Digital KYC leverages biometric verification, online document submission, and AI-driven identity checks to streamline customer onboarding in banking, reducing processing time from days to minutes. Physical KYC requires in-person visits, manual document verification, and face-to-face interaction, resulting in slower, resource-intensive procedures. Discover how digital KYC transforms compliance and customer experience in modern banking.

Why it is important

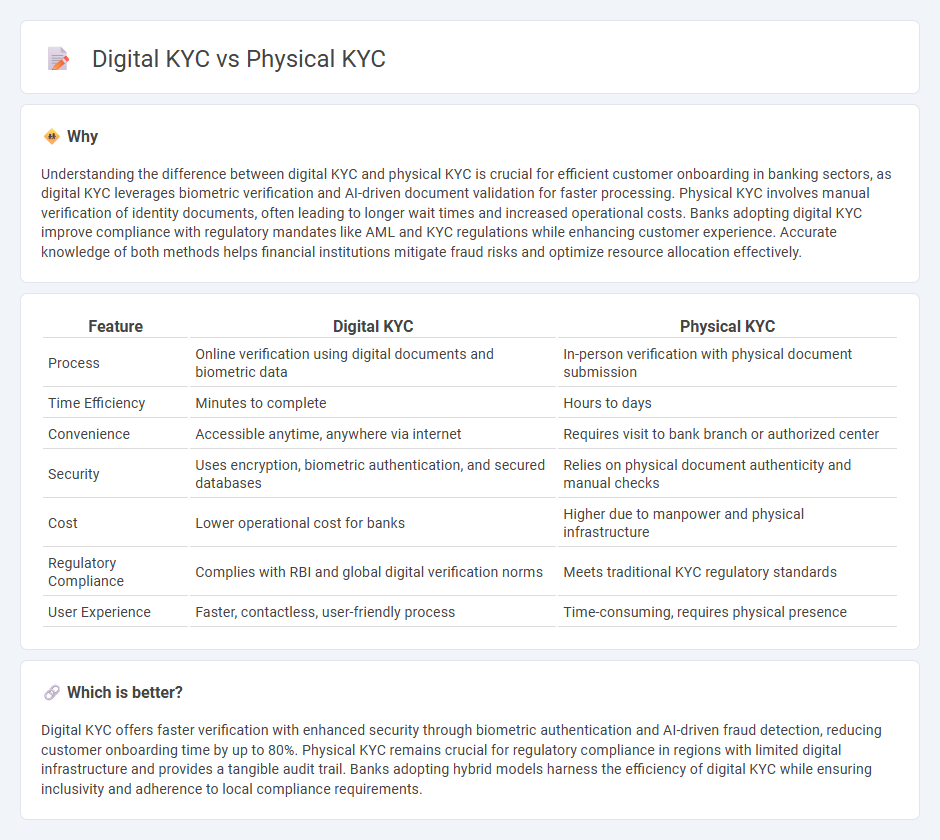

Understanding the difference between digital KYC and physical KYC is crucial for efficient customer onboarding in banking sectors, as digital KYC leverages biometric verification and AI-driven document validation for faster processing. Physical KYC involves manual verification of identity documents, often leading to longer wait times and increased operational costs. Banks adopting digital KYC improve compliance with regulatory mandates like AML and KYC regulations while enhancing customer experience. Accurate knowledge of both methods helps financial institutions mitigate fraud risks and optimize resource allocation effectively.

Comparison Table

| Feature | Digital KYC | Physical KYC |

|---|---|---|

| Process | Online verification using digital documents and biometric data | In-person verification with physical document submission |

| Time Efficiency | Minutes to complete | Hours to days |

| Convenience | Accessible anytime, anywhere via internet | Requires visit to bank branch or authorized center |

| Security | Uses encryption, biometric authentication, and secured databases | Relies on physical document authenticity and manual checks |

| Cost | Lower operational cost for banks | Higher due to manpower and physical infrastructure |

| Regulatory Compliance | Complies with RBI and global digital verification norms | Meets traditional KYC regulatory standards |

| User Experience | Faster, contactless, user-friendly process | Time-consuming, requires physical presence |

Which is better?

Digital KYC offers faster verification with enhanced security through biometric authentication and AI-driven fraud detection, reducing customer onboarding time by up to 80%. Physical KYC remains crucial for regulatory compliance in regions with limited digital infrastructure and provides a tangible audit trail. Banks adopting hybrid models harness the efficiency of digital KYC while ensuring inclusivity and adherence to local compliance requirements.

Connection

Digital KYC (Know Your Customer) integrates seamlessly with physical KYC by using electronic document verification and biometric authentication to validate identity before in-person verification occurs. This hybrid approach enhances security and speed, allowing banks to cross-verify digital records with physical documents for compliance with regulatory standards. Combining both KYC methods reduces fraud risk and improves customer onboarding efficiency in banking operations.

Key Terms

Identity Verification

Physical KYC requires in-person identity verification through document submission and biometric checks, ensuring face-to-face authenticity but often resulting in time-consuming processes. Digital KYC leverages advanced technologies such as AI-driven facial recognition, OCR scanning, and real-time document verification to streamline identity verification while maintaining high security standards. Explore the benefits and challenges of physical and digital KYC methods to optimize your identity verification strategy.

Document Authentication

Physical KYC relies on in-person verification of documents such as passports, driver's licenses, or utility bills, which are manually checked for authenticity. Digital KYC employs advanced technologies like AI-driven OCR, biometric verification, and blockchain to authenticate documents swiftly and reduce fraud risks. Explore the latest innovations in document authentication to understand how digital KYC is reshaping identity verification processes.

Customer Onboarding

Physical KYC requires customers to present original identification documents in person, which can delay the onboarding process and increase operational costs for financial institutions. Digital KYC utilizes biometric verification, electronic document submission, and AI-driven fraud detection to accelerate onboarding while ensuring compliance with regulatory standards like AML and KYC guidelines. Explore how digital KYC streamlines customer onboarding by enhancing security and reducing turnaround time.

Source and External Links

Types of KYC: A Quick Guide to Various Verification Methods - Physical KYC involves submitting customer-attested copies of Proof of Identity and Address in person at a bank or financial institution, useful especially in remote or less digitized areas but operationally complex.

Types of KYC: Key Verification Methods Explained - Smile Identity - Physical document-based KYC is the traditional verification method where customers manually submit and institutions verify physical identity documents like passports and utility bills.

What is KYC and How to do KYC Verification? - ClearTax - Physical KYC requires customers to fill a KYC form and submit physical ID and address proofs at the bank branch in person for document verification and KYC completion.

dowidth.com

dowidth.com