Digital onboarding streamlines account opening by using biometric verification, AI-driven identity checks, and mobile device integration, enhancing customer convenience and reducing processing time by up to 70%. Branch onboarding relies on face-to-face interaction, physical document submission, and manual verification, often resulting in longer wait times and operational costs for banks. Explore how these onboarding methods impact customer experience and operational efficiency in modern banking.

Why it is important

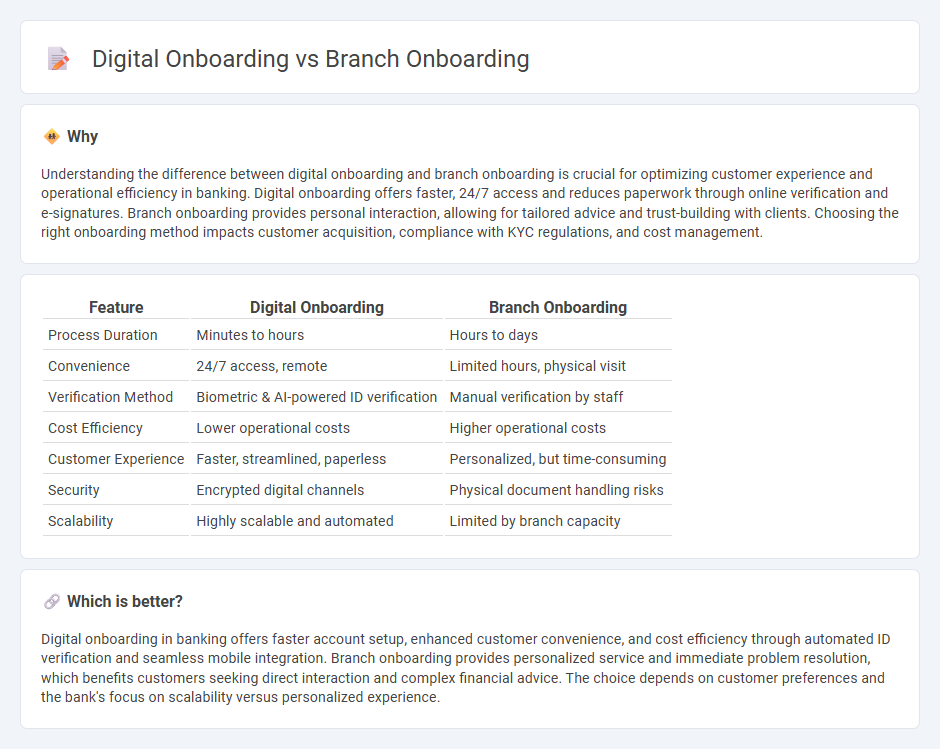

Understanding the difference between digital onboarding and branch onboarding is crucial for optimizing customer experience and operational efficiency in banking. Digital onboarding offers faster, 24/7 access and reduces paperwork through online verification and e-signatures. Branch onboarding provides personal interaction, allowing for tailored advice and trust-building with clients. Choosing the right onboarding method impacts customer acquisition, compliance with KYC regulations, and cost management.

Comparison Table

| Feature | Digital Onboarding | Branch Onboarding |

|---|---|---|

| Process Duration | Minutes to hours | Hours to days |

| Convenience | 24/7 access, remote | Limited hours, physical visit |

| Verification Method | Biometric & AI-powered ID verification | Manual verification by staff |

| Cost Efficiency | Lower operational costs | Higher operational costs |

| Customer Experience | Faster, streamlined, paperless | Personalized, but time-consuming |

| Security | Encrypted digital channels | Physical document handling risks |

| Scalability | Highly scalable and automated | Limited by branch capacity |

Which is better?

Digital onboarding in banking offers faster account setup, enhanced customer convenience, and cost efficiency through automated ID verification and seamless mobile integration. Branch onboarding provides personalized service and immediate problem resolution, which benefits customers seeking direct interaction and complex financial advice. The choice depends on customer preferences and the bank's focus on scalability versus personalized experience.

Connection

Digital onboarding and branch onboarding are interconnected components of modern banking that enhance customer acquisition and experience. Digital onboarding leverages technology to authenticate identity and process applications remotely, while branch onboarding complements by providing personalized support and handling complex transactions. Together, they create a seamless, multi-channel onboarding strategy that improves efficiency and customer satisfaction.

Key Terms

Branch Onboarding:

Branch onboarding involves the physical process of welcoming new customers at a bank branch, where clients complete identity verification, sign documents, and receive personalized assistance from staff. This method emphasizes direct human interaction, allowing for in-depth explanations of products and immediate resolution of customer queries, promoting trust and relationship building. Discover more about how branch onboarding can enhance customer experience and compliance standards.

KYC (Know Your Customer)

Branch onboarding typically involves in-person verification processes for KYC (Know Your Customer), requiring physical document submission and face-to-face identity checks to ensure regulatory compliance. Digital onboarding leverages advanced technologies such as biometric authentication, AI-driven document verification, and real-time data integration to streamline KYC, reduce processing time, and enhance customer experience. Explore deeper insights into how these onboarding methods impact compliance efficiency and customer satisfaction in financial services.

Physical Documentation

Branch onboarding relies heavily on physical documentation, requiring customers to visit a branch to submit paper forms and identification for verification. This process often involves manual data entry and physical storage, increasing the risk of errors and delays compared to digital onboarding methods. Explore the advantages of digital onboarding and its impact on reducing reliance on physical documentation for enhanced customer experience.

Source and External Links

Branch Manager Onboarding - A detailed step-by-step onboarding plan for new branch managers that includes setting up email, arranging orientation, scheduling HR meetings, providing training, and weekly check-ins during the first month to ensure smooth integration and support.

Branch Onboarding Checklist for New Associates - A supervisor-led checklist ensuring new branch associates complete essential training, understand job competencies, branch workflows, emergency procedures, and agency policies during their first two weeks.

Onboarding Guide - Branch Help Center - Technical onboarding instructions for setting up the Branch platform dashboard and SDKs, including adding team members, configuring settings, and integrating deep linking and attribution tools for campaign launches.

dowidth.com

dowidth.com