Hyperpersonalization in banking leverages real-time data and customer behavior to deliver highly tailored financial products and services, enhancing user engagement and satisfaction. Predictive analytics uses historical data and machine learning models to forecast customer needs and market trends, enabling proactive decision-making and risk management. Explore how these technologies revolutionize customer experience and operational efficiency in modern banking.

Why it is important

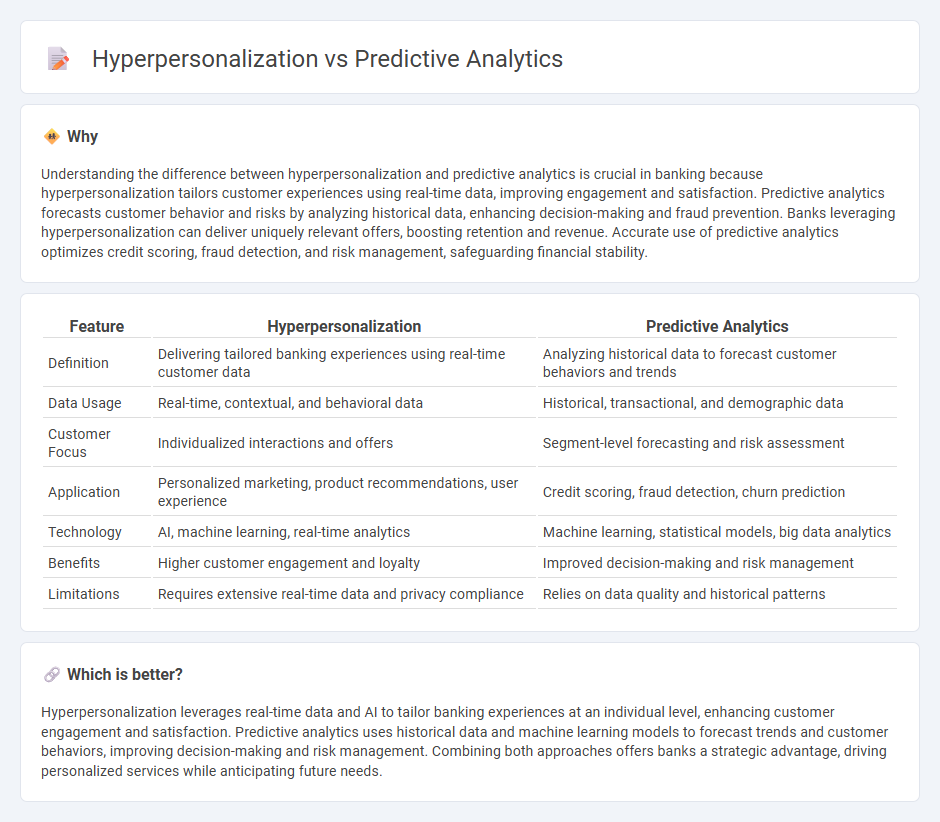

Understanding the difference between hyperpersonalization and predictive analytics is crucial in banking because hyperpersonalization tailors customer experiences using real-time data, improving engagement and satisfaction. Predictive analytics forecasts customer behavior and risks by analyzing historical data, enhancing decision-making and fraud prevention. Banks leveraging hyperpersonalization can deliver uniquely relevant offers, boosting retention and revenue. Accurate use of predictive analytics optimizes credit scoring, fraud detection, and risk management, safeguarding financial stability.

Comparison Table

| Feature | Hyperpersonalization | Predictive Analytics |

|---|---|---|

| Definition | Delivering tailored banking experiences using real-time customer data | Analyzing historical data to forecast customer behaviors and trends |

| Data Usage | Real-time, contextual, and behavioral data | Historical, transactional, and demographic data |

| Customer Focus | Individualized interactions and offers | Segment-level forecasting and risk assessment |

| Application | Personalized marketing, product recommendations, user experience | Credit scoring, fraud detection, churn prediction |

| Technology | AI, machine learning, real-time analytics | Machine learning, statistical models, big data analytics |

| Benefits | Higher customer engagement and loyalty | Improved decision-making and risk management |

| Limitations | Requires extensive real-time data and privacy compliance | Relies on data quality and historical patterns |

Which is better?

Hyperpersonalization leverages real-time data and AI to tailor banking experiences at an individual level, enhancing customer engagement and satisfaction. Predictive analytics uses historical data and machine learning models to forecast trends and customer behaviors, improving decision-making and risk management. Combining both approaches offers banks a strategic advantage, driving personalized services while anticipating future needs.

Connection

Hyperpersonalization in banking leverages predictive analytics to analyze customer data and anticipate individual financial needs, enabling tailored product recommendations and customized services. Predictive analytics models assess transaction histories, spending patterns, and behavioral indicators to forecast future actions, enhancing customer engagement and satisfaction. This synergy drives increased loyalty, higher conversion rates, and optimized cross-selling opportunities within financial institutions.

Key Terms

Predictive analytics:

Predictive analytics leverages historical data, machine learning algorithms, and statistical models to forecast future behaviors and trends, enabling businesses to make informed decisions and optimize strategies. It analyzes customer patterns, purchase history, and market signals to predict outcomes such as customer churn, demand fluctuations, and risk management. Explore how predictive analytics transforms decision-making processes and drives proactive business growth.

Data modeling

Predictive analytics leverages data modeling techniques such as regression analysis, time series forecasting, and machine learning algorithms to identify patterns and predict future outcomes across large datasets. Hyperpersonalization utilizes advanced data models that integrate real-time customer behavior, preferences, and context to deliver individualized experiences at scale. Explore further to understand how sophisticated data modeling drives accuracy and relevance in these cutting-edge applications.

Forecasting

Predictive analytics leverages historical data and statistical algorithms to forecast future trends, customer behaviors, and market shifts with high accuracy, optimizing decision-making processes. Hyperpersonalization uses real-time data combined with AI to deliver tailored experiences and dynamic content based on individual customer preferences and predicted needs. Explore expert insights to understand how these technologies drive business growth and customer engagement.

Source and External Links

What is Predictive Analytics? | IBM - Predictive analytics uses historical data and statistical modeling, data mining, and machine learning to forecast future outcomes, helping organizations identify risks and opportunities by discovering patterns and trends in their data.

What is predictive analytics and how does it work? | Google Cloud - Predictive analytics is the process of using data analysis, machine learning, AI, and statistical models to find patterns that can forecast future behaviors, enabling businesses to predict trends and outcomes with precision.

What is Predictive Analytics? | Salesforce US - Predictive analytics leverages historical data and algorithms--including machine learning and AI--to predict future events, allowing businesses to make proactive, data-driven decisions to improve results.

dowidth.com

dowidth.com