Regtech focuses on leveraging technology to streamline regulatory compliance within the banking sector, reducing risks and enhancing transparency through automated monitoring and reporting tools. Insurtech applies innovative digital solutions to transform the insurance industry, improving customer experience, claims processing, and risk assessment. Discover how these technologies are reshaping financial services by exploring their unique impacts and benefits.

Why it is important

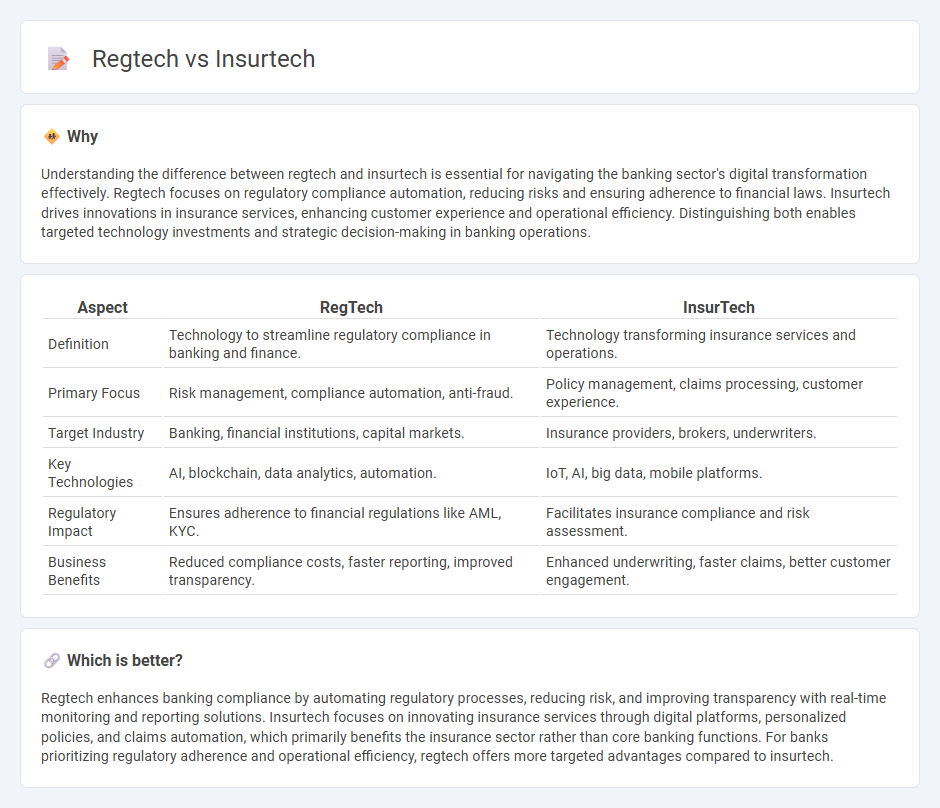

Understanding the difference between regtech and insurtech is essential for navigating the banking sector's digital transformation effectively. Regtech focuses on regulatory compliance automation, reducing risks and ensuring adherence to financial laws. Insurtech drives innovations in insurance services, enhancing customer experience and operational efficiency. Distinguishing both enables targeted technology investments and strategic decision-making in banking operations.

Comparison Table

| Aspect | RegTech | InsurTech |

|---|---|---|

| Definition | Technology to streamline regulatory compliance in banking and finance. | Technology transforming insurance services and operations. |

| Primary Focus | Risk management, compliance automation, anti-fraud. | Policy management, claims processing, customer experience. |

| Target Industry | Banking, financial institutions, capital markets. | Insurance providers, brokers, underwriters. |

| Key Technologies | AI, blockchain, data analytics, automation. | IoT, AI, big data, mobile platforms. |

| Regulatory Impact | Ensures adherence to financial regulations like AML, KYC. | Facilitates insurance compliance and risk assessment. |

| Business Benefits | Reduced compliance costs, faster reporting, improved transparency. | Enhanced underwriting, faster claims, better customer engagement. |

Which is better?

Regtech enhances banking compliance by automating regulatory processes, reducing risk, and improving transparency with real-time monitoring and reporting solutions. Insurtech focuses on innovating insurance services through digital platforms, personalized policies, and claims automation, which primarily benefits the insurance sector rather than core banking functions. For banks prioritizing regulatory adherence and operational efficiency, regtech offers more targeted advantages compared to insurtech.

Connection

Regtech and insurtech intersect in banking by leveraging advanced technologies to enhance regulatory compliance and risk management within financial services. Regtech uses AI and big data analytics to streamline compliance processes, while insurtech applies similar innovations to insurance products integrated into banking portfolios. This synergy improves fraud detection, underwriting accuracy, and customer experience, driving efficiency and reducing operational risks in banking ecosystems.

Key Terms

Digital Insurance Platforms (Insurtech)

Digital Insurance Platforms in insurtech leverage AI, big data analytics, and automation to streamline policy management, claims processing, and customer engagement, enhancing overall operational efficiency. These platforms enable personalized insurance products, faster underwriting, and seamless digital interactions, driving innovation in the insurance sector. Explore more about how digital insurance platforms are transforming the future of insurtech.

Compliance Automation (Regtech)

Regtech leverages advanced AI and machine learning algorithms to streamline compliance automation, reducing regulatory risks and operational costs for financial institutions. Insurtech focuses on transforming insurance processes through digital innovation but does not emphasize regulatory compliance as heavily as regtech. Explore how compliance automation in regtech is revolutionizing risk management and regulatory adherence in finance.

Risk Assessment

Insurtech leverages advanced analytics and AI to revolutionize risk assessment in insurance by providing dynamic, real-time evaluation models that improve underwriting accuracy and claims management. Regtech focuses on regulatory compliance risk by applying automation and machine learning to monitor, report, and predict regulatory risks, ensuring companies meet evolving legal standards efficiently. Explore how integrating insurtech and regtech innovations can transform your risk assessment strategies in complex financial landscapes.

Source and External Links

What Is Insurtech? A Guide For Brokers and Carriers | Salesforce US - Insurtech refers to the use of technology to modernize and innovate the insurance industry, driving efficiencies and improved customer experiences through AI, automation, and mobile apps, benefiting underwriters, brokers, and policyholders alike.

Insurtech Insights | World's Largest Insurtech Community - Insurtech Insights is a global community and event platform connecting insurance entrepreneurs, investors, and incumbents to share innovations, with AI and machine learning predicted to automate 50% of claims by 2025, enhancing fraud detection and accelerating claims processing.

InsurTech NY - The #1 resource for the InsurTech community - InsurTech NY is an international hub connecting carriers, brokers, startups, and investors to foster innovation in insurance through events, matchmaking, and programs that help the industry adopt new technologies and business models.

dowidth.com

dowidth.com