Neobanking offers digital-only financial services with lower fees and 24/7 accessibility, appealing to tech-savvy customers seeking seamless online experiences. Credit unions provide member-owned, nonprofit banking focused on personalized service and community support with competitive interest rates. Explore the key differences and benefits of neobanks and credit unions to find the best fit for your financial needs.

Why it is important

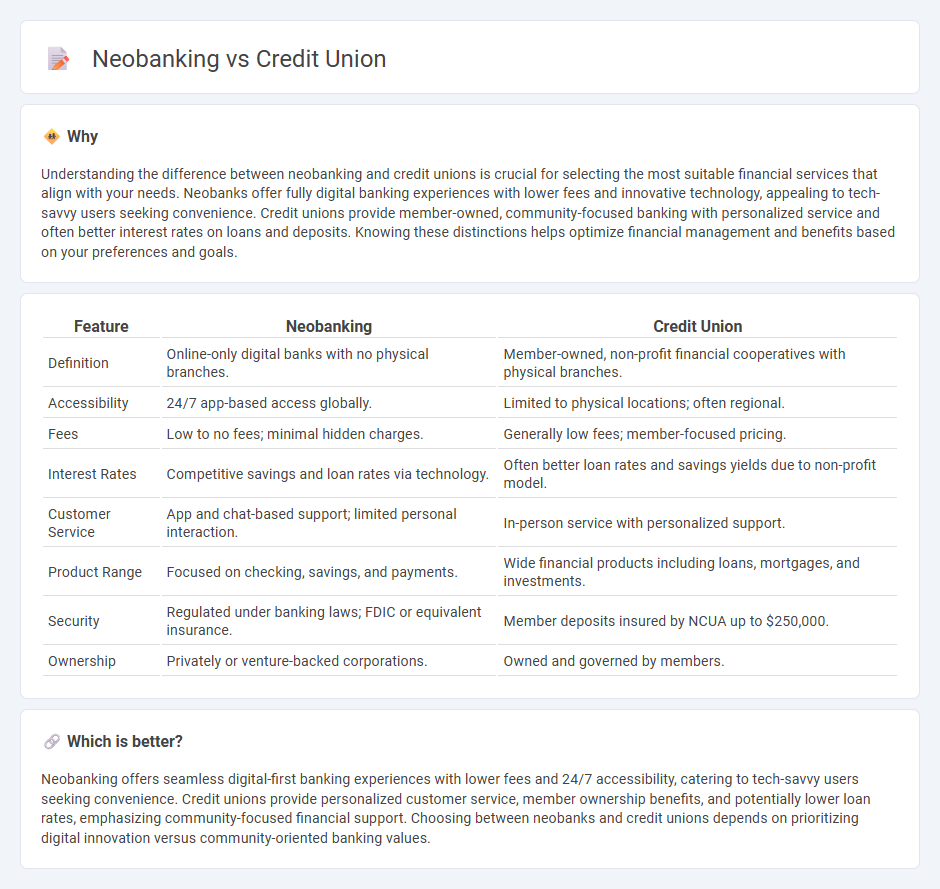

Understanding the difference between neobanking and credit unions is crucial for selecting the most suitable financial services that align with your needs. Neobanks offer fully digital banking experiences with lower fees and innovative technology, appealing to tech-savvy users seeking convenience. Credit unions provide member-owned, community-focused banking with personalized service and often better interest rates on loans and deposits. Knowing these distinctions helps optimize financial management and benefits based on your preferences and goals.

Comparison Table

| Feature | Neobanking | Credit Union |

|---|---|---|

| Definition | Online-only digital banks with no physical branches. | Member-owned, non-profit financial cooperatives with physical branches. |

| Accessibility | 24/7 app-based access globally. | Limited to physical locations; often regional. |

| Fees | Low to no fees; minimal hidden charges. | Generally low fees; member-focused pricing. |

| Interest Rates | Competitive savings and loan rates via technology. | Often better loan rates and savings yields due to non-profit model. |

| Customer Service | App and chat-based support; limited personal interaction. | In-person service with personalized support. |

| Product Range | Focused on checking, savings, and payments. | Wide financial products including loans, mortgages, and investments. |

| Security | Regulated under banking laws; FDIC or equivalent insurance. | Member deposits insured by NCUA up to $250,000. |

| Ownership | Privately or venture-backed corporations. | Owned and governed by members. |

Which is better?

Neobanking offers seamless digital-first banking experiences with lower fees and 24/7 accessibility, catering to tech-savvy users seeking convenience. Credit unions provide personalized customer service, member ownership benefits, and potentially lower loan rates, emphasizing community-focused financial support. Choosing between neobanks and credit unions depends on prioritizing digital innovation versus community-oriented banking values.

Connection

Neobanking and credit unions are connected by their shared goal of providing customer-centric financial services through digital platforms. Both institutions focus on enhancing accessibility, lower fees, and personalized financial products tailored to individual needs. Integration of neobanking technologies enables credit unions to expand their reach, improve member experience, and compete with traditional banks in the digital age.

Key Terms

Member-Owned

Credit unions are member-owned financial cooperatives that prioritize service and financial benefits for their members, often offering lower fees and better interest rates compared to traditional banks. Neobanks operate digitally without physical branches but are typically owned by corporations or investors rather than members, focusing on user-friendly technology and convenience. Explore the key differences in ownership structures and member benefits to understand how credit unions and neobanks serve their customers uniquely.

Digital-Only

Credit unions offer member-owned financial services with a community focus, often including physical branches alongside digital platforms, whereas neobanks operate solely online with streamlined, app-based banking experiences and lower fees. Digital-only credit unions emphasize personalized service and local engagement paired with electronic convenience, while neobanks prioritize technological innovation, rapid onboarding, and user-friendly mobile interfaces. Explore the differences in digital-only banking options to find the best fit for your financial needs.

Cooperative Model

Credit unions operate on a cooperative model where members collectively own and control the institution, emphasizing democratic governance and profit reinvestment for member benefit. Neobanks, by contrast, are digital-first financial services firms often backed by venture capital, lacking member ownership and focusing on tech-driven convenience. Explore how the cooperative structure of credit unions fosters community-focused financial empowerment compared to the investor-driven approach of neobanks.

Source and External Links

What is a Credit Union? - MyCreditUnion.gov - A credit union is a not-for-profit financial institution that is member-owned, provides loans, accepts deposits, and returns profits to members through better rates and lower fees, often serving communities or groups with a common bond.

First New York Federal Credit Union - A credit union offering lending, banking, and investment services in New York, emphasizing personalized financial services in various local communities.

Credit Union of Texas | Better Banking, Auto Loans, Mortgage ... - Credit Union of Texas provides competitive financial products like mortgages and auto loans with a community-focused approach and digital banking services.

dowidth.com

dowidth.com