Finfluencers leverage social media platforms to provide financial advice, tips, and product recommendations, influencing consumer behavior in banking and personal finance. Peer-to-peer lending platforms enable borrowers to obtain loans directly from individual investors, bypassing traditional banks and often offering competitive interest rates. Explore the differences to understand how each shapes modern financial decisions.

Why it is important

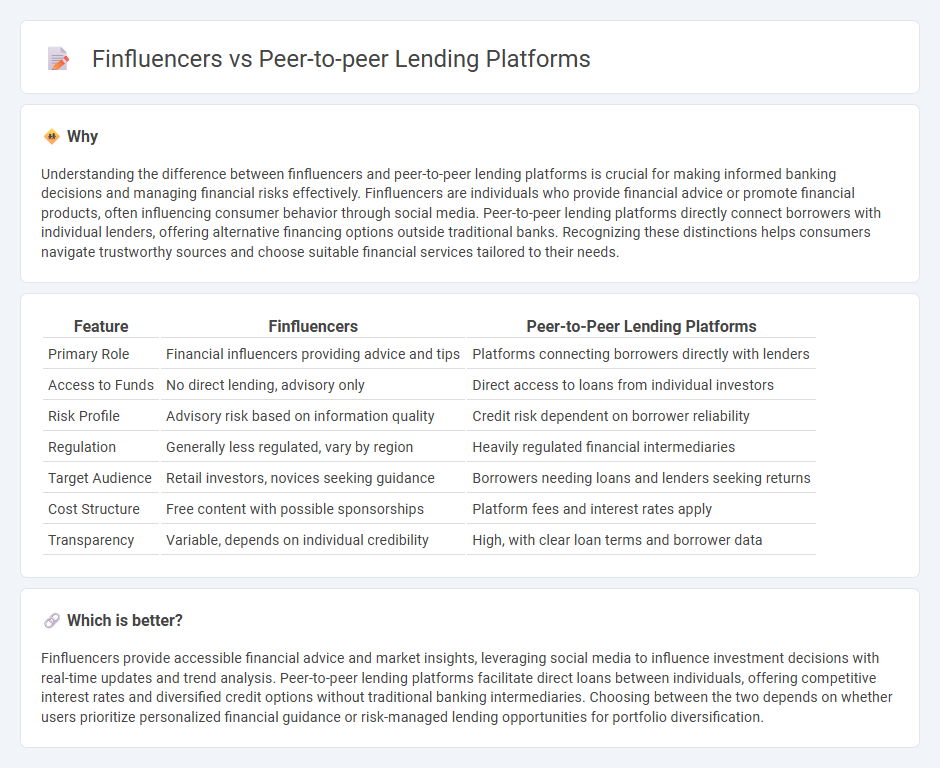

Understanding the difference between finfluencers and peer-to-peer lending platforms is crucial for making informed banking decisions and managing financial risks effectively. Finfluencers are individuals who provide financial advice or promote financial products, often influencing consumer behavior through social media. Peer-to-peer lending platforms directly connect borrowers with individual lenders, offering alternative financing options outside traditional banks. Recognizing these distinctions helps consumers navigate trustworthy sources and choose suitable financial services tailored to their needs.

Comparison Table

| Feature | Finfluencers | Peer-to-Peer Lending Platforms |

|---|---|---|

| Primary Role | Financial influencers providing advice and tips | Platforms connecting borrowers directly with lenders |

| Access to Funds | No direct lending, advisory only | Direct access to loans from individual investors |

| Risk Profile | Advisory risk based on information quality | Credit risk dependent on borrower reliability |

| Regulation | Generally less regulated, vary by region | Heavily regulated financial intermediaries |

| Target Audience | Retail investors, novices seeking guidance | Borrowers needing loans and lenders seeking returns |

| Cost Structure | Free content with possible sponsorships | Platform fees and interest rates apply |

| Transparency | Variable, depends on individual credibility | High, with clear loan terms and borrower data |

Which is better?

Finfluencers provide accessible financial advice and market insights, leveraging social media to influence investment decisions with real-time updates and trend analysis. Peer-to-peer lending platforms facilitate direct loans between individuals, offering competitive interest rates and diversified credit options without traditional banking intermediaries. Choosing between the two depends on whether users prioritize personalized financial guidance or risk-managed lending opportunities for portfolio diversification.

Connection

Finfluencers leverage social media to educate and influence audiences about alternative financial solutions, prominently including peer-to-peer lending platforms. These platforms facilitate direct borrowing and lending between individuals, bypassing traditional banks, which finfluencers highlight as accessible and flexible financing options. The synergy between finfluencers and peer-to-peer lending increases awareness, trust, and adoption rates among younger, digitally-savvy investors.

Key Terms

**Peer-to-peer lending platforms:**

Peer-to-peer lending platforms facilitate direct loans between individual borrowers and investors, bypassing traditional financial institutions, leading to competitive interest rates and quicker loan approvals. These platforms leverage advanced algorithms and data analytics to assess credit risk, ensuring secure and efficient lending transactions. Discover the advantages of P2P lending and how it can transform your investment and borrowing experience.

Crowdfunding

Peer-to-peer lending platforms facilitate direct loans between individuals without traditional banks, offering investors opportunities to fund personal or business projects through crowdfunding models. Finfluencers leverage social media to educate and engage audiences about financial strategies, often promoting crowdfunding initiatives and peer-to-peer lending options as alternative investment avenues. Explore how the intersection of fintech and social media is reshaping crowdfunding to maximize your financial potential.

Risk assessment

Peer-to-peer lending platforms utilize algorithm-driven credit scoring models that analyze borrowers' financial history and transactional data to minimize default risk. Finfluencers often base risk assessment on personal experience and market sentiment, which can lack rigorous data-backed evaluation. Discover more about how these approaches impact investment safety and decision-making.

Source and External Links

Top 10 Peer-to-Peer Lending Platforms | FinTech Magazine - Peer-to-peer lending platforms connect borrowers directly with lenders, typically offering lower rates for borrowers and better returns for investors, with leading platforms like Peerform and Mintos operating globally since 2005 under regulatory frameworks such as MiFID II.

Peer-to-Peer Lending for Your Startup - The Hartford Insurance - P2P lending lets individuals and alternative investors fund loans with lower interest rates than banks, where borrowers apply via an online platform and lenders pick loans matching their risk profile, making it suitable especially for small business funding.

SoLo Funds - SoLo Funds is a community-driven P2P finance platform where members lend and borrow on flexible terms without mandatory fees or compound interest, emphasizing transparency and mutual support.

dowidth.com

dowidth.com