Loyalty fintech companies specialize in creating personalized reward programs to enhance customer retention and increase transaction frequency, while payment service providers focus on facilitating seamless and secure payment processing across multiple platforms. Both sectors drive innovation in financial technology but target distinct aspects of the banking ecosystem, with loyalty fintech emphasizing customer engagement and payment service providers prioritizing transaction efficiency. Explore how these evolving fintech solutions are transforming banking experiences and customer relationships.

Why it is important

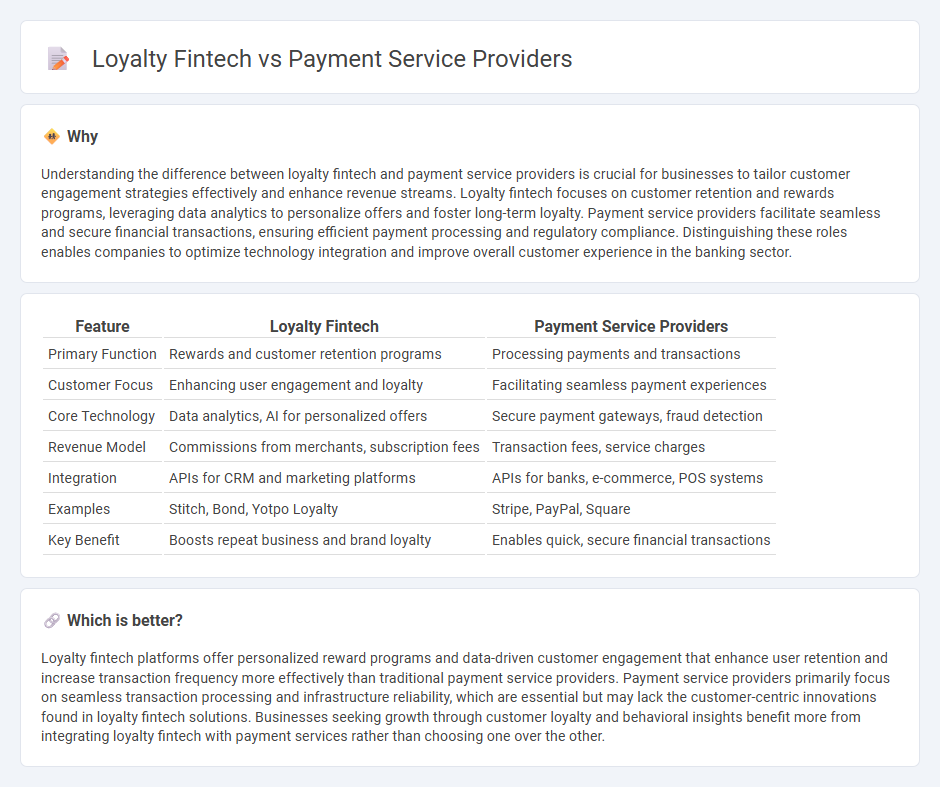

Understanding the difference between loyalty fintech and payment service providers is crucial for businesses to tailor customer engagement strategies effectively and enhance revenue streams. Loyalty fintech focuses on customer retention and rewards programs, leveraging data analytics to personalize offers and foster long-term loyalty. Payment service providers facilitate seamless and secure financial transactions, ensuring efficient payment processing and regulatory compliance. Distinguishing these roles enables companies to optimize technology integration and improve overall customer experience in the banking sector.

Comparison Table

| Feature | Loyalty Fintech | Payment Service Providers |

|---|---|---|

| Primary Function | Rewards and customer retention programs | Processing payments and transactions |

| Customer Focus | Enhancing user engagement and loyalty | Facilitating seamless payment experiences |

| Core Technology | Data analytics, AI for personalized offers | Secure payment gateways, fraud detection |

| Revenue Model | Commissions from merchants, subscription fees | Transaction fees, service charges |

| Integration | APIs for CRM and marketing platforms | APIs for banks, e-commerce, POS systems |

| Examples | Stitch, Bond, Yotpo Loyalty | Stripe, PayPal, Square |

| Key Benefit | Boosts repeat business and brand loyalty | Enables quick, secure financial transactions |

Which is better?

Loyalty fintech platforms offer personalized reward programs and data-driven customer engagement that enhance user retention and increase transaction frequency more effectively than traditional payment service providers. Payment service providers primarily focus on seamless transaction processing and infrastructure reliability, which are essential but may lack the customer-centric innovations found in loyalty fintech solutions. Businesses seeking growth through customer loyalty and behavioral insights benefit more from integrating loyalty fintech with payment services rather than choosing one over the other.

Connection

Loyalty fintech and payment service providers connect through integrated platforms that enable seamless reward management and transaction processing, enhancing customer engagement and retention. These providers utilize advanced data analytics and secure payment technologies to tailor personalized loyalty programs linked directly to payment methods. By combining fintech innovations with payment systems, they drive increased transaction frequency and improve overall consumer experience in the banking ecosystem.

Key Terms

**Payment Service Providers:**

Payment Service Providers (PSPs) facilitate secure transactions by enabling merchants to accept multiple payment methods including credit cards, digital wallets, and bank transfers, ensuring seamless payment processing and fraud prevention. They offer robust APIs, real-time transaction monitoring, and compliance with financial regulations such as PCI DSS and PSD2, critical for maintaining trust and efficiency in e-commerce. Explore the evolving landscape of PSPs to understand how they optimize payment experiences and support global business growth.

Merchant Acquiring

Payment service providers streamline merchant acquiring by offering secure, compliant transaction processing and seamless integration with point-of-sale systems, enhancing payment acceptance efficiency. Loyalty fintech platforms complement this by embedding customer engagement tools and reward mechanisms directly into the merchant acquiring process, driving repeat business and increasing transaction volumes. Explore how combining advanced payment solutions with loyalty fintech can transform merchant acquiring strategies.

Payment Gateway

Payment service providers specialize in facilitating secure and efficient transaction processing through payment gateways, enabling businesses to accept various payment methods such as credit cards and digital wallets. Loyalty fintech solutions integrate payment gateways with rewards and customer engagement platforms to incentivize repeat purchases and enhance customer retention. Explore our detailed analysis to understand the impact of payment gateways on loyalty fintech strategies.

Source and External Links

15 Online Payment Service Providers You Need to Know - Payment service providers like PayPal, Stripe, Square, Authorize.net, and Braintree offer diverse payment acceptance options including credit/debit cards, digital wallets, and provide features such as fraud protection and detailed analytics for businesses.

What is a Payment Service Provider? Meaning and Examples - PSPs partner with acquiring banks to help merchants accept payments easily, with popular providers like PayPal suited for low-volume transactions, Square focusing on mobile credit card processing, and Stripe being ideal for e-commerce with customizable payment solutions.

What is a Payment Service Provider? - Payment service providers simplify payment acceptance by handling transaction processing, supporting multiple payment types, offering fraud protection, and eliminating the need for merchants to manage complicated merchant accounts with banks.

dowidth.com

dowidth.com