitor pricing, customer willingness to pay. |

| Application in Banking | Customized product recommendations, personalized offers, targeted communications. | Variable loan interest rates, fluctuating fees, dynamic credit card offers. |

| Benefits | Increased customer loyalty, improved satisfaction, higher conversion rates. | Maximized profits, improved price competitiveness, better demand management. |

| Challenges | Data privacy concerns, complex data integration, scalability. | Customer perception risks, regulatory compliance, price transparency issues. |

Which is better?

Hyperpersonalization leverages advanced data analytics and AI to tailor banking products and services to individual customer preferences, enhancing user experience and increasing customer loyalty. Dynamic pricing adjusts interest rates, fees, or loan terms based on real-time market conditions and customer risk profiles, optimizing profitability and competitive positioning for banks. Combining hyperpersonalization with dynamic pricing offers a customer-centric approach that balances personalized offers with adaptive financial strategies, driving both satisfaction and revenue growth.

Connection

Hyperpersonalization in banking leverages AI and big data analytics to tailor financial products and services to individual customer needs, enhancing engagement and satisfaction. Dynamic pricing adjusts fees, interest rates, and loan terms based on real-time customer profiles and market conditions, enabling banks to optimize profitability while meeting personalized demands. The integration of hyperpersonalization and dynamic pricing creates a seamless customer experience, driving competitive advantage and increased revenue streams for financial institutions.

Key Terms

Real-time Data Analytics

Dynamic pricing leverages real-time data analytics to adjust prices based on market demand, competitor pricing, and customer behavior, enhancing revenue management. Hyperpersonalization uses advanced data analytics to tailor offers and experiences to individual customer preferences by analyzing real-time interactions and contextual data. Explore how integrating dynamic pricing with hyperpersonalization through powerful real-time data analytics can transform your business strategy.

Customer Segmentation

Dynamic pricing adjusts product prices based on real-time market demand and customer behavior patterns, enabling businesses to target broad customer segments effectively. Hyperpersonalization leverages advanced data analytics and AI to create highly tailored offers and experiences for individual customers, refining segmentation to a granular level. Explore how integrating dynamic pricing with hyperpersonalization strategies can revolutionize your customer segmentation and drive increased revenue.

Personalized Offers

Dynamic pricing adjusts prices in real-time based on demand, competition, and customer behavior, optimizing revenue through market-sensitive strategies. Hyperpersonalization leverages advanced data analytics and AI to create highly tailored offers that resonate with individual preferences, enhancing customer engagement and loyalty. Explore further to understand how combining dynamic pricing with hyperpersonalized offers can maximize sales and customer satisfaction.

Source and External Links

Dynamic Pricing: What Is It & How It Effects E-Commerce - Dynamic pricing is a strategy where e-commerce businesses adjust prices in real time based on demand, competition, and other factors to boost revenue, with prices fluctuating sometimes within minutes in response to supply and demand changes.

What is Dynamic Pricing? - DealHub - Dynamic pricing uses real-time market data such as inventory, competitor pricing, and customer behavior to optimize prices, enabling businesses to maximize profitability and adjust prices by factors like time, segment, or channel.

Dynamic pricing - Wikipedia - Dynamic pricing, also known as surge or variable pricing, is a revenue management strategy where prices are flexible and change based on current market demand to encourage buying during low-demand and moderate prices during high demand periods.

dowidth.com

dowidth.com