Crypto custody involves securing digital assets using private keys stored in hardware wallets, multi-signature setups, or trusted third-party custodians, emphasizing cybersecurity and blockchain verification. Physical asset custody entails managing tangible valuables like gold, cash, or securities through secure vaults, insurance, and regulatory compliance. Discover the critical distinctions and risk management strategies between crypto custody and physical asset custody.

Why it is important

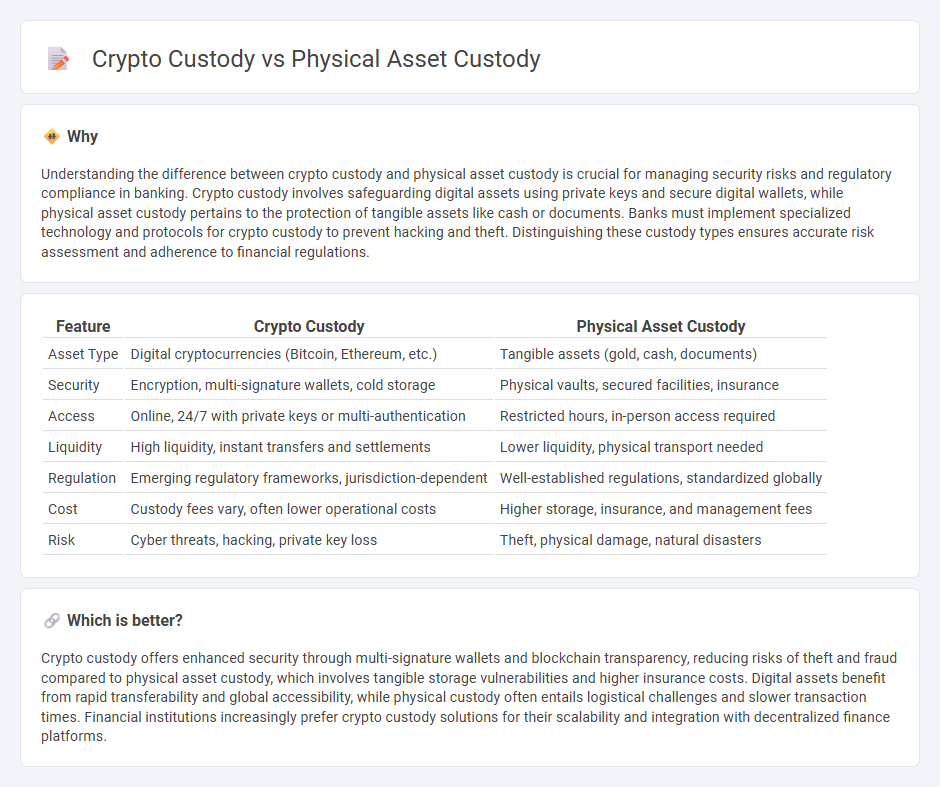

Understanding the difference between crypto custody and physical asset custody is crucial for managing security risks and regulatory compliance in banking. Crypto custody involves safeguarding digital assets using private keys and secure digital wallets, while physical asset custody pertains to the protection of tangible assets like cash or documents. Banks must implement specialized technology and protocols for crypto custody to prevent hacking and theft. Distinguishing these custody types ensures accurate risk assessment and adherence to financial regulations.

Comparison Table

| Feature | Crypto Custody | Physical Asset Custody |

|---|---|---|

| Asset Type | Digital cryptocurrencies (Bitcoin, Ethereum, etc.) | Tangible assets (gold, cash, documents) |

| Security | Encryption, multi-signature wallets, cold storage | Physical vaults, secured facilities, insurance |

| Access | Online, 24/7 with private keys or multi-authentication | Restricted hours, in-person access required |

| Liquidity | High liquidity, instant transfers and settlements | Lower liquidity, physical transport needed |

| Regulation | Emerging regulatory frameworks, jurisdiction-dependent | Well-established regulations, standardized globally |

| Cost | Custody fees vary, often lower operational costs | Higher storage, insurance, and management fees |

| Risk | Cyber threats, hacking, private key loss | Theft, physical damage, natural disasters |

Which is better?

Crypto custody offers enhanced security through multi-signature wallets and blockchain transparency, reducing risks of theft and fraud compared to physical asset custody, which involves tangible storage vulnerabilities and higher insurance costs. Digital assets benefit from rapid transferability and global accessibility, while physical custody often entails logistical challenges and slower transaction times. Financial institutions increasingly prefer crypto custody solutions for their scalability and integration with decentralized finance platforms.

Connection

Crypto custody and physical asset custody intersect through secure storage practices and regulatory compliance frameworks designed to protect valuable assets. Both domains utilize multi-layered security protocols such as encrypted private keys for digital assets and high-security vaults for physical assets, ensuring asset integrity and mitigating theft risks. Financial institutions increasingly integrate hybrid custody solutions enabling seamless management and auditing of both digital cryptocurrencies and tangible assets under unified risk management strategies.

Key Terms

Vault Storage

Vault storage for physical asset custody involves secure, often climate-controlled facilities designed to protect valuables such as precious metals, documents, and artworks from theft, damage, and environmental hazards. Crypto custody in vault storage refers to specialized hardware security modules (HSMs), cold wallets, and multi-signature technologies that safeguard private keys against digital theft and hacking attempts. Explore the key differences and security protocols behind vault storage for both physical and crypto assets to better understand their protection mechanisms.

Private Key Management

Physical asset custody involves secure storage and protection of tangible items like gold, real estate, or artwork, relying on physical security measures. Crypto custody centers on the management of private keys, which are essential for accessing and controlling digital assets on blockchain networks, requiring advanced encryption and multi-signature solutions. Explore the critical differences in private key management to ensure the highest level of security in your asset custody strategy.

Cold Wallet

Cold wallets provide secure storage for cryptocurrency by keeping private keys offline, reducing the risk of hacking compared to online hot wallets. Unlike physical asset custody, which involves tangible items stored in vaults or secure locations, cold wallets rely on encrypted hardware or paper backups to prevent unauthorized access. Explore the benefits and risks of cold wallet crypto custody for enhanced digital asset protection.

Source and External Links

Final Rule: Custody of Funds or Securities of Clients by ... - SEC.gov - Defines custody as possession or authority to obtain possession of client funds or securities, requiring advisers to maintain client assets with a qualified custodian to protect them from misuse or loss.

Custody of Assets & Custodians | Definition, Rules & Examples - Custody means having authority to access and protect client assets, with custodians acting as financial entities that hold and safeguard physical or digital assets on behalf of clients under regulatory oversight.

Asset Custody 101: Safeguarding Your Financial Assets - Asset custody involves a third-party custodian ensuring safekeeping, transaction facilitation, and protection of financial assets including securities and cash, guarding against theft and mismanagement.

dowidth.com

dowidth.com