Personal finance automation tools streamline budgeting, saving, and investment tracking by leveraging AI to analyze spending patterns and optimize financial decisions. Credit risk assessment tools utilize machine learning algorithms to evaluate borrower creditworthiness through data points such as payment history, income stability, and credit utilization rates. Explore how these innovative banking technologies transform financial management and lending accuracy.

Why it is important

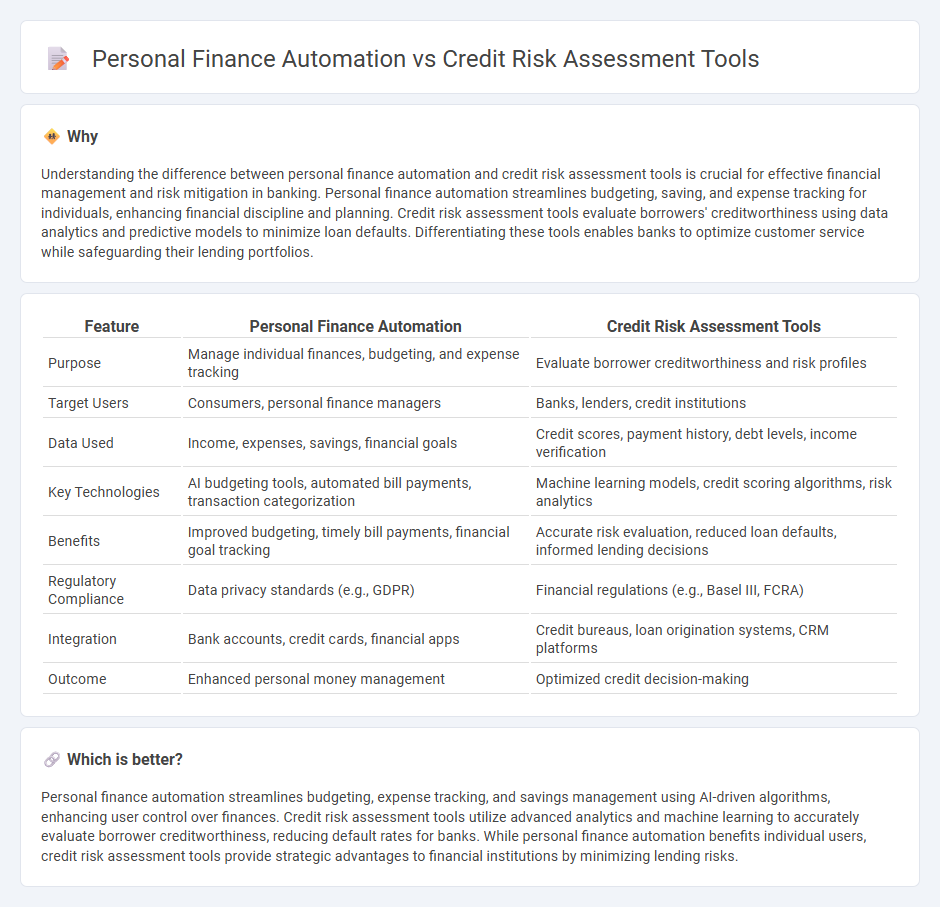

Understanding the difference between personal finance automation and credit risk assessment tools is crucial for effective financial management and risk mitigation in banking. Personal finance automation streamlines budgeting, saving, and expense tracking for individuals, enhancing financial discipline and planning. Credit risk assessment tools evaluate borrowers' creditworthiness using data analytics and predictive models to minimize loan defaults. Differentiating these tools enables banks to optimize customer service while safeguarding their lending portfolios.

Comparison Table

| Feature | Personal Finance Automation | Credit Risk Assessment Tools |

|---|---|---|

| Purpose | Manage individual finances, budgeting, and expense tracking | Evaluate borrower creditworthiness and risk profiles |

| Target Users | Consumers, personal finance managers | Banks, lenders, credit institutions |

| Data Used | Income, expenses, savings, financial goals | Credit scores, payment history, debt levels, income verification |

| Key Technologies | AI budgeting tools, automated bill payments, transaction categorization | Machine learning models, credit scoring algorithms, risk analytics |

| Benefits | Improved budgeting, timely bill payments, financial goal tracking | Accurate risk evaluation, reduced loan defaults, informed lending decisions |

| Regulatory Compliance | Data privacy standards (e.g., GDPR) | Financial regulations (e.g., Basel III, FCRA) |

| Integration | Bank accounts, credit cards, financial apps | Credit bureaus, loan origination systems, CRM platforms |

| Outcome | Enhanced personal money management | Optimized credit decision-making |

Which is better?

Personal finance automation streamlines budgeting, expense tracking, and savings management using AI-driven algorithms, enhancing user control over finances. Credit risk assessment tools utilize advanced analytics and machine learning to accurately evaluate borrower creditworthiness, reducing default rates for banks. While personal finance automation benefits individual users, credit risk assessment tools provide strategic advantages to financial institutions by minimizing lending risks.

Connection

Personal finance automation leverages data analytics and machine learning algorithms that also underpin credit risk assessment tools, enabling real-time monitoring of spending patterns and financial behaviors. These interconnected technologies enhance accuracy in evaluating creditworthiness by incorporating automated tracking of income, expenses, and debt repayment habits. Integration of both systems allows banks to offer personalized financial advice while maintaining robust risk management frameworks.

Key Terms

**Credit Risk Assessment Tools:**

Credit risk assessment tools utilize advanced algorithms and machine learning to analyze credit scores, payment history, and financial behavior, providing precise predictions of a borrower's likelihood to default. These tools are essential for banks, lenders, and financial institutions to minimize loan defaults and optimize credit decisions based on comprehensive data analytics. Discover how cutting-edge credit risk assessment tools can transform your financial risk management strategies.

Credit Scoring Models

Credit scoring models form the backbone of credit risk assessment tools, utilizing statistical algorithms to evaluate an individual's creditworthiness based on payment history, outstanding debts, and credit utilization ratios. Personal finance automation leverages these models to offer users real-time credit insights and tailored financial recommendations, enhancing decision-making and financial health management. Explore how integrated credit scoring technologies transform both risk assessment and personal finance automation for optimized financial outcomes.

Risk Rating Systems

Risk rating systems in credit risk assessment tools quantify borrower risk by analyzing credit history, income, and repayment capacity, enabling lenders to make informed decisions. Personal finance automation emphasizes budgeting and expense tracking but lacks sophisticated risk evaluation algorithms found in credit risk platforms. Explore the detailed mechanisms behind risk rating systems to enhance your financial risk management knowledge.

Source and External Links

Top 7 Credit Risk Management Tools in 2025 - Gaviti - Lists leading platforms like GiniMachine, ACTICO, Pega, and Experian, which offer AI-driven credit scoring, real-time risk assessment, and comprehensive analytics for effective credit risk management.

Top Techniques for Credit Risk Assessment and Monitoring - Nected - Highlights key models and methods including credit scoring (FICO, VantageScore), advanced statistical and machine learning models, credit valuation adjustments, and management quality assessments for evaluating borrower default risk.

Credit Risk Solutions & Management - Moody's - Describes CreditForecast, a platform offering consumer credit risk insights, economic forecasts, stress-testing, and scenario analysis to help lenders benchmark portfolios and make informed decisions under varying macroeconomic conditions.

dowidth.com

dowidth.com