Predictive analytics leverages historical data and machine learning algorithms to identify patterns that forecast future outcomes, enhancing decision-making processes in banking. In loan default prediction, these techniques analyze borrower behavior, credit history, and economic indicators to estimate the likelihood of repayment failure, reducing financial risk and improving portfolio management. Explore how predictive analytics transforms loan default prediction and strengthens banking strategies.

Why it is important

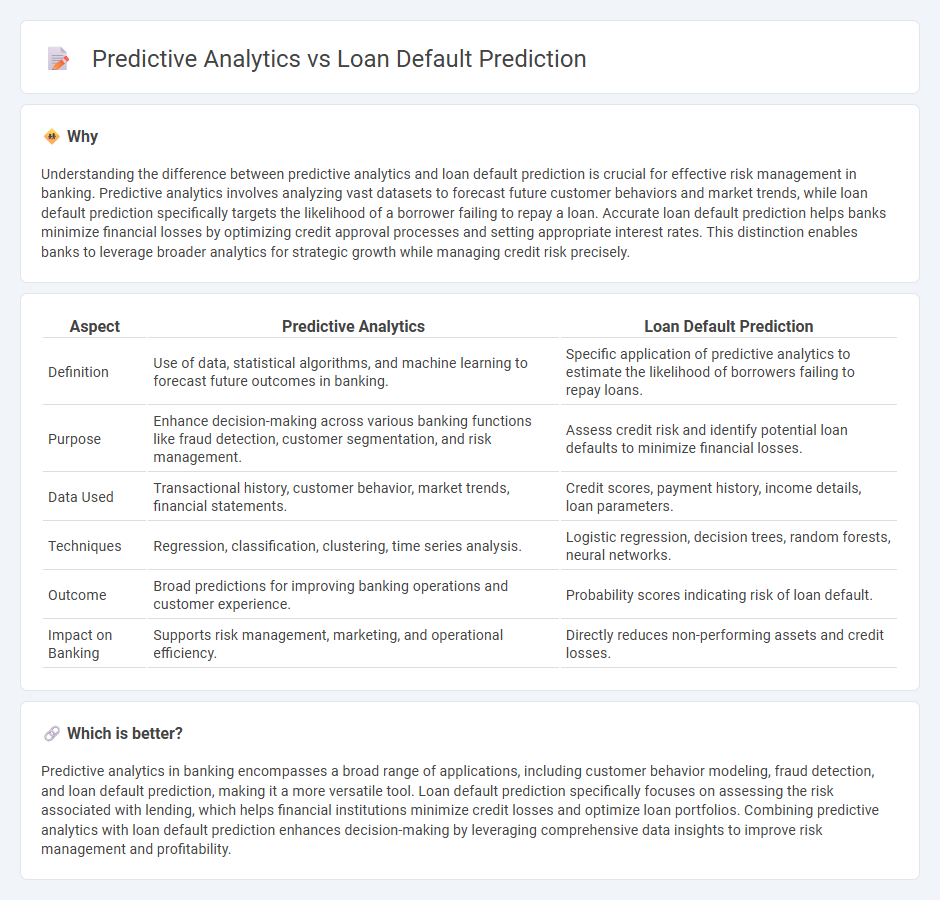

Understanding the difference between predictive analytics and loan default prediction is crucial for effective risk management in banking. Predictive analytics involves analyzing vast datasets to forecast future customer behaviors and market trends, while loan default prediction specifically targets the likelihood of a borrower failing to repay a loan. Accurate loan default prediction helps banks minimize financial losses by optimizing credit approval processes and setting appropriate interest rates. This distinction enables banks to leverage broader analytics for strategic growth while managing credit risk precisely.

Comparison Table

| Aspect | Predictive Analytics | Loan Default Prediction |

|---|---|---|

| Definition | Use of data, statistical algorithms, and machine learning to forecast future outcomes in banking. | Specific application of predictive analytics to estimate the likelihood of borrowers failing to repay loans. |

| Purpose | Enhance decision-making across various banking functions like fraud detection, customer segmentation, and risk management. | Assess credit risk and identify potential loan defaults to minimize financial losses. |

| Data Used | Transactional history, customer behavior, market trends, financial statements. | Credit scores, payment history, income details, loan parameters. |

| Techniques | Regression, classification, clustering, time series analysis. | Logistic regression, decision trees, random forests, neural networks. |

| Outcome | Broad predictions for improving banking operations and customer experience. | Probability scores indicating risk of loan default. |

| Impact on Banking | Supports risk management, marketing, and operational efficiency. | Directly reduces non-performing assets and credit losses. |

Which is better?

Predictive analytics in banking encompasses a broad range of applications, including customer behavior modeling, fraud detection, and loan default prediction, making it a more versatile tool. Loan default prediction specifically focuses on assessing the risk associated with lending, which helps financial institutions minimize credit losses and optimize loan portfolios. Combining predictive analytics with loan default prediction enhances decision-making by leveraging comprehensive data insights to improve risk management and profitability.

Connection

Predictive analytics leverages historical banking data, customer behavior patterns, and financial indicators to forecast the likelihood of loan defaults, enhancing risk management strategies. Machine learning algorithms process variables such as credit scores, income levels, and repayment histories to identify high-risk borrowers accurately. This integration helps banks minimize losses by enabling proactive decision-making and tailored loan offerings.

Key Terms

Credit Scoring

Loan default prediction is a specialized application within predictive analytics that uses historical credit data, payment behavior, and borrower characteristics to assess the likelihood of a borrower defaulting on a loan. Credit scoring models, including logistic regression and machine learning algorithms like random forests and gradient boosting, are fundamental tools for quantifying credit risk and making informed lending decisions. Explore advanced credit scoring techniques and their impact on reducing default rates and improving portfolio management for deeper insights.

Machine Learning

Loan default prediction leverages machine learning algorithms to analyze borrower data and identify patterns indicating the likelihood of default, improving risk assessment accuracy. Predictive analytics encompasses a broader scope, utilizing various statistical techniques and machine learning models to forecast trends across multiple domains including finance. Explore the latest machine learning innovations and applications in loan default prediction to enhance decision-making and reduce financial risks.

Risk Assessment

Loan default prediction is a specific application within predictive analytics, targeting the identification of borrowers likely to fail in repaying loans by analyzing behavioral patterns, credit history, and financial data. Predictive analytics employs statistical algorithms and machine learning models to assess risk factors, enhancing the accuracy of risk assessment and enabling lenders to make informed decisions. Explore advanced methodologies and tools to deepen your understanding of risk assessment through predictive analytics.

Source and External Links

Loan Default Prediction System - RIT Digital Institutional Repository - This study reviews machine learning models like decision trees, logistic regression, and neural networks for loan default prediction, finding neural networks often achieve the highest accuracy on lending club datasets, with techniques such as random forest and SMOTE used for class imbalance issues.

Applying Cost-Sensitive Machine Learning Models to Loan Default ... - This thesis highlights XGBoost as the best performing model for loan default prediction on Small Business Administration data, improving prediction of non-performing loans especially when combined with cost-sensitive learning and considering macroeconomic factors and sectors.

Predict the likelihood of a loan default - DataRobot docs - AI-driven models for loan default prediction focus on estimating Expected Credit Loss via Probability of Default, Loss Given Default, and Exposure at Default metrics, supporting regulatory compliance and risk management in consumer and SME loan portfolios.

dowidth.com

dowidth.com