Personal finance automation streamlines budgeting, saving, and investing by using algorithms to manage money efficiently without constant manual input, reducing human error and increasing financial discipline. Peer-to-peer lending platforms connect individual borrowers with investors directly, offering competitive interest rates and alternative financing outside traditional banks. Explore how each approach can transform your financial strategy and decision-making today.

Why it is important

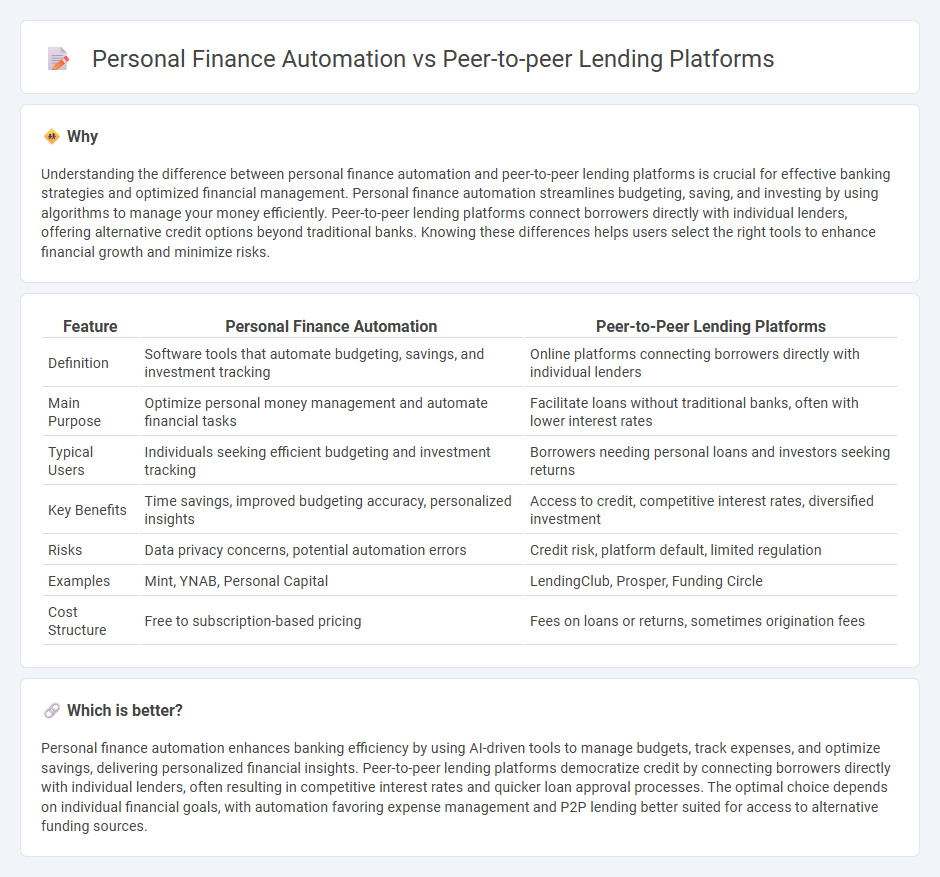

Understanding the difference between personal finance automation and peer-to-peer lending platforms is crucial for effective banking strategies and optimized financial management. Personal finance automation streamlines budgeting, saving, and investing by using algorithms to manage your money efficiently. Peer-to-peer lending platforms connect borrowers directly with individual lenders, offering alternative credit options beyond traditional banks. Knowing these differences helps users select the right tools to enhance financial growth and minimize risks.

Comparison Table

| Feature | Personal Finance Automation | Peer-to-Peer Lending Platforms |

|---|---|---|

| Definition | Software tools that automate budgeting, savings, and investment tracking | Online platforms connecting borrowers directly with individual lenders |

| Main Purpose | Optimize personal money management and automate financial tasks | Facilitate loans without traditional banks, often with lower interest rates |

| Typical Users | Individuals seeking efficient budgeting and investment tracking | Borrowers needing personal loans and investors seeking returns |

| Key Benefits | Time savings, improved budgeting accuracy, personalized insights | Access to credit, competitive interest rates, diversified investment |

| Risks | Data privacy concerns, potential automation errors | Credit risk, platform default, limited regulation |

| Examples | Mint, YNAB, Personal Capital | LendingClub, Prosper, Funding Circle |

| Cost Structure | Free to subscription-based pricing | Fees on loans or returns, sometimes origination fees |

Which is better?

Personal finance automation enhances banking efficiency by using AI-driven tools to manage budgets, track expenses, and optimize savings, delivering personalized financial insights. Peer-to-peer lending platforms democratize credit by connecting borrowers directly with individual lenders, often resulting in competitive interest rates and quicker loan approval processes. The optimal choice depends on individual financial goals, with automation favoring expense management and P2P lending better suited for access to alternative funding sources.

Connection

Personal finance automation tools streamline budget tracking and expense management, enabling users to efficiently allocate funds toward peer-to-peer lending investments. Peer-to-peer lending platforms benefit from precise financial data provided by automation, enhancing credit risk assessment and loan customization. Integration of these technologies empowers borrowers and lenders with better financial insights, fostering a more transparent and accessible banking ecosystem.

Key Terms

**Peer-to-Peer Lending Platforms:**

Peer-to-peer lending platforms connect borrowers directly with individual lenders, bypassing traditional financial institutions, resulting in potentially lower interest rates and faster loan approvals. These platforms utilize advanced algorithms to assess creditworthiness and facilitate transparent loan transactions, fostering trust and efficiency in the lending process. Discover how peer-to-peer lending can transform your borrowing experience and investment strategy.

Risk Assessment

Peer-to-peer lending platforms utilize advanced algorithms and credit scoring models to assess borrower risk, leveraging data such as credit history, income verification, and loan purpose to predict default probabilities. Personal finance automation tools focus on individual spending patterns, income consistency, and debt management to provide real-time risk insights and financial health monitoring for users. Explore the latest advancements in risk assessment technology to optimize both lending decisions and personal financial strategies.

Loan Origination

Peer-to-peer lending platforms streamline loan origination by connecting borrowers directly with individual investors, reducing reliance on traditional banks and enabling faster approval processes through automated credit scoring and risk assessment algorithms. Personal finance automation, on the other hand, focuses on simplifying users' management of loan applications and repayments by integrating multiple financial accounts and providing real-time monitoring and payment scheduling tools. Explore how these technologies transform loan origination to optimize lending efficiency and user experience.

Source and External Links

Top 10 Peer-to-Peer Lending Platforms | FinTech Magazine - Highlights leading global and UK-based P2P lending platforms like Peerform, October, Mintos, and Kiva, focusing on personal, SME, and micro-loans with industry reputation and regulatory compliance.

Peer-to-Peer Lending for Your Startup - The Hartford Insurance - Explains how P2P lending connects borrowers directly with individual and institutional lenders online, offering lower rates and loan amounts typically between $1,000 and $40,000, with streamlined application and risk management processes.

P2P Lending Software - LenderKit - Offers customizable white-label software solutions for launching, testing, and scaling peer-to-peer lending platforms, supporting real estate, SME, and microloan markets with automation and growth features.

dowidth.com

dowidth.com