Income streaming in banking refers to the continuous generation of revenue through recurring services such as loan interest, account maintenance fees, and transaction charges. Advisory fees are earnings derived from providing expert financial guidance, investment management, and tailored wealth solutions to clients. Explore how banks balance income streaming and advisory fees to optimize profitability and client relationships.

Why it is important

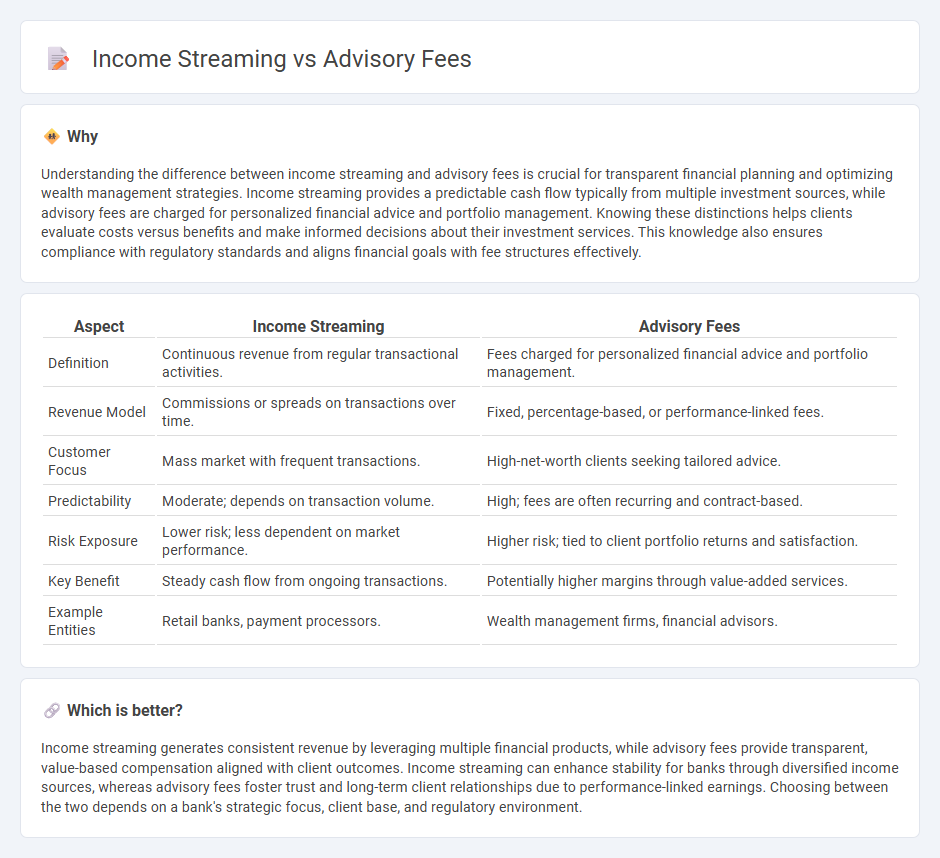

Understanding the difference between income streaming and advisory fees is crucial for transparent financial planning and optimizing wealth management strategies. Income streaming provides a predictable cash flow typically from multiple investment sources, while advisory fees are charged for personalized financial advice and portfolio management. Knowing these distinctions helps clients evaluate costs versus benefits and make informed decisions about their investment services. This knowledge also ensures compliance with regulatory standards and aligns financial goals with fee structures effectively.

Comparison Table

| Aspect | Income Streaming | Advisory Fees |

|---|---|---|

| Definition | Continuous revenue from regular transactional activities. | Fees charged for personalized financial advice and portfolio management. |

| Revenue Model | Commissions or spreads on transactions over time. | Fixed, percentage-based, or performance-linked fees. |

| Customer Focus | Mass market with frequent transactions. | High-net-worth clients seeking tailored advice. |

| Predictability | Moderate; depends on transaction volume. | High; fees are often recurring and contract-based. |

| Risk Exposure | Lower risk; less dependent on market performance. | Higher risk; tied to client portfolio returns and satisfaction. |

| Key Benefit | Steady cash flow from ongoing transactions. | Potentially higher margins through value-added services. |

| Example Entities | Retail banks, payment processors. | Wealth management firms, financial advisors. |

Which is better?

Income streaming generates consistent revenue by leveraging multiple financial products, while advisory fees provide transparent, value-based compensation aligned with client outcomes. Income streaming can enhance stability for banks through diversified income sources, whereas advisory fees foster trust and long-term client relationships due to performance-linked earnings. Choosing between the two depends on a bank's strategic focus, client base, and regulatory environment.

Connection

Income streaming in banking generates consistent revenue by spreading fee-based services like advisory fees over time. Advisory fees are a critical component of this model, providing banks with a steady cash flow through wealth management and financial planning services. This connection enhances the bank's profitability by creating recurring income tied to client investment portfolios and advisory engagements.

Key Terms

Fee-based revenue

Fee-based revenue generates consistent income by charging clients a percentage of assets under management, contrasting with commission-based advisory fees that fluctuate with transaction volume. This approach aligns advisor incentives with client portfolio growth, promoting long-term financial planning. Explore how fee-based revenue models enhance financial advisory business stability and client trust.

Transaction commissions

Transaction commissions typically refer to fees charged per trade, impacting advisory fees by increasing costs for clients with frequent transactions. Income streaming focuses on generating steady revenue through ongoing advisory fees rather than one-time transaction commissions. Explore how balancing these models can optimize your financial strategy.

Asset management

Advisory fees in asset management are typically a fixed percentage of assets under management (AUM), providing predictable revenue based on portfolio size, while income streaming focuses on generating recurring income through dividends, interest, or other cash flows from managed assets. Asset managers relying on advisory fees benefit from scale and client asset growth, whereas income streaming strategies prioritize steady cash flows and yield optimization. Explore more about balancing advisory fees and income streaming to enhance asset management profitability.

Source and External Links

How Much Does a Financial Advisor Cost in 2025? - NerdWallet - This article provides an overview of typical financial advisor fee ranges, including AUM, flat fees, hourly rates, per-plan fees, and commission structures.

Pros and Cons of Different Advisory Fee Models - Envestnet - Envestnet discusses the pros and cons of various fee models used by financial advisors, including fixed percentage fees, flat fees, hourly rates, and annual retainers.

How Much Does a Financial Advisor Cost? - SmartAsset - SmartAsset explains the different fee structures for financial advisors, such as assets under management, hourly fees, and subscription-based plans, helping clients understand the costs involved.

dowidth.com

dowidth.com