Alternative credit data leverages non-traditional financial information such as utility payments, rent history, and mobile phone usage to assess creditworthiness beyond conventional credit scores. Psychometric data evaluates behavioral traits and personality characteristics through structured assessments, providing insights into an individual's financial reliability and risk profile. Explore how these innovative approaches are transforming credit evaluation processes in modern banking.

Why it is important

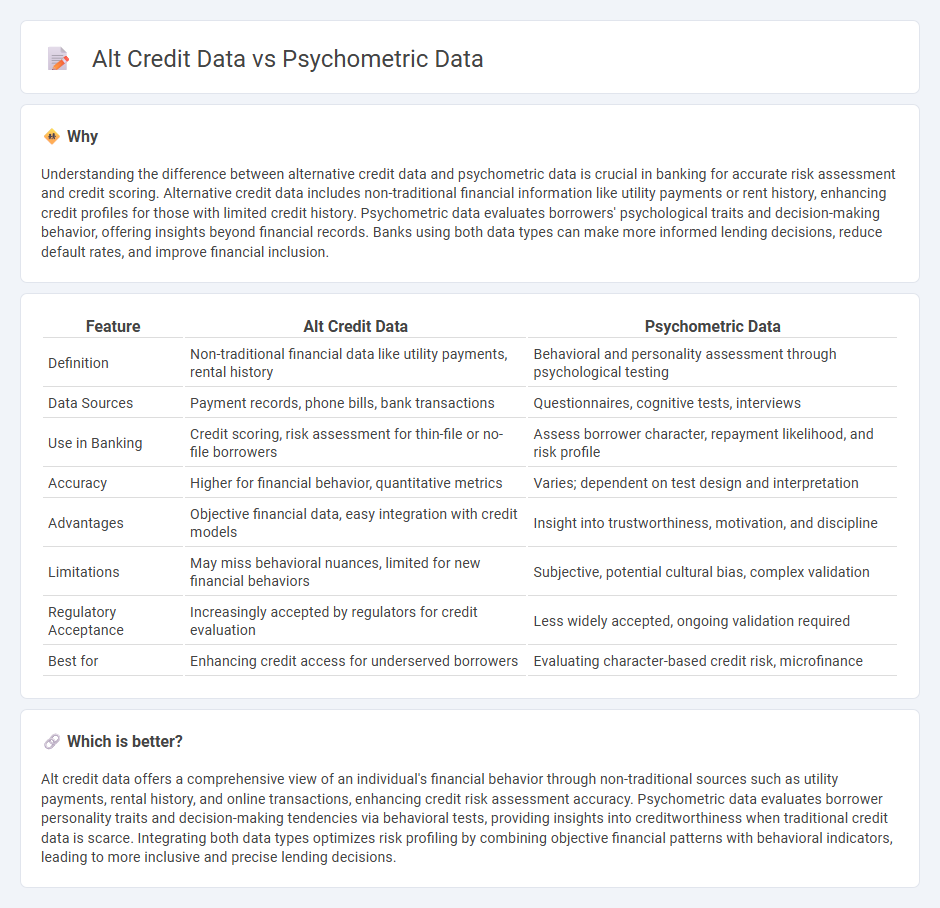

Understanding the difference between alternative credit data and psychometric data is crucial in banking for accurate risk assessment and credit scoring. Alternative credit data includes non-traditional financial information like utility payments or rent history, enhancing credit profiles for those with limited credit history. Psychometric data evaluates borrowers' psychological traits and decision-making behavior, offering insights beyond financial records. Banks using both data types can make more informed lending decisions, reduce default rates, and improve financial inclusion.

Comparison Table

| Feature | Alt Credit Data | Psychometric Data |

|---|---|---|

| Definition | Non-traditional financial data like utility payments, rental history | Behavioral and personality assessment through psychological testing |

| Data Sources | Payment records, phone bills, bank transactions | Questionnaires, cognitive tests, interviews |

| Use in Banking | Credit scoring, risk assessment for thin-file or no-file borrowers | Assess borrower character, repayment likelihood, and risk profile |

| Accuracy | Higher for financial behavior, quantitative metrics | Varies; dependent on test design and interpretation |

| Advantages | Objective financial data, easy integration with credit models | Insight into trustworthiness, motivation, and discipline |

| Limitations | May miss behavioral nuances, limited for new financial behaviors | Subjective, potential cultural bias, complex validation |

| Regulatory Acceptance | Increasingly accepted by regulators for credit evaluation | Less widely accepted, ongoing validation required |

| Best for | Enhancing credit access for underserved borrowers | Evaluating character-based credit risk, microfinance |

Which is better?

Alt credit data offers a comprehensive view of an individual's financial behavior through non-traditional sources such as utility payments, rental history, and online transactions, enhancing credit risk assessment accuracy. Psychometric data evaluates borrower personality traits and decision-making tendencies via behavioral tests, providing insights into creditworthiness when traditional credit data is scarce. Integrating both data types optimizes risk profiling by combining objective financial patterns with behavioral indicators, leading to more inclusive and precise lending decisions.

Connection

Alt credit data and psychometric data jointly enhance risk assessment models in banking by offering multidimensional insights into consumer creditworthiness. Alt credit data includes alternative financial information such as utility payments and rental history, while psychometric data captures behavioral and personality traits through standardized testing. Integrating these data types allows banks to improve loan approval accuracy, reduce default rates, and extend credit access to underserved populations lacking traditional credit histories.

Key Terms

Creditworthiness Assessment

Psychometric data evaluates creditworthiness by analyzing behavioral traits and personality through customized questionnaires, providing insights beyond traditional financial metrics. Alternative credit data incorporates non-traditional financial information like utility payments, rent history, and digital footprints to enhance accuracy in credit risk assessments. Discover how integrating psychometric and alternative credit data revolutionizes creditworthiness evaluation for more inclusive lending decisions.

Non-traditional Data Sources

Psychometric data leverages behavioral insights and personality traits to assess creditworthiness, while alternative credit data includes non-traditional financial records like utility payments, rental histories, and mobile phone usage. These non-traditional data sources provide lenders with a more holistic view of borrowers, especially those lacking formal credit history. Explore more to understand how integrating these data types revolutionizes credit scoring models.

Behavioral Scoring

Psychometric data offers insights into an individual's personality traits, cognitive abilities, and decision-making patterns, which are crucial for behavioral scoring in credit risk assessment. Alternative credit data, such as utility payments, rental history, and social media activity, supplements traditional credit bureau data to provide a broader picture of financial behavior. Explore how behavioral scoring leverages these datasets to enhance credit underwriting accuracy and financial inclusion.

Source and External Links

Guide: 4 Main Types of Psychometric Data (B, I, S, L) - Psychometric data is categorized into behavioral (B), informants' (I), self-report (S), and life (L) types, each serving different research purposes in psychology and organizational contexts.

What is Psychometrics? - Psychometrics is the scientific discipline focused on developing assessment tools and measurement instruments to infer unobservable psychological attributes, using statistical models to connect observable data with theoretical constructs.

Psychometrics: Exploring the key concepts and models - Psychometric data enables the measurement of psychological traits like intelligence and personality, underpinned by principles of reliability, validity, standardization, and fairness to ensure objective and consistent results.

dowidth.com

dowidth.com