Real-time payments enable instant fund transfers and immediate confirmation, enhancing cash flow efficiency and customer satisfaction compared to traditional Electronic Funds Transfers (EFT), which typically process within hours or days. Banks increasingly adopt real-time payment systems like RTP and Faster Payments to meet growing demands for speed and transparency in transactions. Explore how real-time payments are reshaping banking infrastructures and the future of digital finance.

Why it is important

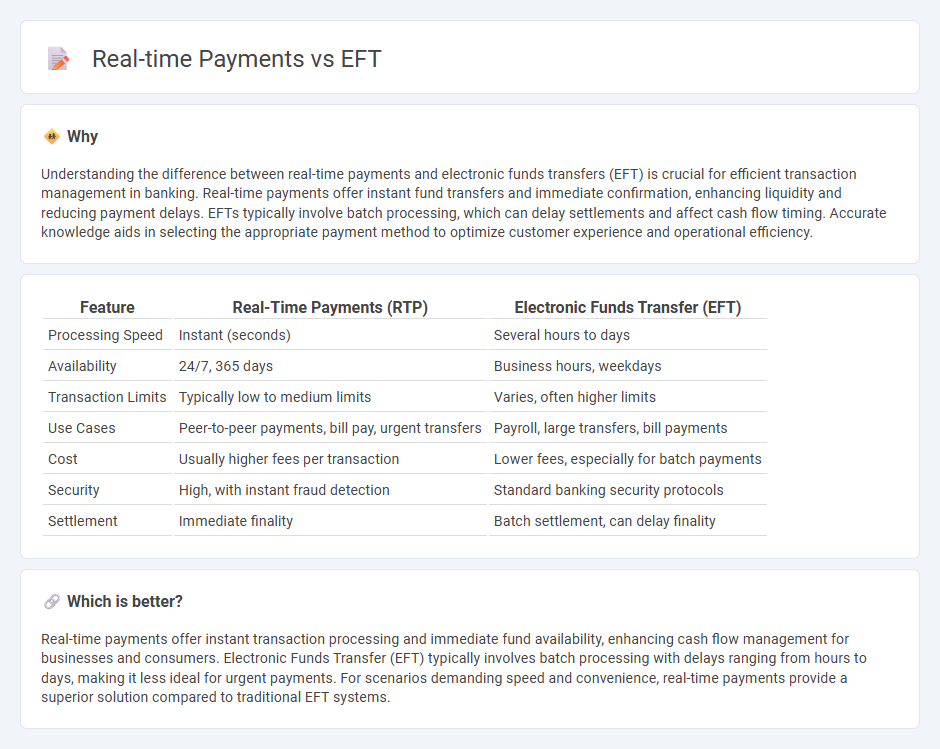

Understanding the difference between real-time payments and electronic funds transfers (EFT) is crucial for efficient transaction management in banking. Real-time payments offer instant fund transfers and immediate confirmation, enhancing liquidity and reducing payment delays. EFTs typically involve batch processing, which can delay settlements and affect cash flow timing. Accurate knowledge aids in selecting the appropriate payment method to optimize customer experience and operational efficiency.

Comparison Table

| Feature | Real-Time Payments (RTP) | Electronic Funds Transfer (EFT) |

|---|---|---|

| Processing Speed | Instant (seconds) | Several hours to days |

| Availability | 24/7, 365 days | Business hours, weekdays |

| Transaction Limits | Typically low to medium limits | Varies, often higher limits |

| Use Cases | Peer-to-peer payments, bill pay, urgent transfers | Payroll, large transfers, bill payments |

| Cost | Usually higher fees per transaction | Lower fees, especially for batch payments |

| Security | High, with instant fraud detection | Standard banking security protocols |

| Settlement | Immediate finality | Batch settlement, can delay finality |

Which is better?

Real-time payments offer instant transaction processing and immediate fund availability, enhancing cash flow management for businesses and consumers. Electronic Funds Transfer (EFT) typically involves batch processing with delays ranging from hours to days, making it less ideal for urgent payments. For scenarios demanding speed and convenience, real-time payments provide a superior solution compared to traditional EFT systems.

Connection

Real-time payments and Electronic Funds Transfers (EFT) are connected through their shared goal of facilitating swift and secure money movement between bank accounts. Real-time payments enable instant fund transfers, enhancing EFT systems by providing immediate transaction settlements. This integration improves liquidity management, reduces fraud risk, and supports seamless digital banking experiences.

Key Terms

Settlement Speed

Electronic Funds Transfer (EFT) processes typically settle within one to three business days, depending on banking hours and intermediary banks, which can delay fund availability. Real-time payments (RTP) offer instantaneous settlement, enabling funds to be transferred and accessed by recipients within seconds, significantly enhancing transaction efficiency and cash flow management. Explore the advantages of real-time payments for faster financial transactions and improved liquidity.

Intermediaries

Electronic Funds Transfers (EFTs) often rely on multiple intermediaries such as correspondent banks and clearinghouses, which can introduce delays and additional fees. Real-time payments streamline this process by minimizing or eliminating intermediaries, enabling near-instantaneous settlement directly between payer and payee financial institutions. Discover how reducing intermediaries in real-time payments transforms transaction speed and cost efficiency.

Availability

EFT transactions typically process within 1-3 business days, limiting immediate fund availability, while real-time payments ensure instant transfer and access to funds 24/7, enhancing liquidity for businesses and individuals. Real-time payment systems like the RTP network or Europe's SEPA Instant Credit Transfer provide near-instant settlement, reducing delays common in traditional EFT methods. Explore how real-time payments can transform your financial operations with enhanced availability.

Source and External Links

What is EFT? - ICEEFT - Emotionally Focused Therapy (EFT) is an evidence-based, attachment-oriented psychotherapy approach effective for individuals, couples, and families, focusing on emotional awareness and healthier relational patterns.

What Is EFT Tapping? - Healthline - EFT Tapping (Emotional Freedom Technique) is an alternative therapy where individuals tap on specific body meridian points to alleviate emotional distress and physical pain, based on principles from Chinese medicine and energy psychology.

dowidth.com

dowidth.com