Alternative data lending leverages non-traditional information such as social media activity, utility payments, and online behavior to assess creditworthiness, expanding access to loans for underserved populations. Relationship banking relies on long-term interactions and detailed personal knowledge between banks and clients, emphasizing trust and customized financial solutions. Discover how these approaches transform lending strategies and impact borrower experiences.

Why it is important

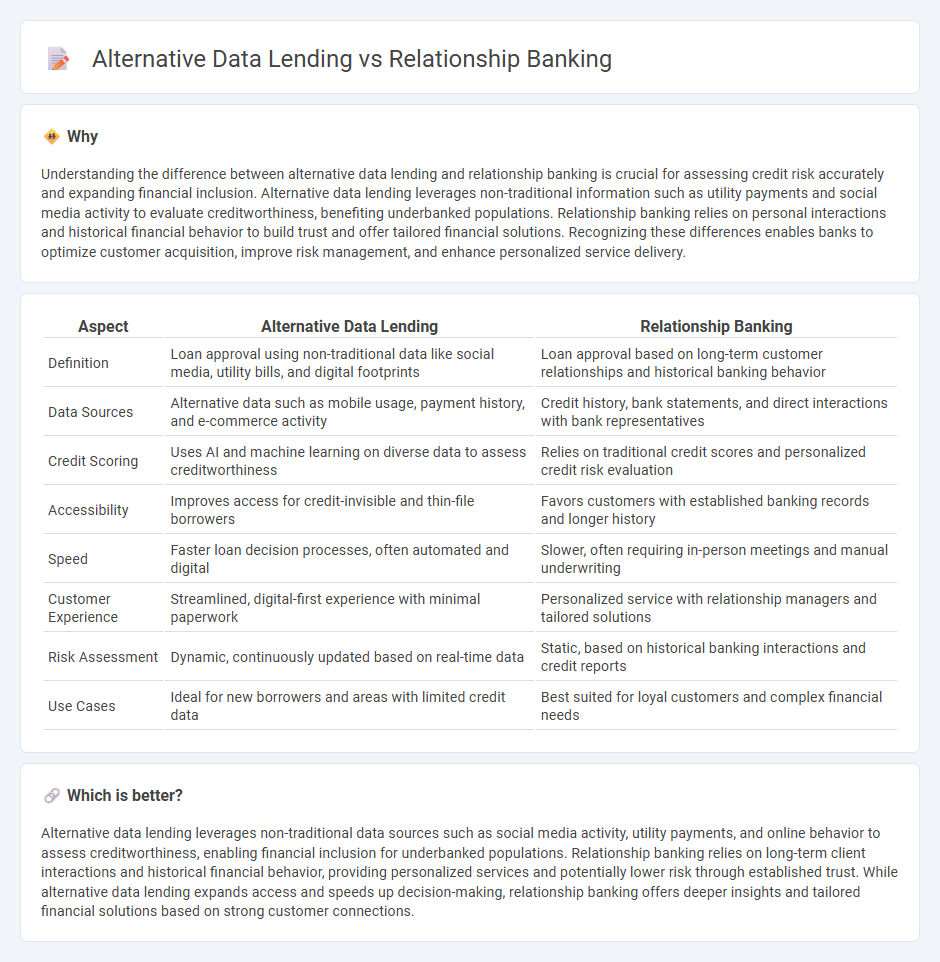

Understanding the difference between alternative data lending and relationship banking is crucial for assessing credit risk accurately and expanding financial inclusion. Alternative data lending leverages non-traditional information such as utility payments and social media activity to evaluate creditworthiness, benefiting underbanked populations. Relationship banking relies on personal interactions and historical financial behavior to build trust and offer tailored financial solutions. Recognizing these differences enables banks to optimize customer acquisition, improve risk management, and enhance personalized service delivery.

Comparison Table

| Aspect | Alternative Data Lending | Relationship Banking |

|---|---|---|

| Definition | Loan approval using non-traditional data like social media, utility bills, and digital footprints | Loan approval based on long-term customer relationships and historical banking behavior |

| Data Sources | Alternative data such as mobile usage, payment history, and e-commerce activity | Credit history, bank statements, and direct interactions with bank representatives |

| Credit Scoring | Uses AI and machine learning on diverse data to assess creditworthiness | Relies on traditional credit scores and personalized credit risk evaluation |

| Accessibility | Improves access for credit-invisible and thin-file borrowers | Favors customers with established banking records and longer history |

| Speed | Faster loan decision processes, often automated and digital | Slower, often requiring in-person meetings and manual underwriting |

| Customer Experience | Streamlined, digital-first experience with minimal paperwork | Personalized service with relationship managers and tailored solutions |

| Risk Assessment | Dynamic, continuously updated based on real-time data | Static, based on historical banking interactions and credit reports |

| Use Cases | Ideal for new borrowers and areas with limited credit data | Best suited for loyal customers and complex financial needs |

Which is better?

Alternative data lending leverages non-traditional data sources such as social media activity, utility payments, and online behavior to assess creditworthiness, enabling financial inclusion for underbanked populations. Relationship banking relies on long-term client interactions and historical financial behavior, providing personalized services and potentially lower risk through established trust. While alternative data lending expands access and speeds up decision-making, relationship banking offers deeper insights and tailored financial solutions based on strong customer connections.

Connection

Alternative data lending enhances relationship banking by providing financial institutions with non-traditional credit information such as social media activity, utility payments, and transactional data. This enriched data allows banks to assess creditworthiness more accurately, fostering trust and personalized service in customer relationships. Integrating alternative data into lending decisions strengthens long-term client engagement and risk management within relationship banking models.

Key Terms

Customer Relationship Management (CRM)

Relationship banking leverages deep customer insights, transaction histories, and personalized interactions to strengthen Customer Relationship Management (CRM) and foster trust and loyalty. Alternative data lending utilizes non-traditional sources such as social media activity, utility payments, and online behavior to supplement credit assessments and expand lending opportunities for underbanked populations. Discover how these approaches transform CRM strategies and redefine customer engagement in modern finance.

Credit Scoring Models

Relationship banking leverages historical customer data, transaction history, and personal interactions to develop robust credit scoring models that emphasize trust and long-term financial behavior. Alternative data lending integrates non-traditional information sources such as social media activity, utility payments, and online behavior to enhance credit risk assessment, especially for thin-file borrowers. Explore how these evolving credit scoring models redefine lending accuracy and financial inclusion.

Non-Traditional Data Sources

Relationship banking relies primarily on traditional financial metrics and personal interactions to assess creditworthiness, while alternative data lending leverages non-traditional data sources such as social media activity, utility payments, and ecommerce behavior to evaluate borrowers. These alternative data sets provide a broader credit profile, especially benefiting underserved or thin-file customers lacking conventional credit histories. Explore how integrating non-traditional data can transform lending decisions and drive financial inclusion.

Source and External Links

What is Relationship Banking? - Relationship banking is a customer-centric approach that builds long-term client relationships by offering personalized financial guidance and consolidating services with a dedicated banker, aiming for a more comprehensive and tailored banking experience than transactional models.

5 Benefits of Relationship Banking - Relationship banking focuses on understanding each client's unique needs and providing personalized, reliable, and agile support for both short- and long-term financial goals, with bankers acting as trusted advisors throughout every banking process.

What Is Relationship Banking? - Relationship banking involves offering a wide range of products and personalized services to loyal customers who maintain multiple accounts, often resulting in exclusive benefits like better rates, discounted fees, and one-on-one financial planning.

dowidth.com

dowidth.com