Finfluencers leverage social media platforms to provide accessible, up-to-date banking tips and financial advice, targeting a tech-savvy audience seeking quick insights. In contrast, financial planners offer personalized, comprehensive strategies tailored to individual banking needs and long-term wealth management. Explore the nuances between these two approaches to enhance your financial decision-making.

Why it is important

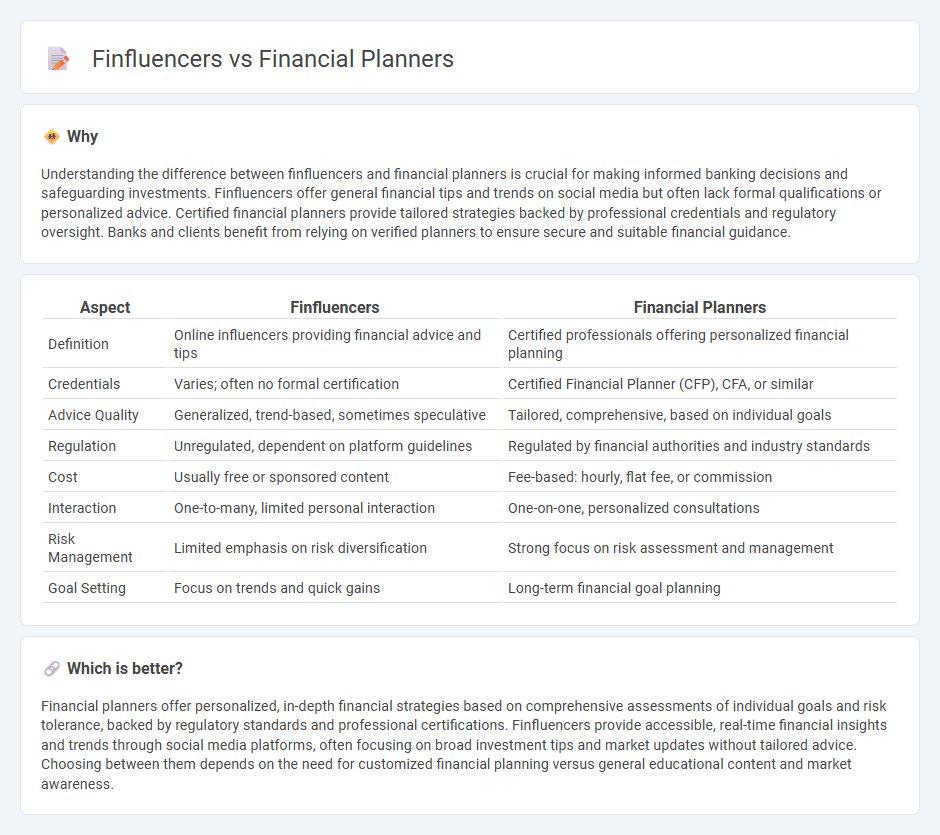

Understanding the difference between finfluencers and financial planners is crucial for making informed banking decisions and safeguarding investments. Finfluencers offer general financial tips and trends on social media but often lack formal qualifications or personalized advice. Certified financial planners provide tailored strategies backed by professional credentials and regulatory oversight. Banks and clients benefit from relying on verified planners to ensure secure and suitable financial guidance.

Comparison Table

| Aspect | Finfluencers | Financial Planners |

|---|---|---|

| Definition | Online influencers providing financial advice and tips | Certified professionals offering personalized financial planning |

| Credentials | Varies; often no formal certification | Certified Financial Planner (CFP), CFA, or similar |

| Advice Quality | Generalized, trend-based, sometimes speculative | Tailored, comprehensive, based on individual goals |

| Regulation | Unregulated, dependent on platform guidelines | Regulated by financial authorities and industry standards |

| Cost | Usually free or sponsored content | Fee-based: hourly, flat fee, or commission |

| Interaction | One-to-many, limited personal interaction | One-on-one, personalized consultations |

| Risk Management | Limited emphasis on risk diversification | Strong focus on risk assessment and management |

| Goal Setting | Focus on trends and quick gains | Long-term financial goal planning |

Which is better?

Financial planners offer personalized, in-depth financial strategies based on comprehensive assessments of individual goals and risk tolerance, backed by regulatory standards and professional certifications. Finfluencers provide accessible, real-time financial insights and trends through social media platforms, often focusing on broad investment tips and market updates without tailored advice. Choosing between them depends on the need for customized financial planning versus general educational content and market awareness.

Connection

Finfluencers leverage social media platforms to disseminate banking insights and investment strategies, influencing consumer behavior towards financial products and services. Financial planners often collaborate with or draw inspiration from finfluencers to enhance client engagement and deliver personalized banking advice. This synergy fosters a more informed clientele, bridging traditional financial planning with modern digital trends in banking.

Key Terms

Fiduciary Duty

Financial planners are legally obligated to act in their clients' best interests, adhering to fiduciary duty standards that ensure transparency and ethical management of assets. Finfluencers, often social media personalities offering financial advice, may lack formal certifications and fiduciary responsibilities, which can result in conflicts of interest and less personalized guidance. Explore in-depth comparisons to understand how fiduciary duty impacts the trustworthiness and reliability of financial advice.

Regulatory Compliance

Financial planners adhere strictly to regulatory compliance enforced by bodies such as the SEC and FINRA, ensuring fiduciary responsibility and client protection through transparent, evidence-based advice. Finfluencers operate primarily on social media platforms and may lack formal certifications, leading to variable adherence to regulations and potential misinformation risks. Discover the key differences in legal accountability and compliance standards between these two financial advising sources.

Disclosure Requirements

Financial planners are bound by strict disclosure requirements, including fiduciary duty mandates that ensure transparency about conflicts of interest and fees, while finfluencers often operate under less regulated standards, with varying degrees of transparency regarding sponsorships and endorsements. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) impose rigorous guidelines on financial planners to protect consumers, whereas finfluencers primarily self-regulate through platform policies and evolving advertising disclosure rules. Explore the distinctions in regulatory frameworks and their impact on trust and accountability in financial advice.

Source and External Links

Financial Planners | FINRA.org - Financial planners come from diverse backgrounds and offer various services; some offer comprehensive planning across your financial picture, while others may only recommend products they sell, and their regulation depends on the other services they provide, with CFP(r) being a highly regarded credential.

Financial Planner: Definition, How to Find One - NerdWallet - Financial planners assess your financial situation and goals to develop a personalized plan, with interactions ranging from initial reviews to ongoing communication tailored to your needs and risk tolerance.

Find a CERTIFIED FINANCIAL PLANNER(r) Professional or Advisor - The Certified Financial Planner(r) professionals specialize in comprehensive financial planning across areas like retirement and asset management, requiring passing rigorous exams and ethics standards to help you create customized plans aligned with your goals.

dowidth.com

dowidth.com