Regtech focuses on using advanced technologies to streamline compliance, risk management, and regulatory processes in the banking sector, reducing costs and enhancing accuracy. Paytech specializes in innovative payment solutions, enabling faster, secure, and more convenient financial transactions for consumers and businesses. Explore the key differences and benefits of regtech and paytech to understand their impact on modern banking.

Why it is important

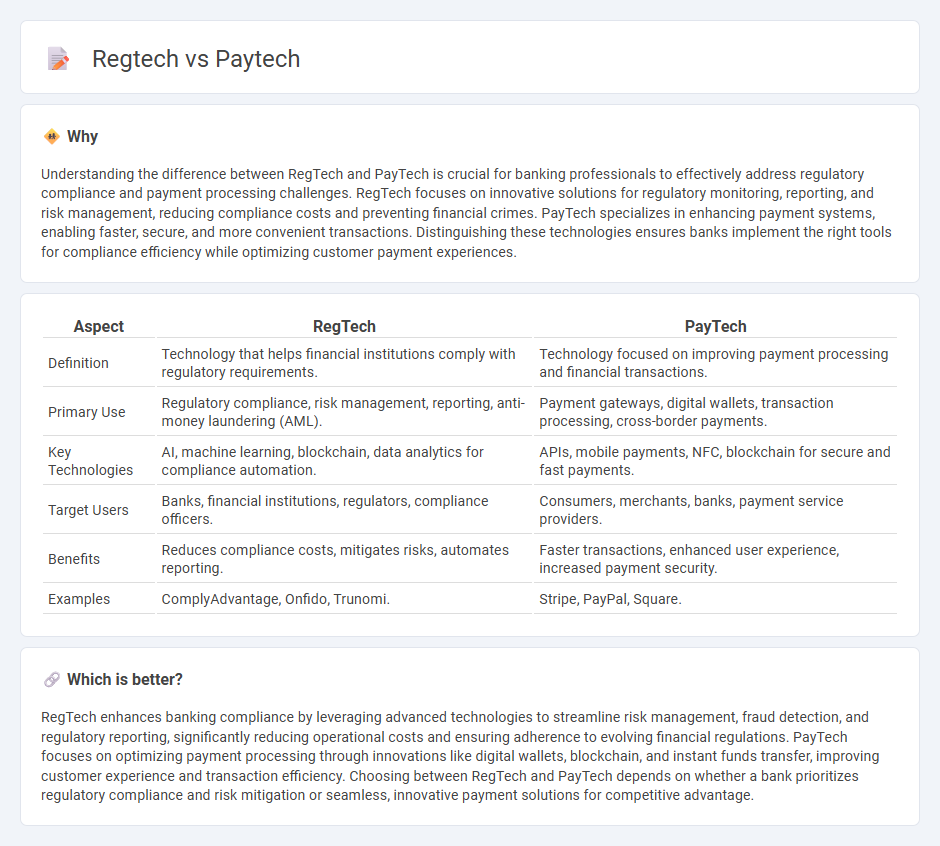

Understanding the difference between RegTech and PayTech is crucial for banking professionals to effectively address regulatory compliance and payment processing challenges. RegTech focuses on innovative solutions for regulatory monitoring, reporting, and risk management, reducing compliance costs and preventing financial crimes. PayTech specializes in enhancing payment systems, enabling faster, secure, and more convenient transactions. Distinguishing these technologies ensures banks implement the right tools for compliance efficiency while optimizing customer payment experiences.

Comparison Table

| Aspect | RegTech | PayTech |

|---|---|---|

| Definition | Technology that helps financial institutions comply with regulatory requirements. | Technology focused on improving payment processing and financial transactions. |

| Primary Use | Regulatory compliance, risk management, reporting, anti-money laundering (AML). | Payment gateways, digital wallets, transaction processing, cross-border payments. |

| Key Technologies | AI, machine learning, blockchain, data analytics for compliance automation. | APIs, mobile payments, NFC, blockchain for secure and fast payments. |

| Target Users | Banks, financial institutions, regulators, compliance officers. | Consumers, merchants, banks, payment service providers. |

| Benefits | Reduces compliance costs, mitigates risks, automates reporting. | Faster transactions, enhanced user experience, increased payment security. |

| Examples | ComplyAdvantage, Onfido, Trunomi. | Stripe, PayPal, Square. |

Which is better?

RegTech enhances banking compliance by leveraging advanced technologies to streamline risk management, fraud detection, and regulatory reporting, significantly reducing operational costs and ensuring adherence to evolving financial regulations. PayTech focuses on optimizing payment processing through innovations like digital wallets, blockchain, and instant funds transfer, improving customer experience and transaction efficiency. Choosing between RegTech and PayTech depends on whether a bank prioritizes regulatory compliance and risk mitigation or seamless, innovative payment solutions for competitive advantage.

Connection

Regtech and paytech intersect by enhancing compliance and security within financial transactions, leveraging advanced technologies such as AI and blockchain to streamline regulatory reporting and payment processing. Regtech solutions automate risk management and fraud detection, directly supporting paytech platforms in maintaining regulatory adherence and safeguarding consumer data during digital payments. This synergy accelerates innovation in banking by reducing operational costs and improving transaction transparency across payment ecosystems.

Key Terms

Payments Infrastructure (Paytech)

Paytech encompasses technologies and solutions that streamline payment processing, enhance transaction security, and improve user experience within payment infrastructure. Key players in paytech include digital wallets, payment gateways, and real-time payment systems, driving innovation in transaction speed and reliability. Explore the evolving paytech landscape to understand its critical role in shaping the future of payments infrastructure.

Compliance Automation (Regtech)

Compliance automation in regtech leverages advanced technologies such as artificial intelligence, machine learning, and blockchain to streamline regulatory reporting, risk management, and fraud detection. Paytech primarily focuses on payment processing and transaction efficiency, whereas regtech emphasizes automated compliance with evolving legal requirements, reducing human error and operational costs. Explore how regtech solutions transform compliance workflows and ensure regulatory adherence.

KYC/AML (Know Your Customer/Anti-Money Laundering)

Paytech enhances KYC/AML processes by streamlining payment verification and fraud detection through advanced digital payment solutions, boosting transaction security and customer onboarding speed. Regtech leverages regulatory technology to ensure compliance with evolving AML laws by automating risk assessment, transaction monitoring, and reporting, reducing regulatory penalties and operational costs. Explore how integrating paytech and regtech innovations can optimize KYC/AML frameworks for robust financial crime prevention.

Source and External Links

What Is Paytech | Papaya Global - Paytech refers to payments involving technology such as QR code bus fares, mobile phone taps on credit card readers, and includes digital wallets, BNPL, account-to-account payments, cryptocurrencies, and real-time payment rails.

How the rise of PayTech is reshaping the payments landscape - EY - PayTechs make up 25% of FinTechs and are driving innovation in instant, frictionless, and embedded payments across open banking, real-time payments, buy now pay later, digital wallets, and digital currencies.

PayTech Group | Defining the Future of Payments - PayTech Group offers specialized consulting, AI-powered analytics, procurement tools, and talent search to innovate and optimize payment systems globally.

dowidth.com

dowidth.com