Wealthtech platforms integrate advanced technology to offer comprehensive financial services, including personalized investment strategies, while robo-advisory focuses on algorithm-driven portfolio management with minimal human intervention. Both leverage artificial intelligence and big data to enhance decision-making, reduce costs, and improve accessibility for investors. Explore the differences and benefits of wealthtech versus robo-advisory to optimize your banking and investment experience.

Why it is important

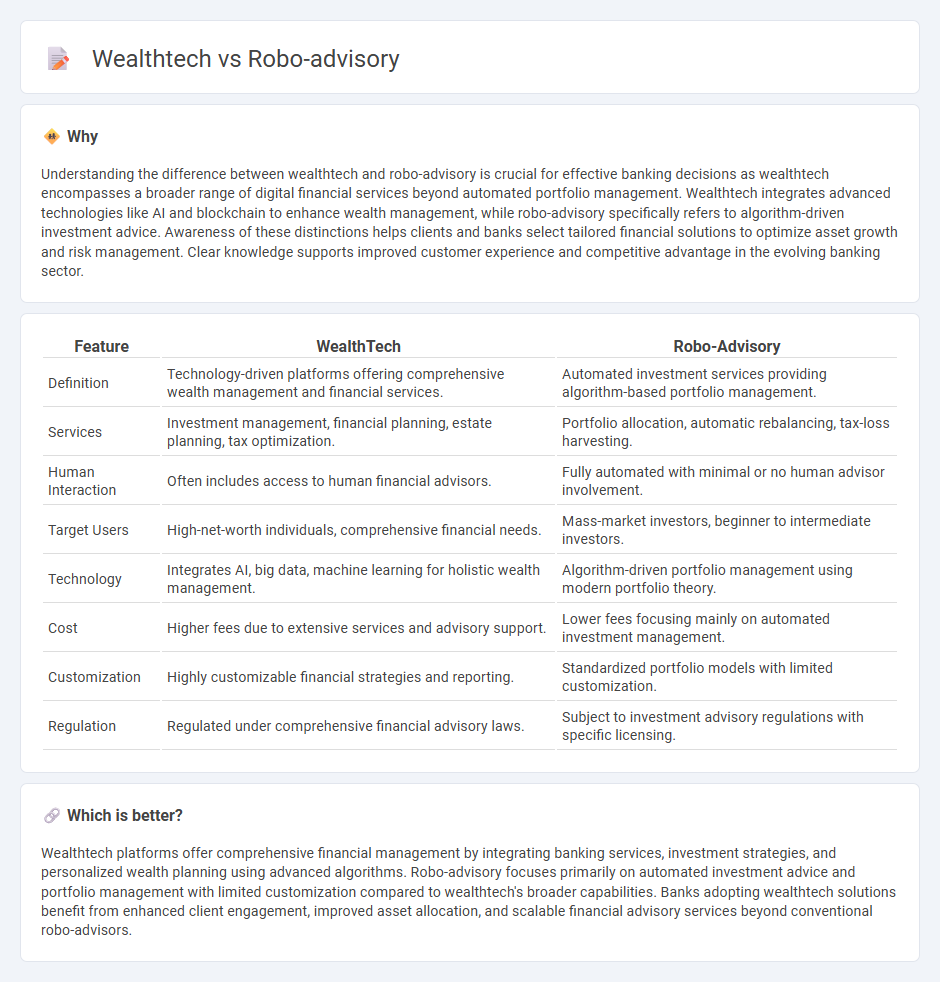

Understanding the difference between wealthtech and robo-advisory is crucial for effective banking decisions as wealthtech encompasses a broader range of digital financial services beyond automated portfolio management. Wealthtech integrates advanced technologies like AI and blockchain to enhance wealth management, while robo-advisory specifically refers to algorithm-driven investment advice. Awareness of these distinctions helps clients and banks select tailored financial solutions to optimize asset growth and risk management. Clear knowledge supports improved customer experience and competitive advantage in the evolving banking sector.

Comparison Table

| Feature | WealthTech | Robo-Advisory |

|---|---|---|

| Definition | Technology-driven platforms offering comprehensive wealth management and financial services. | Automated investment services providing algorithm-based portfolio management. |

| Services | Investment management, financial planning, estate planning, tax optimization. | Portfolio allocation, automatic rebalancing, tax-loss harvesting. |

| Human Interaction | Often includes access to human financial advisors. | Fully automated with minimal or no human advisor involvement. |

| Target Users | High-net-worth individuals, comprehensive financial needs. | Mass-market investors, beginner to intermediate investors. |

| Technology | Integrates AI, big data, machine learning for holistic wealth management. | Algorithm-driven portfolio management using modern portfolio theory. |

| Cost | Higher fees due to extensive services and advisory support. | Lower fees focusing mainly on automated investment management. |

| Customization | Highly customizable financial strategies and reporting. | Standardized portfolio models with limited customization. |

| Regulation | Regulated under comprehensive financial advisory laws. | Subject to investment advisory regulations with specific licensing. |

Which is better?

Wealthtech platforms offer comprehensive financial management by integrating banking services, investment strategies, and personalized wealth planning using advanced algorithms. Robo-advisory focuses primarily on automated investment advice and portfolio management with limited customization compared to wealthtech's broader capabilities. Banks adopting wealthtech solutions benefit from enhanced client engagement, improved asset allocation, and scalable financial advisory services beyond conventional robo-advisors.

Connection

Wealthtech leverages advanced technology platforms to deliver personalized financial services, with robo-advisory serving as a key innovation that automates investment management using algorithms and AI. Robo-advisors enable wealthtech firms to scale portfolio management efficiently, offering tailored asset allocation and risk assessment to clients with lower fees and minimal human intervention. This integration enhances client accessibility to sophisticated financial planning, driving the growth of digital wealth management solutions in modern banking.

Key Terms

Algorithmic Portfolio Management

Algorithmic Portfolio Management forms the core of both robo-advisory and wealthtech platforms, leveraging advanced algorithms to create and manage investment portfolios based on individual risk profiles and financial goals. Robo-advisors primarily offer automated, low-cost investment solutions with limited human intervention, while wealthtech encompasses a broader range of technology-driven financial services, including personalized advice, analytics, and comprehensive wealth management tools. Explore the evolving landscape of algorithmic portfolio management to understand how these technologies reshape the future of investing.

Digital Wealth Platforms

Digital wealth platforms integrate robo-advisory and wealthtech solutions to deliver automated, algorithm-driven financial advice combined with advanced technology for personalized portfolio management. Robo-advisory primarily emphasizes automated investment strategies using algorithms, while wealthtech encompasses a broader range of digital tools including financial planning, client engagement, and compliance management. Explore how these innovations redefine investment management and client experiences in the evolving digital wealth landscape.

Automated Financial Planning

Robo-advisory platforms leverage algorithms to provide automated financial planning, focusing on portfolio management with minimal human intervention. Wealthtech encompasses a broader ecosystem, integrating technologies such as AI, blockchain, and big data to optimize all aspects of wealth management, from financial planning to client engagement. Discover how automated financial planning transforms investment strategies in the wealthtech landscape.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisers that provide personalized investment management and financial advice online using algorithms with minimal human intervention, often focusing on asset allocation through exchange-traded funds (ETFs) and offering lower-cost services than traditional advisors.

What is a robo advisor? | Robo advisory services - Fidelity Investments - A robo advisor is an affordable digital service automating investing by using client-provided information like risk tolerance and goals to suggest and maintain a portfolio, often with lower fees than traditional investment management.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors offer automated, semi-customized asset allocation and investment portfolios, blending features of wealth managers and DIY platforms, providing low-cost, algorithm-driven investment advice with additional financial planning tools and sometimes human advisor access.

dowidth.com

dowidth.com