Digital identity verification in banking confirms a customer's authenticity using biometric data, government IDs, or facial recognition to prevent fraud. Digital signature validation ensures transaction integrity and signer authentication through cryptographic techniques, securing contracts and approvals. Explore how these technologies revolutionize banking security and compliance.

Why it is important

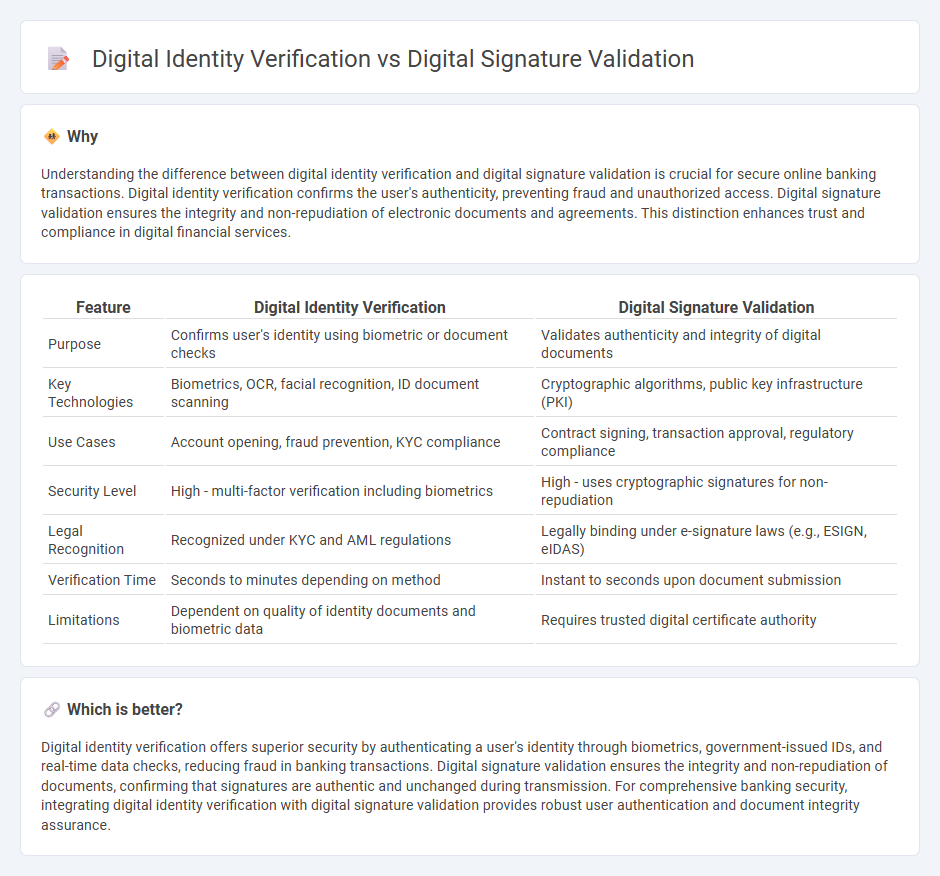

Understanding the difference between digital identity verification and digital signature validation is crucial for secure online banking transactions. Digital identity verification confirms the user's authenticity, preventing fraud and unauthorized access. Digital signature validation ensures the integrity and non-repudiation of electronic documents and agreements. This distinction enhances trust and compliance in digital financial services.

Comparison Table

| Feature | Digital Identity Verification | Digital Signature Validation |

|---|---|---|

| Purpose | Confirms user's identity using biometric or document checks | Validates authenticity and integrity of digital documents |

| Key Technologies | Biometrics, OCR, facial recognition, ID document scanning | Cryptographic algorithms, public key infrastructure (PKI) |

| Use Cases | Account opening, fraud prevention, KYC compliance | Contract signing, transaction approval, regulatory compliance |

| Security Level | High - multi-factor verification including biometrics | High - uses cryptographic signatures for non-repudiation |

| Legal Recognition | Recognized under KYC and AML regulations | Legally binding under e-signature laws (e.g., ESIGN, eIDAS) |

| Verification Time | Seconds to minutes depending on method | Instant to seconds upon document submission |

| Limitations | Dependent on quality of identity documents and biometric data | Requires trusted digital certificate authority |

Which is better?

Digital identity verification offers superior security by authenticating a user's identity through biometrics, government-issued IDs, and real-time data checks, reducing fraud in banking transactions. Digital signature validation ensures the integrity and non-repudiation of documents, confirming that signatures are authentic and unchanged during transmission. For comprehensive banking security, integrating digital identity verification with digital signature validation provides robust user authentication and document integrity assurance.

Connection

Digital identity verification and digital signature validation are closely connected through their reliance on secure cryptographic technologies to authenticate users and ensure transaction integrity in banking. Digital identity verification confirms the user's legitimacy by matching biometric data or identity documents with trusted databases, while digital signature validation assures that the signed digital transaction or document has not been altered and originates from the verified user. Together, these processes enhance fraud prevention, regulatory compliance, and seamless customer onboarding in modern banking systems.

Key Terms

**Digital Signature Validation:**

Digital signature validation ensures the authenticity and integrity of a digitally signed document by verifying the signer's cryptographic signature against a trusted certificate authority. This process confirms that the document has not been altered since signing and that the signature is valid and legally binding. Explore more about how digital signature validation enhances secure transactions and legal compliance.

Public Key Infrastructure (PKI)

Digital signature validation relies on Public Key Infrastructure (PKI) to confirm that a document or message is authentic, untampered, and signed by the holder of a specific private key. Digital identity verification, by contrast, uses PKI to authenticate an individual's identity through digital certificates issued by trusted Certificate Authorities (CAs), ensuring secure access to systems or services. Explore deeper insights into PKI's dual role in enhancing cybersecurity and trust management.

Certificate Authority (CA)

Digital signature validation relies on the Certificate Authority (CA) to authenticate the digital certificate, ensuring data integrity and signer authenticity through cryptographic verification. Digital identity verification involves the CA issuing and managing digital identities by validating personal or organizational credentials before certificate issuance. Discover more about how CAs play a pivotal role in securing digital trust frameworks.

Source and External Links

How to Validate Digital Signatures - To validate a digital signature, obtain the signer's public key or certificate, use verification tools to check the signature's authenticity, integrity, and non-repudiation, and optionally utilize timestamping to confirm the signing time.

How To Validate Digital Signature? - CountyOffice.org - This video explains how to verify digital signatures by opening signed PDFs, checking signature properties, signer certificates, document integrity, and adjusting trust settings to confirm signer legitimacy.

Validating digital signatures, Adobe Acrobat - Adobe Acrobat validates digital signatures by verifying the signature's digital ID certificate status, document integrity, and embedded verification elements such as certificate chains, revocation status, and timestamps to allow long-term validation.

dowidth.com

dowidth.com