Super apps integrate multiple financial services, including banking, payments, and lending, offering users a seamless and comprehensive digital experience. Peer-to-peer payments focus on direct money transfers between individuals, providing fast, low-cost, and convenient transaction solutions. Explore how these technologies shape the future of banking and transform everyday financial interactions.

Why it is important

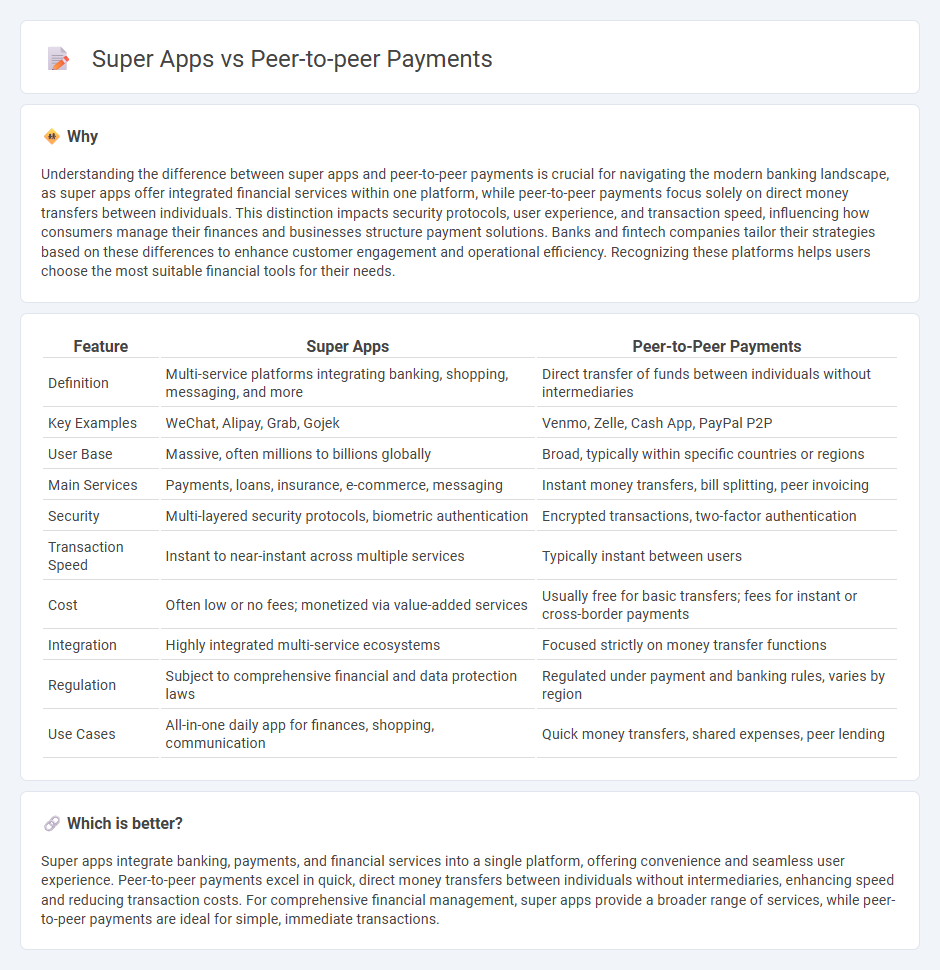

Understanding the difference between super apps and peer-to-peer payments is crucial for navigating the modern banking landscape, as super apps offer integrated financial services within one platform, while peer-to-peer payments focus solely on direct money transfers between individuals. This distinction impacts security protocols, user experience, and transaction speed, influencing how consumers manage their finances and businesses structure payment solutions. Banks and fintech companies tailor their strategies based on these differences to enhance customer engagement and operational efficiency. Recognizing these platforms helps users choose the most suitable financial tools for their needs.

Comparison Table

| Feature | Super Apps | Peer-to-Peer Payments |

|---|---|---|

| Definition | Multi-service platforms integrating banking, shopping, messaging, and more | Direct transfer of funds between individuals without intermediaries |

| Key Examples | WeChat, Alipay, Grab, Gojek | Venmo, Zelle, Cash App, PayPal P2P |

| User Base | Massive, often millions to billions globally | Broad, typically within specific countries or regions |

| Main Services | Payments, loans, insurance, e-commerce, messaging | Instant money transfers, bill splitting, peer invoicing |

| Security | Multi-layered security protocols, biometric authentication | Encrypted transactions, two-factor authentication |

| Transaction Speed | Instant to near-instant across multiple services | Typically instant between users |

| Cost | Often low or no fees; monetized via value-added services | Usually free for basic transfers; fees for instant or cross-border payments |

| Integration | Highly integrated multi-service ecosystems | Focused strictly on money transfer functions |

| Regulation | Subject to comprehensive financial and data protection laws | Regulated under payment and banking rules, varies by region |

| Use Cases | All-in-one daily app for finances, shopping, communication | Quick money transfers, shared expenses, peer lending |

Which is better?

Super apps integrate banking, payments, and financial services into a single platform, offering convenience and seamless user experience. Peer-to-peer payments excel in quick, direct money transfers between individuals without intermediaries, enhancing speed and reducing transaction costs. For comprehensive financial management, super apps provide a broader range of services, while peer-to-peer payments are ideal for simple, immediate transactions.

Connection

Super apps integrate peer-to-peer payment systems to enable seamless, instant money transfers within a single platform, enhancing user convenience and financial inclusivity. These apps leverage digital wallets and real-time transaction processing to facilitate secure and efficient peer-to-peer payments without traditional banking intermediaries. The convergence of super apps and peer-to-peer payments drives the transformation of digital banking by merging social, financial, and commerce services.

Key Terms

Digital Wallets

Digital wallets serve as crucial tools in peer-to-peer payments, enabling seamless, secure transfers between users without intermediaries. Super apps integrate digital wallets into broader ecosystems, combining payments with services like shopping, ride-hailing, and social media to enhance user convenience. Explore the evolving role of digital wallets within these platforms to understand their impact on financial technology innovation.

API Integration

Peer-to-peer payment systems leverage API integration to enable swift, secure transfers directly between users, enhancing user convenience and transactional efficiency. Super apps incorporate APIs not only for payments but also to unify multiple services--such as messaging, shopping, and ride-hailing--within a single platform, delivering a seamless user experience. Explore the evolving role of API integration in fintech to understand its impact on digital economies.

Ecosystem Services

Peer-to-peer payments enable direct financial transactions between users, often facilitated by dedicated apps like Venmo or Zelle, enhancing convenience and speed without intermediaries. Super apps such as WeChat and Grab integrate peer-to-peer payments within a broader ecosystem of services including ride-hailing, food delivery, and e-commerce, creating a seamless user experience and driving higher user engagement. Explore how these ecosystem services shape the future of digital payments and consumer habits.

Source and External Links

P2P Payments And How To Use Them In Your Business - Peer-to-peer (P2P) payments are digital transfers between individuals through apps or websites, allowing users to send money quickly using a linked bank account, debit, or credit card, with some platforms settling instantly and others taking a few days.

What Are P2P Payments and How Do They Work? - PayPal - P2P payments enable people to send and receive funds in minutes via mobile apps or websites, bypassing cash or physical cards for everyday transactions like splitting bills or sending gifts.

What is P2P Payment and How Does It Work - Chase.com - P2P payments are digital transactions that let you send or receive money directly from others using a platform or app, requiring both parties to have access to the same service and a linked funding source.

dowidth.com

dowidth.com