Predictive analytics in banking leverages data models to forecast customer behaviors, enhancing risk management and personalized financial services. Customer segmentation divides clients into distinct groups based on demographics, transaction patterns, and credit profiles to tailor targeted marketing strategies. Explore how these data-driven techniques transform banking profitability and customer experience.

Why it is important

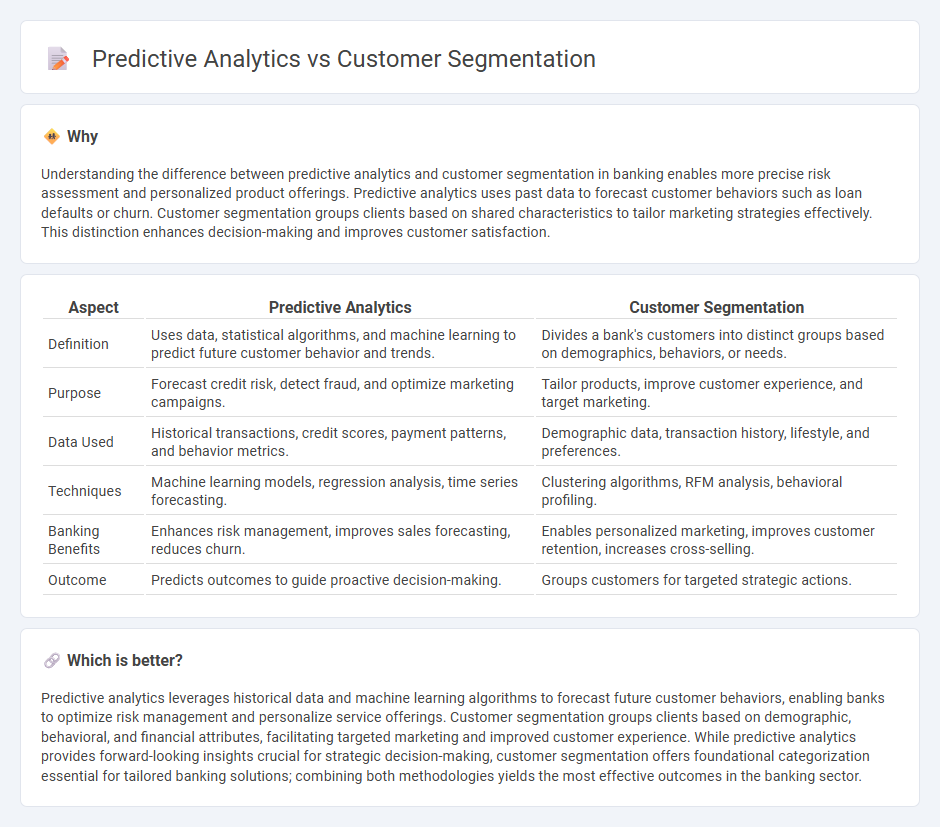

Understanding the difference between predictive analytics and customer segmentation in banking enables more precise risk assessment and personalized product offerings. Predictive analytics uses past data to forecast customer behaviors such as loan defaults or churn. Customer segmentation groups clients based on shared characteristics to tailor marketing strategies effectively. This distinction enhances decision-making and improves customer satisfaction.

Comparison Table

| Aspect | Predictive Analytics | Customer Segmentation |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to predict future customer behavior and trends. | Divides a bank's customers into distinct groups based on demographics, behaviors, or needs. |

| Purpose | Forecast credit risk, detect fraud, and optimize marketing campaigns. | Tailor products, improve customer experience, and target marketing. |

| Data Used | Historical transactions, credit scores, payment patterns, and behavior metrics. | Demographic data, transaction history, lifestyle, and preferences. |

| Techniques | Machine learning models, regression analysis, time series forecasting. | Clustering algorithms, RFM analysis, behavioral profiling. |

| Banking Benefits | Enhances risk management, improves sales forecasting, reduces churn. | Enables personalized marketing, improves customer retention, increases cross-selling. |

| Outcome | Predicts outcomes to guide proactive decision-making. | Groups customers for targeted strategic actions. |

Which is better?

Predictive analytics leverages historical data and machine learning algorithms to forecast future customer behaviors, enabling banks to optimize risk management and personalize service offerings. Customer segmentation groups clients based on demographic, behavioral, and financial attributes, facilitating targeted marketing and improved customer experience. While predictive analytics provides forward-looking insights crucial for strategic decision-making, customer segmentation offers foundational categorization essential for tailored banking solutions; combining both methodologies yields the most effective outcomes in the banking sector.

Connection

Predictive analytics enhances customer segmentation in banking by analyzing historical transaction data and behavioral patterns to forecast future customer needs and preferences. Advanced machine learning algorithms divide clients into distinct segments, enabling targeted marketing strategies and personalized financial product offerings. This integration drives improved customer engagement, risk management, and revenue growth for banks.

Key Terms

**Customer Segmentation:**

Customer segmentation divides a broad customer base into distinct groups based on demographics, behavior, and preferences, enabling personalized marketing strategies and enhanced customer experience. By identifying key segments, businesses can tailor products, optimize resource allocation, and improve targeting accuracy. Explore how customer segmentation drives growth and boosts ROI in your market.

Demographics

Customer segmentation groups individuals based on demographics such as age, gender, income, and location to tailor marketing strategies effectively. Predictive analytics uses demographic data combined with historical behavior to forecast future customer actions and trends. Explore deeper insights into how demographics enhance both methodologies for optimized business outcomes.

Behavioral Segmentation

Behavioral segmentation categorizes customers based on their interactions, purchase patterns, and engagement levels, providing marketers with targeted strategies to enhance customer experience and retention. Predictive analytics leverages historical behavioral data to forecast future customer actions, enabling proactive decision-making and personalized marketing campaigns. Explore how integrating behavioral segmentation with predictive analytics can revolutionize your customer insights and drive business growth.

Source and External Links

What Is Customer Segmentation? | Definition from TechTarget - Customer segmentation is the practice of dividing a customer base into groups with similar characteristics such as demographics, geography, psychographics, and behavior to tailor marketing messages and increase sales conversions.

What is Customer Segmentation? - Customer segmentation organizes customers into specific groups based on shared demographics, psychographics, geography, or behavior to enable targeted, personalized marketing that improves customer experience and campaign effectiveness.

Customer Segmentation Meaning & Analysis Models | Optimove - Customer segmentation strategies use data analytics and machine learning to group customers by behavior, preferences, and value, combining demographic and behavioral insights to deliver highly relevant marketing campaigns.

dowidth.com

dowidth.com