Account aggregation consolidates financial data from multiple sources to provide users with a comprehensive view of their finances, enhancing money management and personalized banking services. KYC (Know Your Customer) involves verifying a customer's identity to comply with regulatory requirements, prevent fraud, and ensure secure banking interactions. Explore how integrating account aggregation with KYC processes transforms customer experience and security in modern banking.

Why it is important

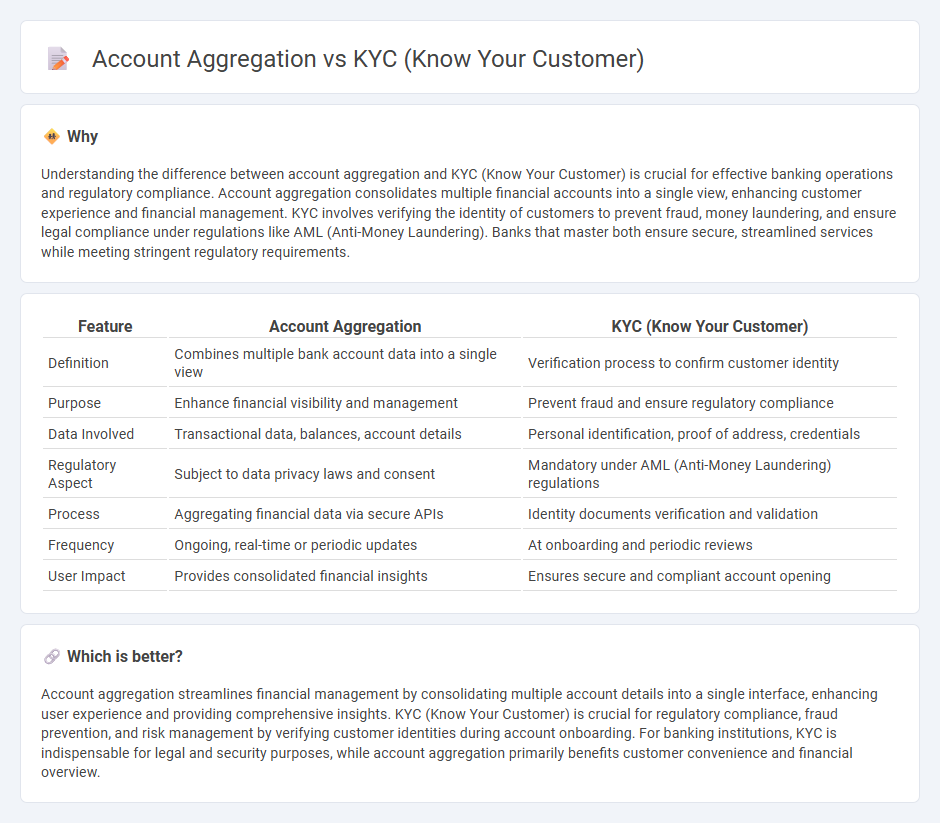

Understanding the difference between account aggregation and KYC (Know Your Customer) is crucial for effective banking operations and regulatory compliance. Account aggregation consolidates multiple financial accounts into a single view, enhancing customer experience and financial management. KYC involves verifying the identity of customers to prevent fraud, money laundering, and ensure legal compliance under regulations like AML (Anti-Money Laundering). Banks that master both ensure secure, streamlined services while meeting stringent regulatory requirements.

Comparison Table

| Feature | Account Aggregation | KYC (Know Your Customer) |

|---|---|---|

| Definition | Combines multiple bank account data into a single view | Verification process to confirm customer identity |

| Purpose | Enhance financial visibility and management | Prevent fraud and ensure regulatory compliance |

| Data Involved | Transactional data, balances, account details | Personal identification, proof of address, credentials |

| Regulatory Aspect | Subject to data privacy laws and consent | Mandatory under AML (Anti-Money Laundering) regulations |

| Process | Aggregating financial data via secure APIs | Identity documents verification and validation |

| Frequency | Ongoing, real-time or periodic updates | At onboarding and periodic reviews |

| User Impact | Provides consolidated financial insights | Ensures secure and compliant account opening |

Which is better?

Account aggregation streamlines financial management by consolidating multiple account details into a single interface, enhancing user experience and providing comprehensive insights. KYC (Know Your Customer) is crucial for regulatory compliance, fraud prevention, and risk management by verifying customer identities during account onboarding. For banking institutions, KYC is indispensable for legal and security purposes, while account aggregation primarily benefits customer convenience and financial overview.

Connection

Account aggregation streamlines the process of consolidating financial data from multiple accounts, enhancing the accuracy and efficiency of KYC (Know Your Customer) procedures. By integrating real-time transaction information and identity verification, banks can better assess customer risk and ensure regulatory compliance. This synergy reduces fraud and facilitates a seamless onboarding experience while maintaining robust security standards.

Key Terms

Customer Identification

KYC (Know Your Customer) involves verifying the identity of customers through official documents and biometric data to prevent fraud and comply with regulatory requirements. Account aggregation collects and consolidates financial data from multiple accounts into a single view, enhancing financial management but requiring secure identification protocols to protect customer information. Explore detailed distinctions and benefits to fully understand how each approach impacts customer identification.

Data Consolidation

KYC (Know Your Customer) processes primarily focus on verifying customer identity and compliance using personal data collected directly from the user, ensuring regulatory adherence and risk mitigation. Account aggregation consolidates financial data from multiple accounts and institutions into a unified platform, enabling comprehensive financial insights and management without redundancy in identity verification. Explore more to understand how these distinct data consolidation methods enhance both security and user experience.

Regulatory Compliance

KYC (Know Your Customer) processes ensure regulatory compliance by verifying the identity, risk profile, and financial activities of customers to prevent fraud, money laundering, and terrorist financing. Account aggregation consolidates financial data from multiple accounts into a single platform but must adhere to strict data protection regulations and obtain explicit customer consent to remain compliant. Explore how integrating robust KYC practices with secure account aggregation enhances compliance frameworks in financial institutions.

Source and External Links

The Importance of Know Your Customer - Entrust - KYC (Know Your Customer) is a due diligence process used by organizations to verify client identities, helping to detect fraud, money laundering, and terrorism financing, while maintaining customer trust and preventing revenue loss.

What is KYC? Overview & short explanations - IDnow - KYC refers to verifying new customers' identities to prevent illegal activities like money laundering and fraud, supported by regional regulations such as EU Directives and the USA Patriot Act.

Know your customer - Wikipedia - KYC includes verifying identities and assessing risks, and has related concepts like KYCC (Know Your Customer's Customer) and KYB (Know Your Business), which extend due diligence to customers' business partners and the businesses themselves to combat criminal activities.

dowidth.com

dowidth.com