Neobanking offers a fully digital banking experience with lower fees and enhanced convenience, leveraging mobile apps and AI-driven services to meet modern consumer demands. Traditional banking provides established physical branch networks, comprehensive financial products, and regulatory stability but often with higher fees and slower service. Explore the key differences and benefits of neobanking versus traditional banking to find the best fit for your financial needs.

Why it is important

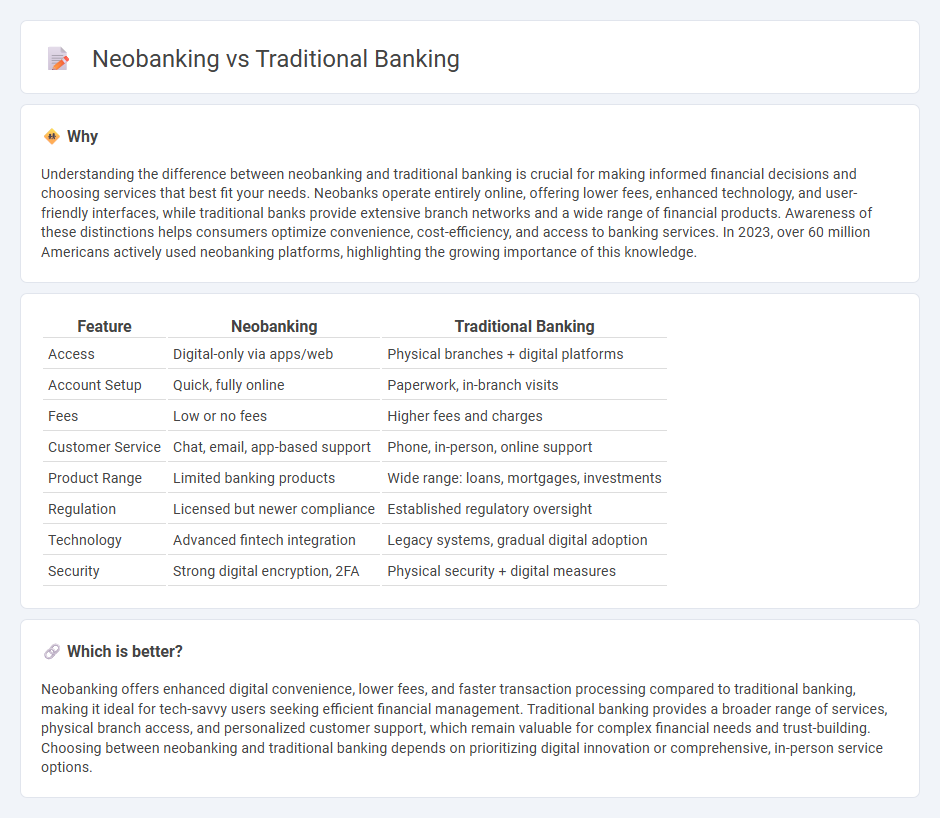

Understanding the difference between neobanking and traditional banking is crucial for making informed financial decisions and choosing services that best fit your needs. Neobanks operate entirely online, offering lower fees, enhanced technology, and user-friendly interfaces, while traditional banks provide extensive branch networks and a wide range of financial products. Awareness of these distinctions helps consumers optimize convenience, cost-efficiency, and access to banking services. In 2023, over 60 million Americans actively used neobanking platforms, highlighting the growing importance of this knowledge.

Comparison Table

| Feature | Neobanking | Traditional Banking |

|---|---|---|

| Access | Digital-only via apps/web | Physical branches + digital platforms |

| Account Setup | Quick, fully online | Paperwork, in-branch visits |

| Fees | Low or no fees | Higher fees and charges |

| Customer Service | Chat, email, app-based support | Phone, in-person, online support |

| Product Range | Limited banking products | Wide range: loans, mortgages, investments |

| Regulation | Licensed but newer compliance | Established regulatory oversight |

| Technology | Advanced fintech integration | Legacy systems, gradual digital adoption |

| Security | Strong digital encryption, 2FA | Physical security + digital measures |

Which is better?

Neobanking offers enhanced digital convenience, lower fees, and faster transaction processing compared to traditional banking, making it ideal for tech-savvy users seeking efficient financial management. Traditional banking provides a broader range of services, physical branch access, and personalized customer support, which remain valuable for complex financial needs and trust-building. Choosing between neobanking and traditional banking depends on prioritizing digital innovation or comprehensive, in-person service options.

Connection

Neobanking and traditional banking are connected through the integration of digital platforms that enhance customer experience and expand service accessibility. Traditional banks often collaborate with neobanks or adopt their innovative technologies to streamline operations, offering seamless digital services such as mobile banking, instant payments, and personalized financial management. This synergy drives the evolution of banking by combining established financial infrastructures with agile, tech-driven solutions.

Key Terms

Physical Branches

Traditional banking relies heavily on extensive physical branch networks offering face-to-face customer service, cash handling, and in-person financial advice. Neobanks operate primarily online without physical branches, emphasizing digital transactions, mobile apps, and 24/7 accessibility to enhance convenience and reduce operational costs. Explore the evolving landscape of banking by learning more about the impact of physical branches on customer experience and service delivery.

Digital-Only Services

Traditional banking relies on brick-and-mortar branches and offers a mix of in-person and online services, whereas neobanking operates exclusively through digital platforms with no physical locations. Neobanks provide seamless mobile experiences, lower fees, and faster account setup times, appealing primarily to tech-savvy customers seeking convenience. Explore how digital-only services are revolutionizing financial access and customer experience.

Core Banking Systems

Traditional banking relies on legacy core banking systems designed for on-premises operations, offering stability but limited agility in adopting new technologies. Neobanking leverages cloud-native core banking platforms, enabling real-time processing, enhanced scalability, and seamless integration with digital services. Explore how these core banking systems shape the future of financial services and customer experiences.

Source and External Links

Online Banking vs. Traditional Banking - This webpage explores the differences between traditional banking with physical branches offering a wide range of services and online banking, which prioritizes digital convenience and user experience.

Traditional vs. Online Banking - This guide details the benefits and drawbacks of traditional banking, including its physical branches and extensive services, compared to online banking.

Online vs Traditional Banks: Pros, Cons, and More Explained - This article discusses the advantages and disadvantages of traditional banks, highlighting their physical locations and comprehensive services, as well as their limitations and fees.

dowidth.com

dowidth.com