Loyalty fintech companies specialize in enhancing customer retention through rewards programs and personalized financial incentives, differentiating themselves from neobanks that primarily focus on providing streamlined, digital-first banking solutions without traditional branch networks. These fintech platforms leverage data analytics to offer tailored loyalty experiences that drive user engagement and long-term value, while neobanks emphasize low fees, seamless app interfaces, and innovative banking services. Explore how these distinct approaches are shaping the future of customer experience in financial services.

Why it is important

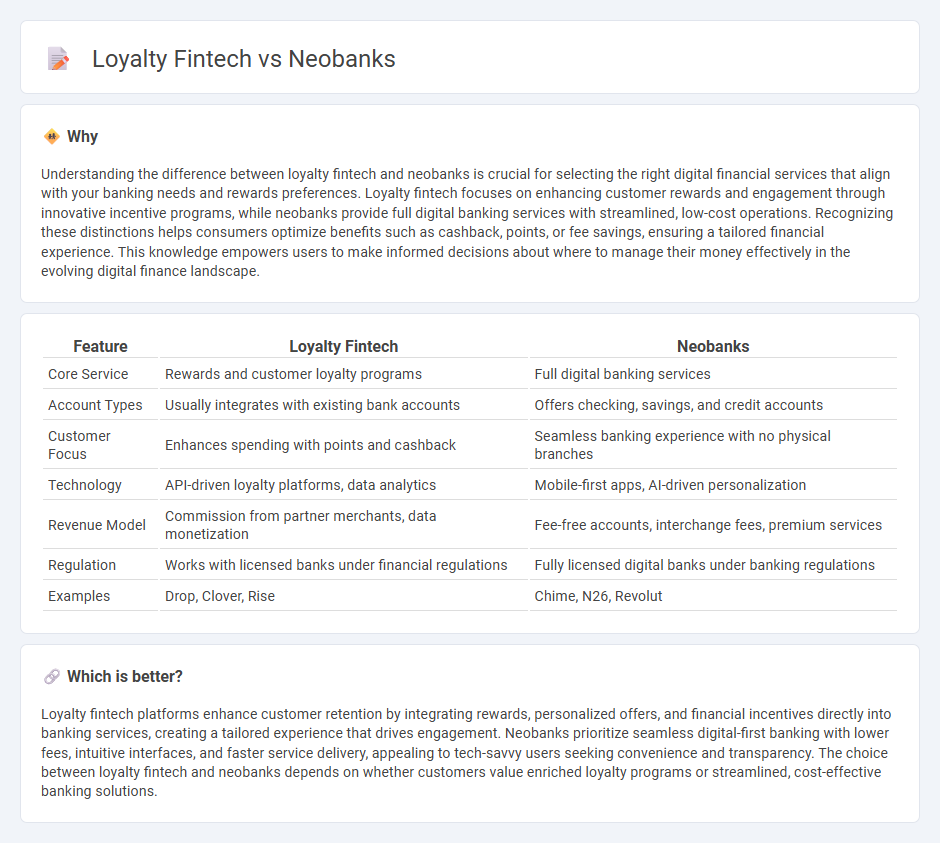

Understanding the difference between loyalty fintech and neobanks is crucial for selecting the right digital financial services that align with your banking needs and rewards preferences. Loyalty fintech focuses on enhancing customer rewards and engagement through innovative incentive programs, while neobanks provide full digital banking services with streamlined, low-cost operations. Recognizing these distinctions helps consumers optimize benefits such as cashback, points, or fee savings, ensuring a tailored financial experience. This knowledge empowers users to make informed decisions about where to manage their money effectively in the evolving digital finance landscape.

Comparison Table

| Feature | Loyalty Fintech | Neobanks |

|---|---|---|

| Core Service | Rewards and customer loyalty programs | Full digital banking services |

| Account Types | Usually integrates with existing bank accounts | Offers checking, savings, and credit accounts |

| Customer Focus | Enhances spending with points and cashback | Seamless banking experience with no physical branches |

| Technology | API-driven loyalty platforms, data analytics | Mobile-first apps, AI-driven personalization |

| Revenue Model | Commission from partner merchants, data monetization | Fee-free accounts, interchange fees, premium services |

| Regulation | Works with licensed banks under financial regulations | Fully licensed digital banks under banking regulations |

| Examples | Drop, Clover, Rise | Chime, N26, Revolut |

Which is better?

Loyalty fintech platforms enhance customer retention by integrating rewards, personalized offers, and financial incentives directly into banking services, creating a tailored experience that drives engagement. Neobanks prioritize seamless digital-first banking with lower fees, intuitive interfaces, and faster service delivery, appealing to tech-savvy users seeking convenience and transparency. The choice between loyalty fintech and neobanks depends on whether customers value enriched loyalty programs or streamlined, cost-effective banking solutions.

Connection

Loyalty programs in fintech leverage data analytics to create personalized rewards, enhancing customer retention and engagement within neobanks. Neobanks integrate these loyalty solutions seamlessly through mobile platforms, providing users with instant access to cashback, discounts, and exclusive offers. This synergy between loyalty fintech and neobanks drives competitive differentiation by improving user experience and fostering long-term financial relationships.

Key Terms

**Neobanks:**

Neobanks leverage digital-only platforms to offer streamlined banking services with lower fees, real-time transaction tracking, and enhanced customer experiences compared to traditional banks. Their integration with fintech innovations enables personalized financial management tools, seamless mobile payments, and improved access to credit. Explore how neobanks are revolutionizing banking by delivering agility and customer-centric solutions.

Digital-Only Platform

Digital-only platforms in neobanks emphasize seamless banking experiences with features like instant account setup, real-time transaction monitoring, and integrated budgeting tools, catering to tech-savvy customers seeking convenience. Loyalty fintech platforms leverage digital-only infrastructure to enhance customer retention by offering personalized rewards, gamified savings, and exclusive merchant partnerships, driving higher engagement and lifetime value. Explore the evolving dynamics between neobanks and loyalty fintech to understand how digital-only platforms are reshaping financial services.

API Integration

Neobanks leverage API integration to seamlessly connect with third-party financial services, offering customers real-time access to personalized banking solutions and enhanced user experience. Loyalty fintech platforms use APIs to integrate reward programs directly with payment and banking systems, enabling instant reward redemption and detailed spending analytics. Explore how API integration drives innovation in both neobanking and loyalty fintech ecosystems.

Source and External Links

Neobank - A neobank is a type of direct bank that operates exclusively using online banking without traditional physical branches.

Top Neobanks of 2025: Leading the Digital Banking - Popular neobanks like Revolut, Chime, Monzo, and Starling Bank differ in features and markets, often working with partner banks to provide FDIC insurance and regulatory compliance.

What is a Neobank? How fintech is transforming banking - Neobanks are digital-first financial companies without physical branches, offering services such as bank accounts, cards, currency exchange, and trading, with rapid market growth and millions of customers globally.

dowidth.com

dowidth.com